BTC Surges as US Jobs Data Sparks Market Rally

Bitcoin (BTC) surged to $100,000 on 7 February as the latest US employment data provided a much-needed boost to risk assets. Despite concerns over Federal Reserve interest rate policy, the cryptocurrency rallied, defying broader macroeconomic concerns.

Bitcoin Defies Mixed Jobs Report

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD making sharp gains after the US reported lower-than-expected job additions for January. The US economy added 143,000 jobs, falling short of the projected 169,000 and significantly below traders’ estimates. This weaker employment growth signalled a labour market less resilient to restrictive financial policies than initially believed.

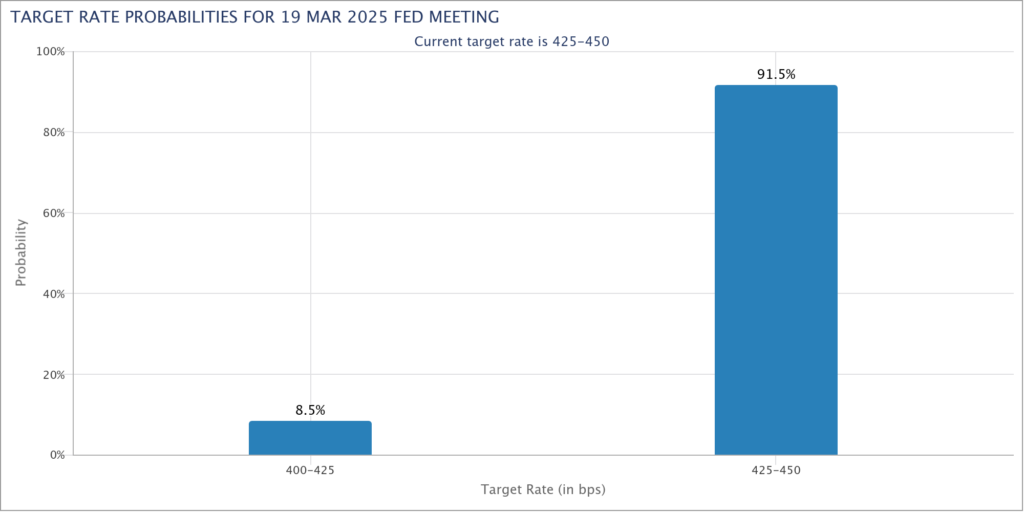

Despite this, the latest data from the CME Group’s FedWatch Tool showed diminishing expectations of an interest rate cut at the Federal Reserve’s next meeting in March. The probability of a 0.25% rate cut dropped from 14.5% before the jobs report to just 8.5%.

“The unemployment rate fell to 4.0%, below expectations of 4.1%,” noted trading resource The Kobeissi Letter on X. “We now have the lowest unemployment rate since May 2024. The Fed pause is here to stay.”

BTC Eyes Key Resistance Levels

Bitcoin’s return to six figures came as traders welcomed the rally, despite the disconnect from broader economic trends.

“Well, that’s BTC breaking out now,” commented popular trader Daan Crypto Trades on X, alongside a chart showing BTC/USD breaking from a falling wedge formation on hourly timeframes. “A higher low has been made. Now, bulls need to push past the local high at around $102K to confirm a shift in market structure.”

On a broader outlook, trader Roman expressed optimism, expecting a strong weekly close. “Both 1D and 1W have completely reset, allowing BTC to break this range and continue its uptrend to $130K,” he said. “Let’s see what happens at the $108K resistance.”

Meanwhile, another well-followed analyst, Skew, highlighted $100,000 as a key level to flip into support. “Positioning will likely pick up again with trend resolution,” he stated, identifying $102,000 as the crucial level for bulls to surpass to sustain upward momentum.

With Bitcoin reaching a psychological milestone, traders remain watchful for signs of continued bullish momentum or potential pullbacks amid ongoing macroeconomic uncertainties.

Leave a Reply