Bitcoin surged past the $110,000 mark on June 11, fuelling a fresh wave of bullish predictions from market analysts and institutional investors. The flagship cryptocurrency has climbed over 10% since June 5, pushing the broader crypto market’s capitalisation above $3.4 trillion for the first time in weeks.

As Bitcoin inches closer to its all-time high, experts are projecting a range of potential future prices—from a conservative $120,000 to a sensational $1 million in the coming years.

Bitcoin’s Rally Gains Momentum

Data from TradingView shows that Bitcoin’s price reached $110,000 on June 11, having jumped from a low of $108,400 on June 10. At the time of writing, BTC was trading at around $109,400, reflecting a 1.7% daily gain.

This price movement coincides with a broader market rally. Bitcoin’s momentum has brought it within 2.1% of its all-time high of over $111,000. Analysts suggest that if BTC can flip $108,000 into a solid support level, it could enter a fresh price discovery phase.

Prominent crypto analyst Jelle stated, “Bitcoin’s monthly chart looks ready for acceleration… A few months of up only with a blow-off cherry on top?” According to Jelle, once BTC convincingly breaks above $111,000, targets of $120,000, $140,000, and even $150,000 are in sight.

Key Resistance and Technical Patterns

Michael van de Poppe, founder of MN Capital, believes Bitcoin may consolidate before breaking above $110,500. If it does, he expects it to accelerate towards new highs, similar to previous breakouts above $106,500 and $108,000.

Technical analyst Mags pointed to a bullish cup-and-handle formation on the weekly chart, which projects a price target of $125,000. In the daily timeframe, BTC also appears to be forming both a bull flag and a cup-and-handle pattern, typically seen as bullish indicators. These chart setups suggest a potential move toward $140,000.

However, analysts caution that the $112,000 zone is packed with leveraged positions and may act as a significant resistance level. According to AlphaBTC, a well-followed analyst on X, “$BTC is struggling to break through that 110K level and may need a longer consolidation before it has the energy to take out the ATH.”

Institutional Bulls: $1 Million and Beyond?

Michael Saylor, chairman of Strategy and one of Bitcoin’s most vocal advocates, remains steadfast in his long-term vision. In a recent interview with Bloomberg, Saylor declared that cis heading to $1 million, arguing that crypto winter is “not coming back.”

“Winter is not coming back. We’re past that phase; if Bitcoin’s not going to zero, it’s going to $1 million,” he said. His firm currently holds 582,000 BTC, valued at approximately $63.85 billion, and has been consistently buying since 2020.

Others share Saylor’s long-term bullish outlook. ARK Invest has raised its bullish case Bitcoin price target from $1.5 million to $2.4 million by 2030. Meanwhile, Anthony Scaramucci of SkyBridge Capital has set a $500,000 price target, citing limited supply and increasing demand through ETFs.

Bitwise’s European research head, Andre Dragosch, also predicts a price of $200,000 in 2025, rising to $1 million by 2029, attributing this to increasing institutional interest and Bitcoin’s built-in scarcity.

Short-Term Challenges and Market Risks

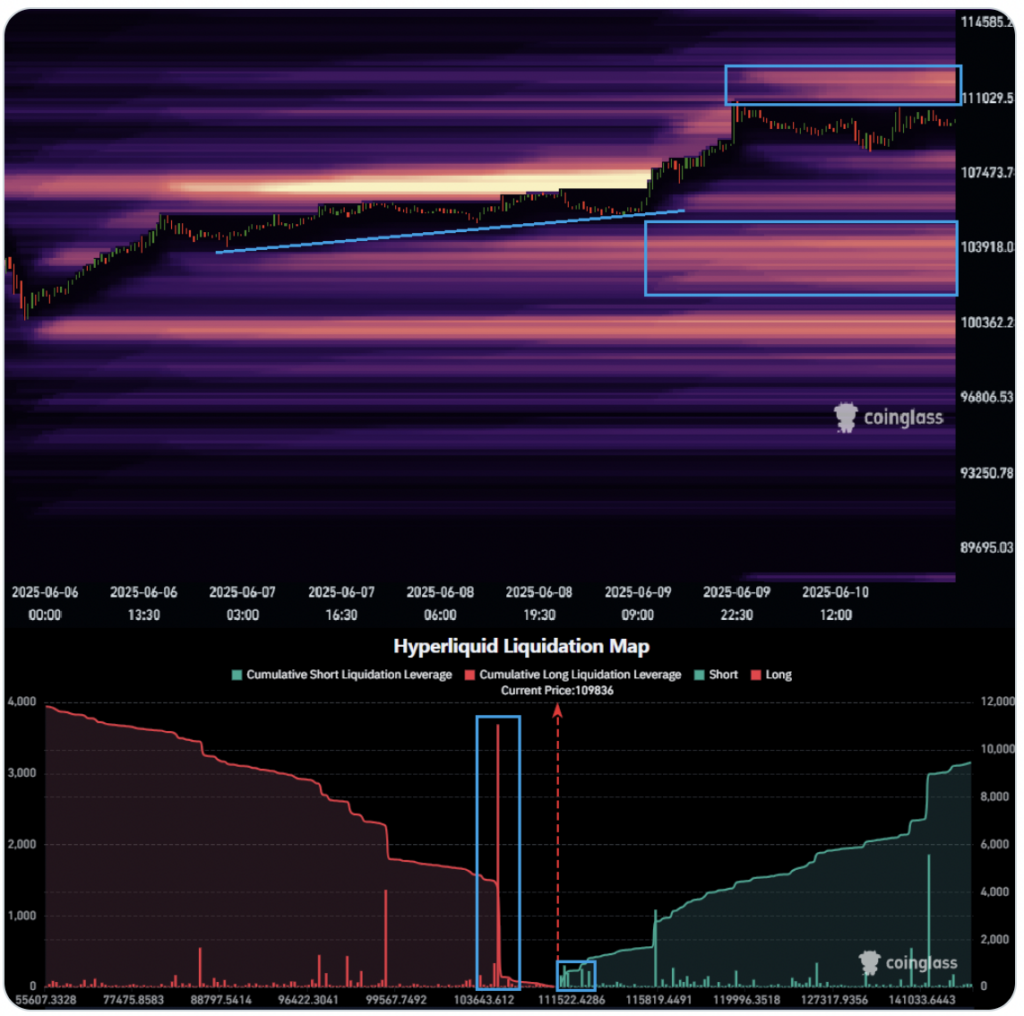

Despite the bullish sentiment, risks remain. Analysts highlight the importance of breaking above $112,000—a level with high liquidation activity. If Bitcoin can surpass this threshold, a short squeeze could push the price to $114,000, triggering a cascade of liquidations among short positions.

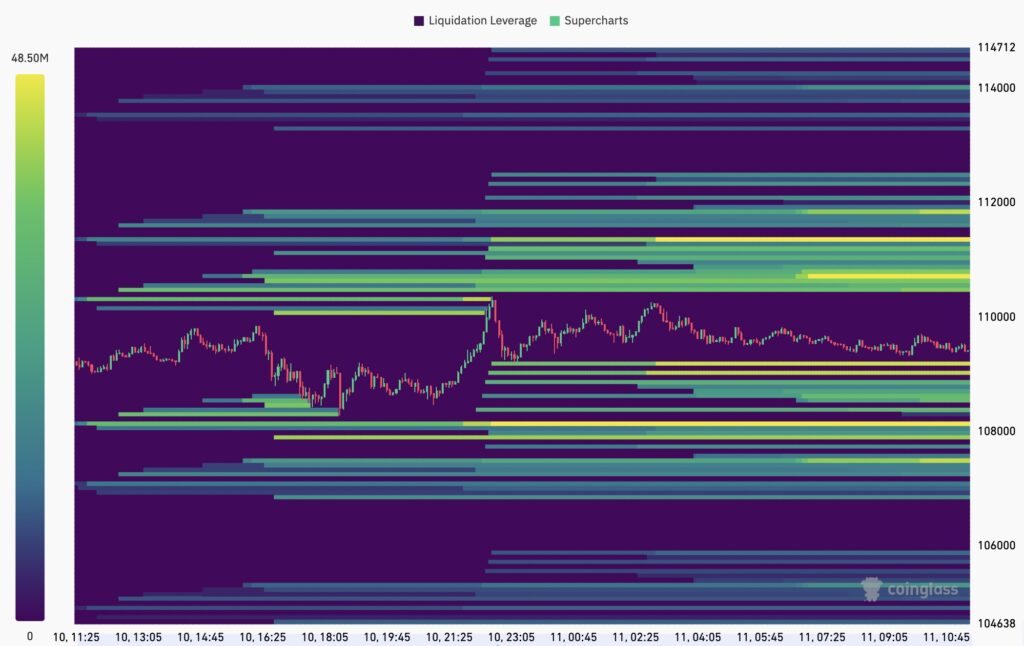

Binance’s BTC/USDT liquidation heatmap identifies $112,000 and $114,000 as high-liquidity zones. These areas could act as magnet levels, drawing price action due to concentrated leveraged positions.

While the long-term outlook remains optimistic, experts advise caution in the short term. Regulatory hurdles, high volatility, and macroeconomic uncertainties could still impact market dynamics.

Conclusion

Bitcoin’s recent rally to $110,000 has reignited bullish projections, with near-term targets set between $120,000 and $150,000. However, some long-term investors like Michael Saylor and ARK Invest believe the cryptocurrency could reach as high as $1 million or more within the next five years.

With technical patterns aligning and institutional demand growing, Bitcoin appears poised for its next major move. But breaking through key resistance levels and weathering short-term volatility will be crucial in determining how high BTC can truly go.

Leave a Reply