Bitcoin surged to a four-week high on Wednesday, touching $117,000, as traders braced for potential market turbulence linked to the U.S. Federal Reserve’s latest interest rate decision. With markets fully pricing in a rate cut, focus now shifts to Fed Chair Jerome Powell’s post-FOMC remarks.

Rate Cut Expectations at 100%

According to CME’s FedWatch tool, there is a 96% probability of a 25-basis-point cut and a 4% chance of a deeper 50-basis-point reduction at the Wednesday FOMC meeting. Polymarket bettors mirror this sentiment, assigning a 93% probability to a 25-bps cut and 5% to a 50-bps cut.

Odds are also building for a series of three cuts by year-end, although analysts caution that much of the potential market impact may already be priced in.

President Donald Trump has continued pressing Powell for faster easing, while Powell has previously hinted at adjustments given softening inflation and a cooling labor market. Traders now expect Powell’s language at the press conference to be the key catalyst for market volatility.

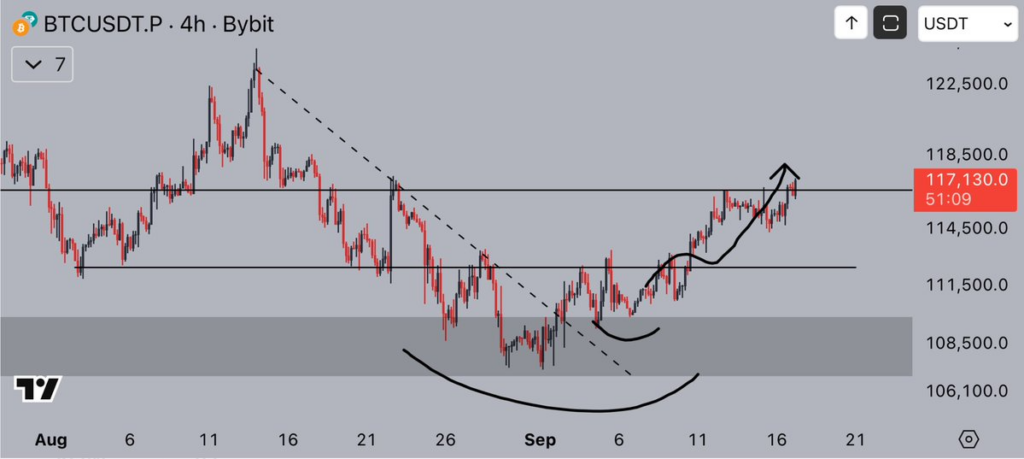

Bitcoin Approaches Key Resistance

Bitcoin rose above $117,000 on Wednesday before consolidating. Analysts warn that the area between $117,500 and $118,500 now represents a critical resistance zone.

Crypto analyst Jelle said Bitcoin is “slowly grinding higher” into the $116.5K–$118K range, noting that a sustained break above $118,000 could open the door to new all-time highs.

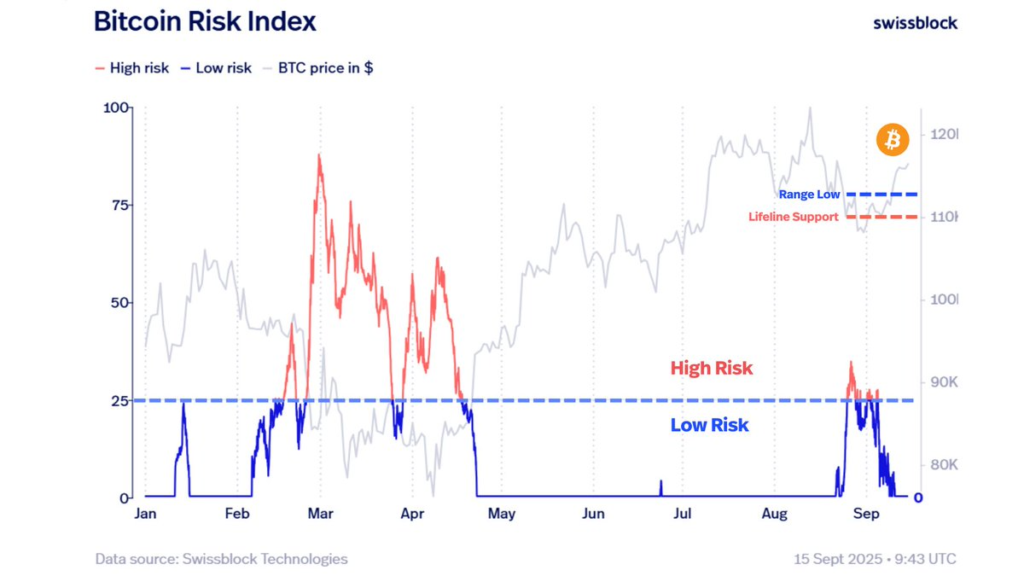

Swissblock, a private wealth manager, added that “volatility is guaranteed” following the Fed’s decision, with its Bitcoin Risk Index determining whether the bullish structure can hold or a sell-off follows.

Path Toward $120K and Beyond

Michael van de Poppe, founder of MN Capital, suggested that clearing $118,000 could trigger a move toward $120,000 and eventually to Bitcoin’s all-time high near $124,500.

Similarly, analyst AlphaBTC predicted a possible push to $118,000 before retracement, depending on post-FOMC reactions.

Should Bitcoin fail to hold above resistance, key support lies between $116,800 and $114,500, a range tested multiple times in recent days. A deeper pullback could see BTC revisit $112,000, which aligns with the 100-day simple moving average.

Market Awaits Powell’s Tone

While traders have already positioned for a 25-bps cut, the true driver of short-term volatility will be Powell’s messaging. Any signal of a more aggressive easing cycle could lift Bitcoin past resistance, while a cautious or hawkish tone may trigger selling pressure.

“Break $118K and hold above it, and new all-time highs are next,” Jelle emphasized, highlighting the fine balance markets face heading into Powell’s news conference.

For now, Bitcoin remains on the cusp of a breakout, with macroeconomic forces set to dictate whether the rally extends into uncharted territory or retreats back into familiar support zones.

Leave a Reply