Bitcoin has once again made headlines as it shattered its previous all-time high (ATH), touching $109,845 and pushing the boundaries of bullish momentum. After surpassing the earlier resistance at $109,588, the flagship cryptocurrency has entered a fresh price discovery phase, marked by growing institutional confidence and strong market fundamentals.

This surge comes on the back of renewed adoption and increasing investor optimism, positioning Bitcoin as a $2 trillion asset. For the first time since its last major consolidation, BTC has confirmed a clean breakout above critical resistance levels, sparking discussions around the next possible high, which many analysts now place around $119,000.

Whales Lead the Charge: $1 Billion Long Sparks Confidence

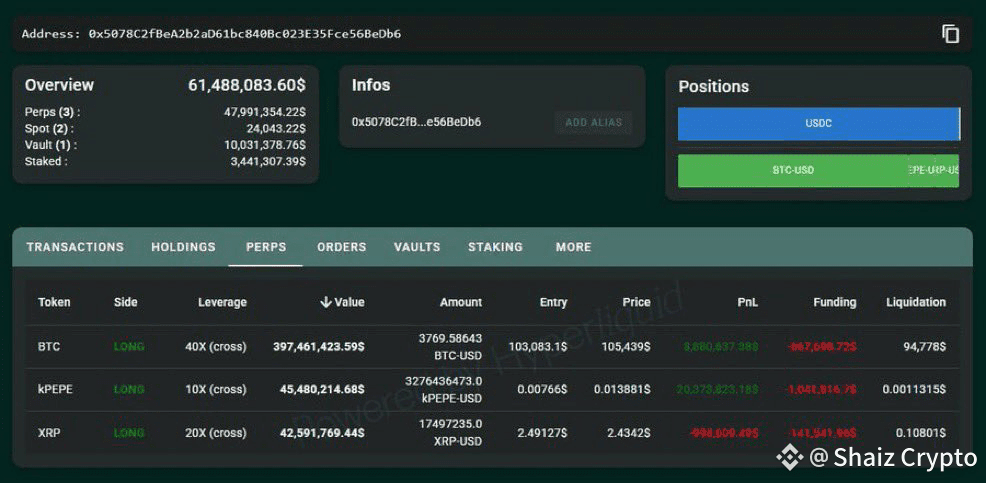

While retail traders remain cautious amid high volatility, crypto whales are making bold moves. A standout example is the reported position by James Wynn, a high-profile investor known as the “40X BTC Whale.” According to insider sources, Wynn has increased his long exposure to $1 billion, a move that underscores high conviction in Bitcoin’s continued upward trajectory.

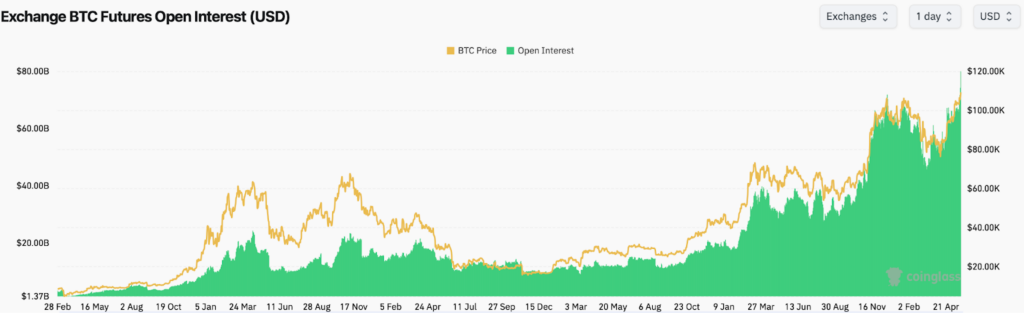

This aggressive bet is not without reason. Record-breaking inflows into Bitcoin ETFs have provided a solid foundation for institutional backing, while a growing number of profitable holders further amplifies the market’s positive sentiment. At the same time, Bitcoin’s open interest (OI) on Binance has surged by $13 billion, a new ATH signaling increasing market participation and growing liquidity.

The rise in OI also implies that more traders are entering futures and options contracts, which can lead to heightened volatility. However, in bullish markets, it often aligns with momentum continuation, especially when coupled with increased ETF flows and whale activity.

Technical Indicators Align with Bullish Momentum

From a technical standpoint, Bitcoin’s recent price action presents a textbook bullish pattern. The asset completed a sharp V-shaped recovery, smashing through the final resistance zone and confirming entry into price discovery. Moreover, a potential Golden Cross where the 50-day moving average (MA) crosses above the 200-day MA appears imminent, further validating the bullish structure.

In parallel, a bullish divergence has emerged in the Directional Movement Index (DMI). Although a bearish crossover between the +DI and -DI was anticipated earlier, the sudden price spike has reversed the trend, suggesting the beginning of a new ascending phase. This alignment of technical indicators strengthens the argument for sustained upward momentum in the short to mid-term.

Additionally, Bitcoin has broken its ATH just 121 days after its last peak, a relatively short consolidation period, which indicates robust demand and reduced sell pressure. With both market capitalization and realized cap setting new records, BTC’s upward path appears far from over.

What’s Next for BTC: $119K in Sight?

Now that Bitcoin is firmly in its price discovery phase, the key question on everyone’s mind is: where does it go from here?

Analysts point toward $119,000 as the next logical price milestone. This projection is based on Fibonacci extensions and prior breakout behavior during previous bull cycles. With strong on-chain support, high confidence from whales, and historical precedence for steep climbs post-ATH breaches, this target seems plausible if current conditions persist.

However, investors should be wary of sudden pullbacks. In price discovery, volatility tends to increase, and sharp corrections can occur before the next leg up. Still, the overall trend remains undeniably bullish, especially with institutional capital driving much of the current rally.

The Bulls Are Back in Control

Bitcoin’s breakout above $109K has reignited the crypto market’s momentum, with traders, analysts, and institutions alike turning their eyes toward even higher targets. The combination of whale accumulation, ETF inflows, technical indicators, and on-chain metrics all point toward continued bullishness.

While the road to $119,000 may not be linear, the path is being paved by growing adoption, macroeconomic tailwinds, and a maturing crypto ecosystem. As long as the key support levels hold and investor sentiment remains strong, Bitcoin’s rally might just be getting started.

Leave a Reply