Despite a temporary dip during the $2.6 billion options expiry, Bitcoin remains on track toward a potential six-figure rally.

Bitcoin Surges Before Options Expiry

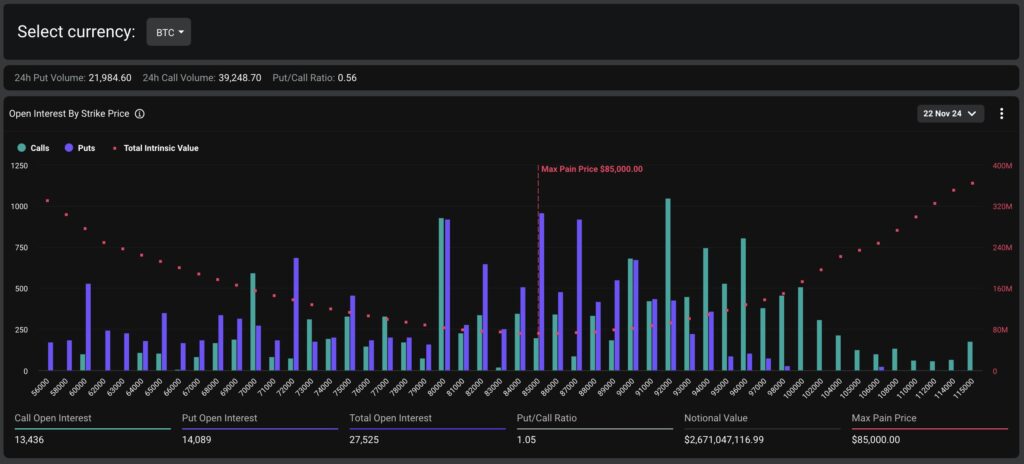

Bitcoin hit an all-time high of $99,523 on 22 November at 7:30 am UTC, just 30 minutes before a massive $2.67 billion options expiry. The expiry, with a “max pain” price point of $85,000 as noted by Deribit exchange, initially caused Bitcoin to dip to $97,805. However, market analysts remain optimistic about Bitcoin’s upward momentum.

Blake Player, head of growth at VALR, commented, “Options expiring reflects a reduction in open interest and leverage. I don’t expect this to significantly impact Bitcoin’s price.”

Leverage Reduction a Positive for Long-Term Growth

Deleveraging in the crypto market could pave the way for Bitcoin to continue its rally. Kris Marszalek, CEO of Crypto.com, previously noted that a market correction was necessary before Bitcoin could surpass $100,000.

This reduced leverage aligns with increasing investor confidence, as stablecoin flows to crypto exchanges reached a record $9.7 billion on 22 November.

ETF Inflows Bolster Bitcoin’s Rally

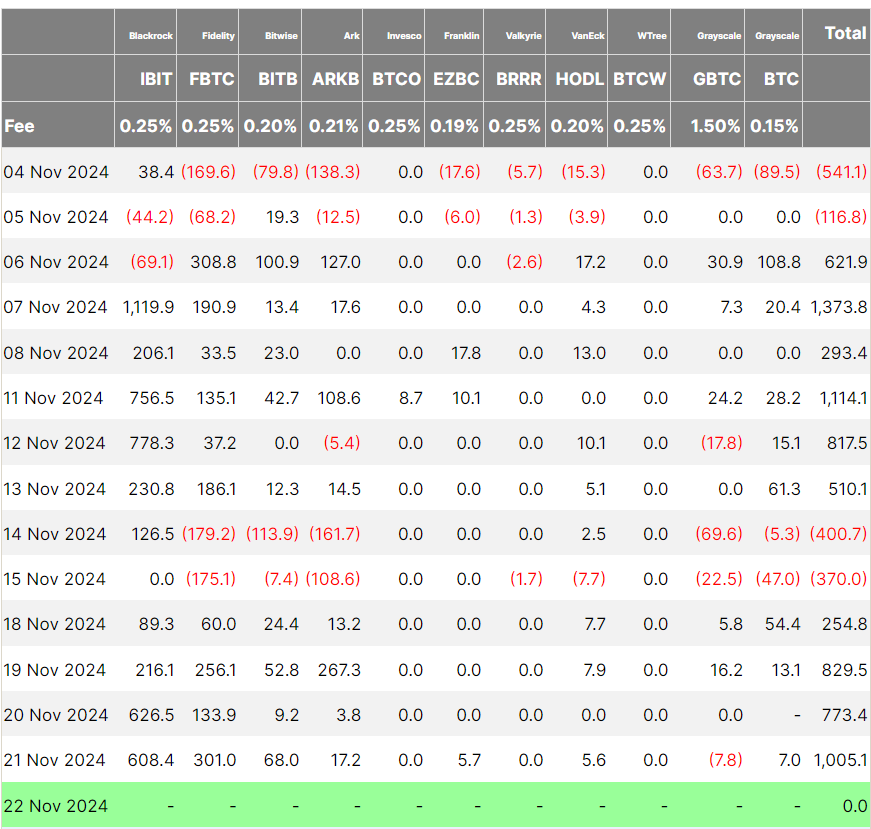

Spot Bitcoin exchange-traded funds (ETFs) have seen significant interest, with over $1 billion in cumulative net inflows recorded on 21 November. This marks the third-highest inflow day of the month and is a critical factor driving Bitcoin’s record-breaking rally.

Ryan Lee, chief analyst at Bitget Research, suggested that Bitcoin could breach $100,000 before the end of November. “The positive inflows into US spot Bitcoin ETFs continue to push Bitcoin toward new all-time highs,” he said.

Analysts Predict Further Gains

While Bitcoin remains on track for $110,000 in the long term, the timing of its next significant move is uncertain. “Reaching $110,000 seems inevitable, but ups and downs along the way are expected,” said Szymon Sypniewicz, CEO of Ramp Network.

With November historically being a strong month for Bitcoin, the cryptocurrency has already posted a 40% monthly gain, and experts remain optimistic about its trajectory leading into 2025.

Leave a Reply