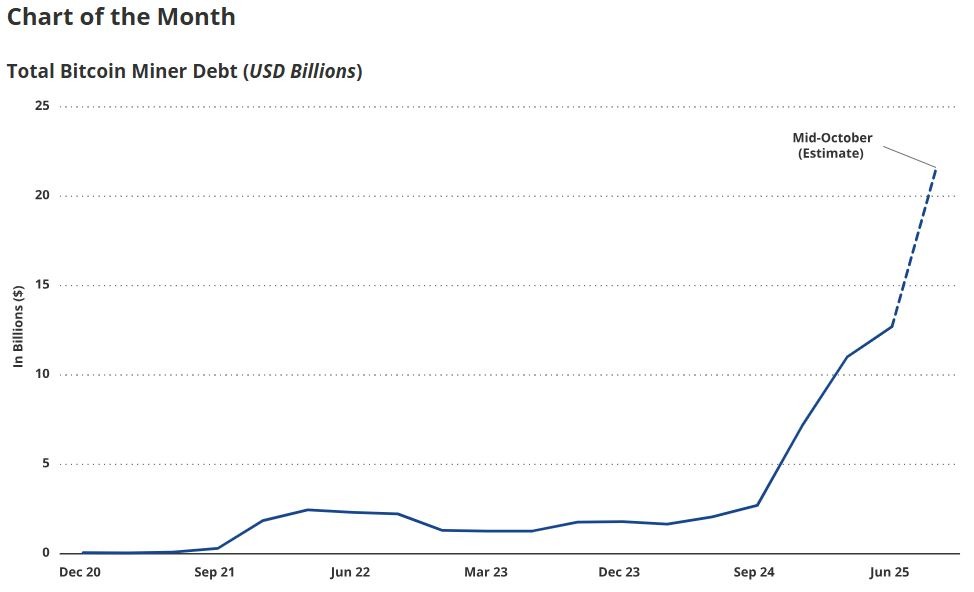

Debt levels among Bitcoin miners have surged dramatically, soaring from $2.1 billion to $12.7 billion in just one year, as mining firms scramble to maintain hashrate dominance and capitalise on the booming demand for artificial intelligence (AI) infrastructure.

According to a recent VanEck report, the sector is undergoing a deep transformation, blending next-generation mining hardware, AI integration and heavy borrowing in a bid to stay profitable amid shrinking Bitcoin rewards and escalating energy demands.

Miners Borrow Big to Defend Hashrate Share

In their October Bitcoin ChainCheck report, VanEck analysts Nathan Frankovitz and Matthew Sigel warned that the industry’s growing leverage highlights an “urgent race to maintain hashrate share.” Without ongoing upgrades, miners risk losing their share of daily Bitcoin rewards as newer, more efficient machines outpace older rigs.

The analysts described this dynamic as the “melting ice cube problem,” where mining equipment quickly loses value as technology advances.

Historically, miners relied on equity markets to fund capital-intensive upgrades. However, with equity becoming costlier and harder to secure, debt has emerged as the preferred financing route.

“Miners’ revenues are difficult to underwrite because they rely almost entirely on Bitcoin’s speculative price,” VanEck said. “Debt has become a cheaper and more predictable alternative.”

Record-Breaking $12.7 Billion in Debt

VanEck’s data shows total miner debt has jumped 500% year-on-year, marking the steepest increase on record. Industry tracker The Miner Mag further noted that combined debt and convertible-note offerings from 15 publicly listed miners hit $4.6 billion in Q4 2024, fell to $200 million in early 2025 and then rebounded to $1.5 billion by Q2 2025.

Recent debt-funded expansions highlight this capital rush:

- Bitfarms raised $588 million via a convertible note offering in October to build out AI and high-performance computing (HPC) infrastructure across North America.

- TeraWulf issued $3.2 billion in senior secured notes to expand its Lake Mariner data centre in New York.

- IREN completed a $1 billion convertible notes offering, allocating part of the proceeds toward new operational initiatives.

This aggressive borrowing signals the sector’s determination to preserve competitiveness amid a challenging market environment shaped by Bitcoin’s April 2024 halving, which cut block rewards to 3.125 BTC per block.

Miners Pivot Toward AI and HPC Hosting

The halving significantly squeezed miner revenues, forcing firms to diversify their business models. Many are now repurposing portions of their power capacity for AI and HPC workloads, a move designed to secure predictable, long-term cash flows.

“In doing so, miners have secured more stable income streams backed by multi-year contracts,” said Frankovitz and Sigel.

“The relative predictability of these cash flows has enabled miners to tap into debt markets, diversifying their revenues away from Bitcoin’s speculative cycles and lowering their overall cost of capital.”

This shift toward AI hosting also aligns with broader energy trends. AI data centres require substantial, continuous power, a need that Bitcoin miners are uniquely positioned to meet due to their established access to large-scale, often renewable, energy sources.

AI Integration: A Boon, Not a Threat

While some analysts have expressed concern that AI diversification could dilute miners’ focus on Bitcoin, VanEck views it as a net positive for the network’s resilience and sustainability.

“AI’s priority for electricity is a net benefit to Bitcoin,” the report stated. “It enables miners to diversify revenue while reducing their cost of capital.”

Miners can monetise idle power capacity during periods of low AI demand, replacing costly diesel backup systems and improving overall energy efficiency.

This synergy, according to VanEck, strengthens both industries, promoting smarter energy use and stabilising operational margins.

It also offers miners a valuable hedge against Bitcoin’s price volatility, effectively turning data centres into hybrid hubs for digital assets and AI computation.

Leveraged but More Efficient

Despite concerns over surging leverage, industry analysts suggest that the new debt-fuelled expansion could usher in a more efficient and diversified mining ecosystem.

By combining renewable energy, AI hosting, and modernised hardware, miners are crafting a more sustainable model that may help weather future downturns.

If managed prudently, this “AI-mining hybrid model” could secure long-term profitability and reinforce Bitcoin’s network strength ahead of 2026, a year many analysts expect to bring renewed growth in both crypto and AI infrastructure.

Leave a Reply