Top Bitcoin Miners See Massive Q1 Output

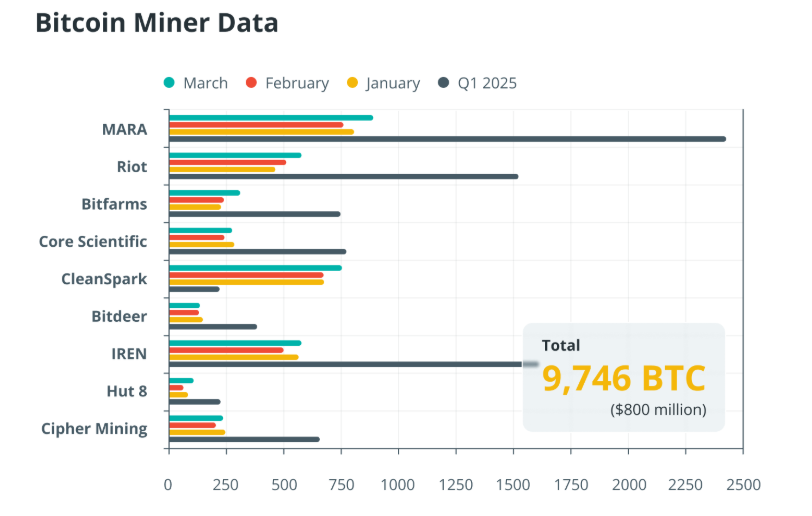

The first quarter of 2025 has seen record-breaking Bitcoin production, with the largest publicly traded mining companies generating nearly $800 million worth of BTC. A total of over 9,700 Bitcoin were mined, based on data compiled from public filings, as the cryptocurrency continues to hover around all-time highs.

At the forefront, Marathon Digital led the sector by mining 2,285 BTC—equivalent to roughly $186 million. The company’s March production alone stood at 829 BTC, marking a 17.4% increase from February and a 10.5% rise compared to January. CleanSpark followed closely, producing 1,950 BTC worth approximately $160 million, with a 13.4% month-on-month rise in March. Iren (formerly Iris Energy) took third place, mining 1,513 BTC, valued near $124 million.

Bitcoin was trading at around $81,600 at the time of reporting, further boosting the sector’s overall quarterly performance.

Paul Atkins Confirmed as SEC Chair

In a significant political development, the US Senate confirmed Paul Atkins as the new chair of the Securities and Exchange Commission (SEC) on April 9. The vote passed 52-44, largely along party lines.

Atkins, a pro-crypto figure and former SEC commissioner (2002–2008), was nominated by President Donald Trump late last year. He replaces Gary Gensler, under whose leadership the SEC aggressively pursued legal action against several crypto companies.

Atkins is expected to steer the agency in a new direction. During his Senate confirmation hearing in March, he emphasised the need for a “rational, coherent, and principled approach” to regulating digital assets. His background includes founding Patomak Global Partners and co-chairing the Token Alliance, a crypto advocacy group, until late 2024.

Trump Suspends Some Tariffs, Intensifies Pressure on China

Also on April 9, President Trump introduced a 90-day pause on “reciprocal tariffs,” reducing tariff rates to 10% for countries that do not impose counter-tariffs on US goods. However, China faces a significant hike, with Trump raising the tariff rate on Chinese goods to 125% in retaliation to Beijing’s own trade measures.

In a statement shared via Truth Social, Trump remarked: “At some point, hopefully, in the near future, China will realise that the days of ripping off the USA, and other Countries, is no longer sustainable or acceptable.”

The announcement caused a strong reaction in the markets. The S&P 500 index rallied nearly 7%, highlighting ongoing investor sensitivity to geopolitical developments and trade policy.

Crypto Market Outlook

With Bitcoin prices stable near record highs, investor interest in mining and digital asset infrastructure remains robust. Meanwhile, Paul Atkins’ leadership at the SEC could mark a shift towards a more favourable regulatory landscape for the crypto industry. However, the intensifying US-China trade tensions add a layer of uncertainty that could influence global markets, including digital assets, in the months ahead.

Leave a Reply