Bitcoin surged towards $113,000 on Thursday after fresh US labour market data revealed the weakest job growth in over three years. Investors flocked to the cryptocurrency as a hedge against mounting economic uncertainty and rising expectations of interest rate cuts by the Federal Reserve.

Labour Market Weakness Shakes Wall Street

The US Bureau of Labor Statistics (BLS) reported that the economy added only 22,000 jobs in August, well short of the 75,000 forecast. The unemployment rate rose to 4.3%, the highest since October 2021, signalling cracks in a labour market that had long appeared resilient.

Adding to concerns, revisions to earlier months’ data painted a darker picture. June and July job creation figures were revised down by a combined 285,000, intensifying fears that the employment slowdown is more entrenched than initially thought.

“That’s a total of -285,000 jobs in two months. What is happening here?” analysts asked as sentiment soured.

Bloomberg added more context, noting that US companies announced just 1,494 new positions in August – the lowest August reading since 2009, while layoffs surged 39% to 85,979. For the first time since April 2021, unemployed Americans outnumbered available job openings, with 7.24 million jobseekers versus 7.18 million vacancies.

Bitcoin Gains as Investors Seek Macro Hedge

The bleak data immediately shifted market dynamics. Bitcoin climbed as high as $112,974, up over 2% in the past 24 hours, cementing its role as a macro hedge against deteriorating fundamentals.

While traditional assets wobbled, the pioneer cryptocurrency attracted capital flows from investors seeking safety beyond the labour market narrative. Analysts argue that Bitcoin’s appeal lies in its independence from government monetary policy, making it attractive in times when traditional economic indicators falter.

“This is another reminder that Bitcoin has become more than a speculative trade, it’s increasingly treated as a barometer of fear, risk and resilience,” one market strategist observed.

Tariffs, Technology and Fed Balancing Act

The slowdown has multiple roots. Analysts point to Trump-era tariffs dampening business confidence, while the rapid adoption of artificial intelligence (AI) continues to reshape employment patterns. Together, these forces are challenging the post-pandemic recovery narrative.

Meanwhile, the Federal Reserve faces a delicate balancing act. Wage growth rose 3.7% year-on-year, outpacing inflation at 2.7%, complicating the inflation picture. While stronger wages usually give the Fed pause on cutting rates, the sharp hiring slowdown suggests that inaction could risk a deeper downturn.

“Wage growth is steady, but the jobs engine is stalling. The Fed will need to weigh the risks of moving too late against the danger of cutting too soon,” analysts said ahead of the September policy meeting.

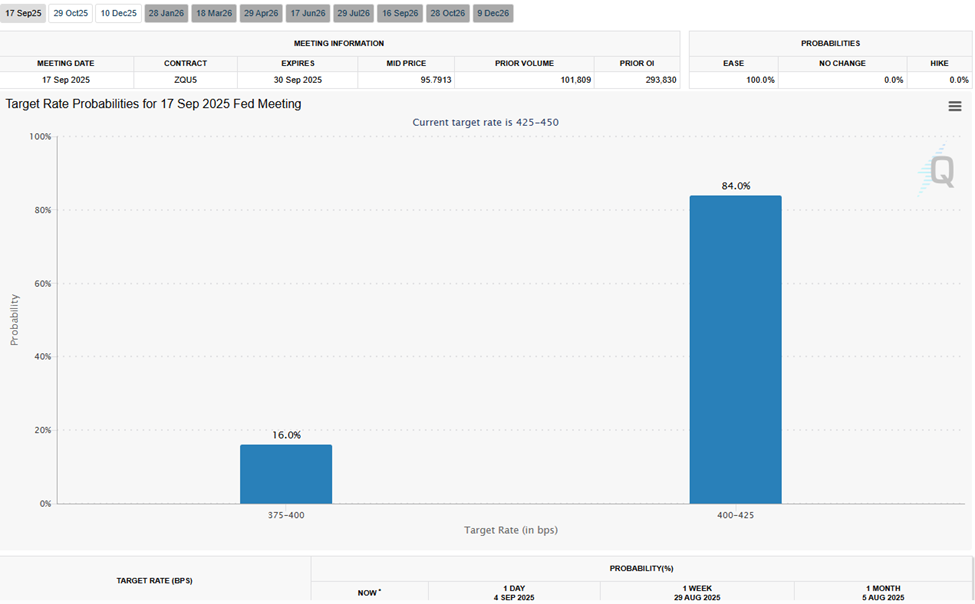

Shifting Rate Expectations Boosts Crypto

Markets are quickly pricing in a dovish shift. Bank of America now projects two rate cuts this year, a stark revision from its earlier forecast of no cuts until 2025. Such expectations have strengthened the case for Bitcoin and other alternative assets.

For investors, the August jobs report marked more than a data miss; it signalled a turning point for the US economy. Rising layoffs, falling job creation and higher unemployment suggest that momentum is faltering. Against this backdrop, Bitcoin’s resilience offers a compelling hedge.

As one market analyst summed up: “With every weak jobs print, Bitcoin’s role as a macro hedge becomes clearer. Investors aren’t just betting on digital gold, they’re looking for shelter from a slowing economy.”

Leave a Reply