Bitcoin is on the verge of reclaiming uncharted territory as its price edges closer to fresh all-time highs. The world’s largest cryptocurrency has surged past the $120,000 mark and is now testing the crucial $123,348 resistance zone, the last significant barrier before a potential “blue sky breakout”.

The move comes on the back of rising open interest and increasing institutional participation, both of which underscore strong market demand and the possibility of further upside momentum.

Rising Momentum Within a Bullish Channel

For months, Bitcoin has been trading within a well-defined long-term channel, consistently forming higher highs and higher lows, a hallmark of a robust bullish trend.

Recently, BTC defended the channel’s lower boundary in confluence with the point of control, creating the perfect springboard for the next leg higher. This defence triggered a rally that carried the price into the $123,348 high-timeframe resistance zone.

The significance of this region cannot be overstated. It represents the final structural hurdle before Bitcoin enters price discovery mode. Should this resistance be decisively reclaimed, traders and investors could see a surge towards the next logical target of $131,000, aligning with the channel’s upper boundary.

Open Interest Signals Healthy Demand

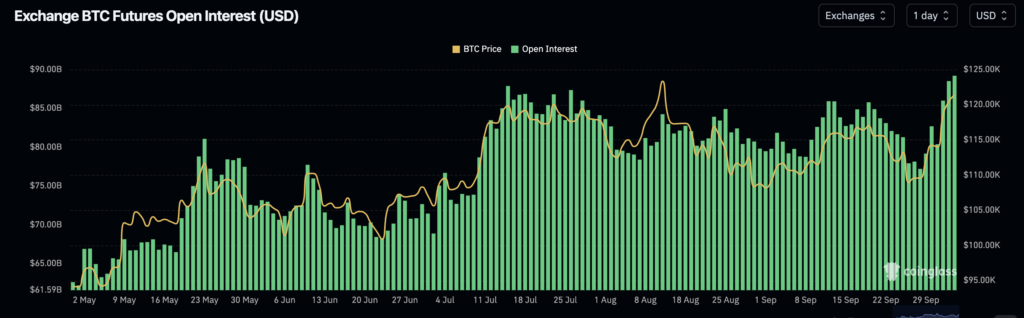

One of the most striking features of the current rally is the concurrent rise in open interest. Open interest tracks the total number of outstanding futures and options contracts in the market and when it rises in tandem with price, it generally signals healthy demand and sustainable growth.

The alignment of these two indicators suggests that Bitcoin’s rally is not simply driven by speculative fervour, but by genuine market participation. Increased open interest indicates that more traders and institutions are entering positions with conviction, strengthening the foundation for continued expansion.

This trend mirrors previous Bitcoin cycles, where a sustained rise in open interest alongside bullish structure often preceded powerful continuation rallies.

Institutional Confidence Reinforces the Rally

Adding weight to the bullish case is growing institutional involvement. Strategy’s Bitcoin holdings have now climbed to $77.4 billion as the cryptocurrency reclaimed the $120,000 mark. Such significant inflows from large players illustrate mounting confidence in Bitcoin’s long-term trajectory.

Furthermore, optimism from traditional financial institutions is beginning to reach new heights. A major Wall Street bank recently projected that Bitcoin could climb as high as $231,000, reflecting the scale of expectations surrounding the next stage of this bull cycle.

These endorsements not only bolster credibility for Bitcoin but also highlight its evolving status as a mainstream financial asset.

What Lies Ahead for Bitcoin?

The technical outlook for Bitcoin remains decisively bullish. Market structure continues to respect the ascending channel, with each expansion followed by measured corrections, a sign of sustainable growth rather than unchecked speculation.

The immediate focus remains on the $123,348 resistance level. A decisive breakout would likely accelerate momentum towards $131,000, the channel’s upper boundary. Beyond this, the absence of historical price levels means Bitcoin would enter blue sky territory, where heightened volatility and rapid price discovery are to be expected.

That said, traders should remain cautious. While the long-term trend favours continuation, markets often experience sharp pullbacks during periods of record-breaking advances. Increased volatility above all-time highs could test investor discipline before the next leg higher unfolds.

Conclusion

Bitcoin stands at the cusp of a historic breakout, powered by strong technical structure, surging open interest and deepening institutional confidence. The test of $123,348 will prove pivotal in determining whether the cryptocurrency launches into price discovery with a move toward $131,000 and beyond.

With market conditions aligning in favour of bulls, the coming weeks may mark a defining moment for Bitcoin’s trajectory. Whether this leads to the long-anticipated surge towards six-figure milestones or a temporary pause before further gains, one thing is certain: Bitcoin’s momentum shows no signs of slowing.

Leave a Reply