BTC rebounds strongly amid market volatility triggered by geopolitical tensions and upcoming ETF options launch.

Bitcoin continues to rally near its all-time highs, defying bearish pressure, with prices touching $93,243 on November 19. The cryptocurrency is inching closer to its record high of $93,700, set just days earlier on November 13, buoyed by upcoming market developments and geopolitical uncertainty.

BTC Eyes $94K Amid Liquidity Hunt

Bitcoin’s price showed a 2.4% daily gain, rebounding from a dip following the Wall Street open. Analysts suggest this volatility was driven by the ongoing conflict between Russia and Ukraine, which has impacted risk-asset markets. Despite a brief sell-off, BTC/USD recovered to trade near $93,700, just shy of its all-time high.

Market data reveals significant sell-side interest near $94,000, with many traders expecting a liquidity sweep at this level. According to Daan Crypto Trades, “The longer price consolidates around this region, the more likely we’ll take out those highs as positions keep building up.”

ETF Options Launch Supports Narrow Price Range

The imminent launch of BlackRock’s iShares Bitcoin Trust (IBIT) ETF options is also contributing to Bitcoin’s steady performance. Analyst Skew observed that bid liquidity is moving higher on exchange order books, which has kept BTC within a narrow price corridor.

Trader Justin Bennett remains optimistic, predicting a short-term breakout and a possible move toward $100,000. “A sweep of shorts seems likely… the question is, does a $94K sweep turn into a deviation, or can Bitcoin finally push toward $100K?” he shared on X.

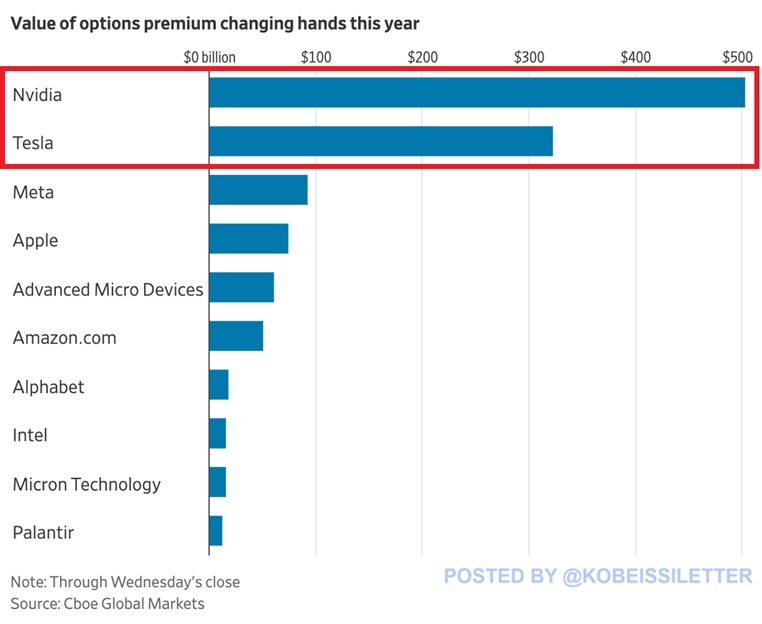

Nvidia Earnings Could Spark Market Volatility

Another key event on traders’ radars is the upcoming release of Nvidia’s corporate earnings, scheduled for November 20. With the options market predicting a 12% move in Nvidia’s stock, analysts warn of potential marketwide volatility.

“Nvidia’s earnings are HUGE,” noted The Kobeissi Letter, underscoring the influence this tech giant’s performance could have on broader market sentiment, including Bitcoin.

As Bitcoin flirts with record highs, traders remain focused on these critical market catalysts, which could shape its trajectory in the days to come.

Leave a Reply