Bitcoin endured heavy losses on Friday, slipping to its lowest level since early July and triggering more than half a billion dollars in crypto liquidations. Despite hopes pinned on a bullish relative strength index (RSI) divergence, the market failed to hold key support levels, leaving traders on edge as the price risks deeper downside moves.

Bitcoin Dips Below Key Levels

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin (BTC/USD) shedding nearly 4% in daily losses after the Wall Street open, dragging the asset to its weakest levels since 8 July. The dip was largely attributed to significant whale selling on Binance, the world’s largest exchange, which compounded the day’s bearish momentum.

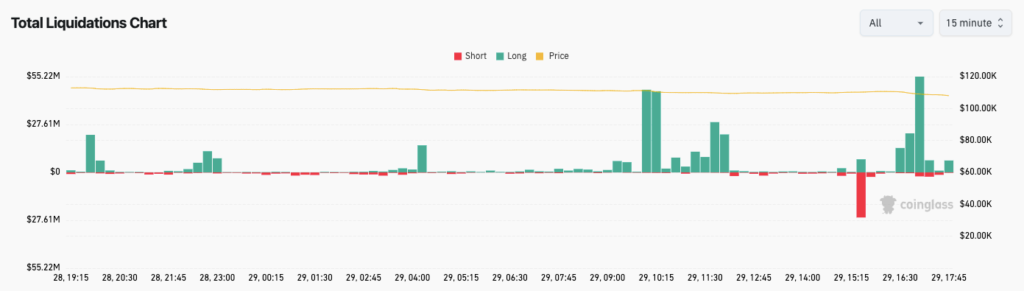

Market intelligence platform CoinGlass reported that total crypto liquidations over the previous 24 hours exceeded $530 million, underscoring the scale of the market wipeout. Traders noted that Bitcoin is now approaching a critical reversal zone, one that has historically acted as a battleground for bulls and bears.

“Good area to keep watching. Right on top of the previous range and consolidation area,” observed well-followed analyst Daan Crypto Trades.

Similarly, trader Crypto Caesar highlighted the failure to reclaim $112,000 as support, while stressing that the broader sentiment remains fragile without a decisive recovery.

Bulls Look to RSI Divergence for Hope

Even amid the bloodbath, some traders pointed to the RSI indicator for glimmers of optimism. On the four-hour chart, Bitcoin has continued to maintain a bullish RSI divergence, a scenario where the RSI forms higher lows while price action moves lower. Such divergences can often precede a short-term reversal.

Crypto commentator Javon Marks noted that this technical setup could pave the way for a rebound:

“$BTC (Bitcoin), still coming off of a confirmed bullish divergence can still have a huge reversal back up to $123,000 in the works. This means that despite the current action, we could see a nearly +15% move back near the all-time highs…”

However, scepticism remains strong. Analysts argue that for any sustainable rally to emerge, Bitcoin must first secure a weekly close above $114,000, a threshold identified earlier in the week as critical for bullish continuation.

Seasonal Weakness Meets Macro Uncertainty

Adding to Bitcoin’s woes is the market’s seasonality. September has historically been the weakest month for the cryptocurrency, with traders often wary of macroeconomic pressures and thinning liquidity.

The macro backdrop continues to loom large, with US inflation concerns at the forefront. The Federal Reserve’s Personal Consumption Expenditures (PCE) Index, widely considered the central bank’s preferred inflation gauge, matched expectations but reinforced signs of a rebound in inflationary pressures.

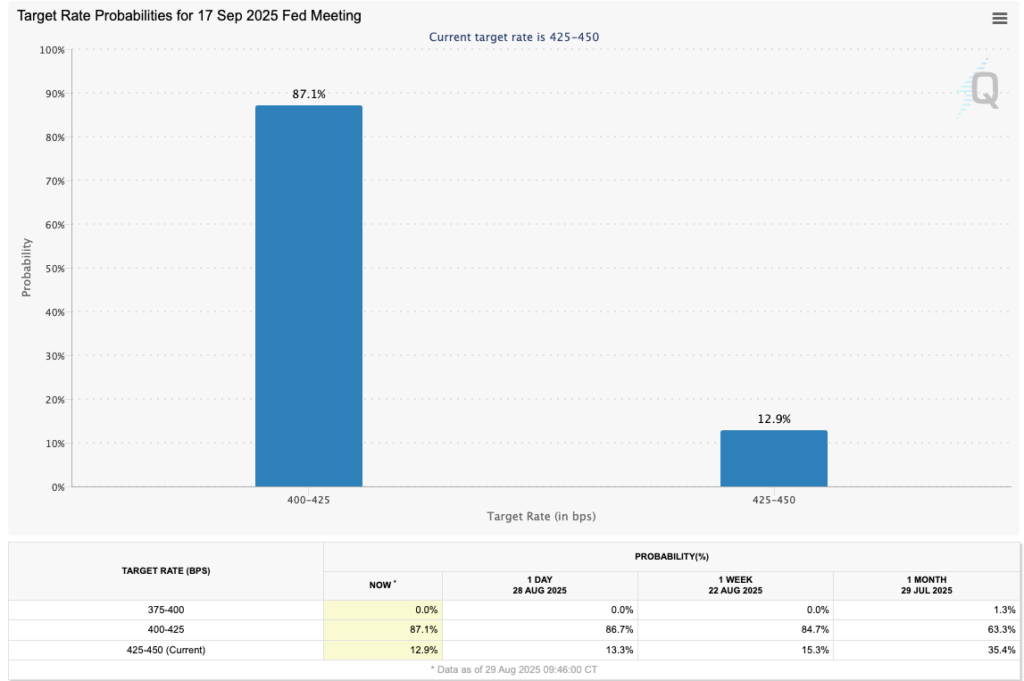

Despite this, CME Group’s FedWatch Tool showed that markets still expect the Fed to cut rates in September, a development typically viewed as supportive for risk assets, including Bitcoin.

Even so, trading firm Mosaic Asset warned that the picture could shift rapidly. “Outlook for rate cuts could be in jeopardy if next week’s payrolls are stronger than expected,” the firm cautioned. With the Fed’s next policy decision set for 17 September, volatility in crypto markets could intensify further.

What Comes Next for Bitcoin?

For now, traders are eyeing the $100,000 zone as the next critical downside target should bearish pressure persist. The inability to hold above $112,000 has added weight to this scenario, while whale-driven selling continues to pressure the order books.

Short-term traders may take comfort in RSI divergence, but without broader market conviction, any bounce could prove fleeting. Analysts stress that Bitcoin’s ability to close above $114,000 remains vital to shifting sentiment and halting the slide.

With macro headwinds, seasonal weakness, and investor caution at play, Bitcoin faces a critical fortnight ahead. Whether RSI-driven momentum can translate into a meaningful recovery or whether bears tighten their grip toward $100,000 will likely depend on both on-chain flows and upcoming US economic data.

Leave a Reply