Bitcoin has surged close to a new record, driven by optimism surrounding the United States and China finalizing their long-awaited trade agreement. The cryptocurrency market is riding on the prospect of reduced global economic uncertainty as the two economic superpowers iron out their trade differences.

US-China Trade Deal Sparks Market Optimism

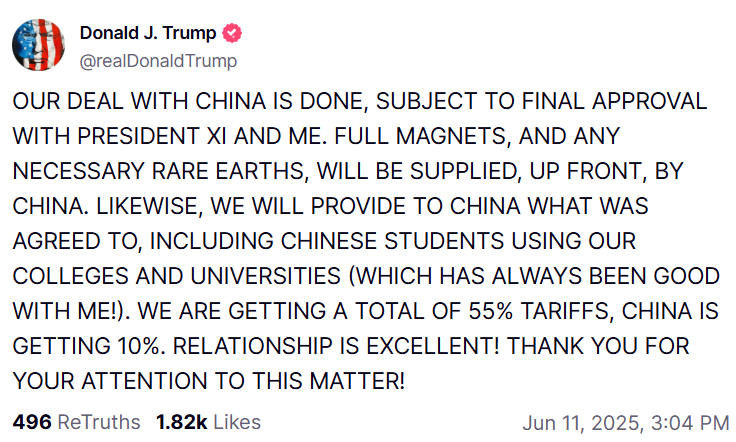

On Wednesday, former US President Donald Trump announced that a trade agreement with China was “done,” pending final approvals. The deal includes the US imposing a total of 55% tariffs while China counters with 10%. Trump described the relationship between the nations as “excellent,” signaling a positive diplomatic outlook.

China’s Vice Commerce Minister, Li Chenggang, also confirmed progress, stating the two sides reached an in-principle agreement during recent negotiations in London. These developments mark a shift toward resolving a trade conflict that has weighed heavily on global markets.

Bitcoin Hits $110K Before Slight Retracement

In light of the trade deal news, Bitcoin reached a 24-hour high of $110,300 before pulling back slightly to $109,560. Analysts believe the crypto’s bullish momentum reflects a broader market relief, as tariff-related uncertainties start to diminish.

Global Macro Investor CEO Raoul Pal suggested that most remaining negotiations could merely be posturing, further fueling optimism. Meanwhile, Wall Street’s mixed response to the news hints at ongoing caution regarding concrete policy changes.

Crypto Markets Recovering From Tariff Shock

Bitcoin’s recent rally contrasts sharply with its performance earlier this year. On April 7, the cryptocurrency fell to a year-to-date low of $74,434, following Trump’s announcement of reciprocal import tariffs. This move also caused the S&P 500 to shed over $5 trillion in value, its largest drop to date.

Tariff-related uncertainties have also impacted crypto venture capital (VC) investments, which dropped to 62 deals in May 2025, a record monthly low. Analysts attributed this slowdown to deteriorating market sentiment caused by heightened trade tensions.

Bitcoin and Beyond

The easing of trade tensions could provide a much-needed boost to traditional and crypto markets alike. Analysts are cautiously optimistic, noting that while progress in US-China relations has buoyed sentiment, the market remains sensitive to further developments.

Bitcoin’s resurgence demonstrates its resilience in the face of macroeconomic pressures. With global markets stabilizing, the cryptocurrency could see additional upside, provided that trade negotiations maintain their current trajectory.

Leave a Reply