Bitcoin (BTC) recently surpassed the pivotal $95,000 mark, sparking mixed reactions across the market. While miners exhibit growing confidence, traders remain cautious, with derivatives data hinting at bearish sentiment. This divergence between key market participants raises questions about the coin’s next move.

Miners Accumulate as Reserves Hit Turning Point

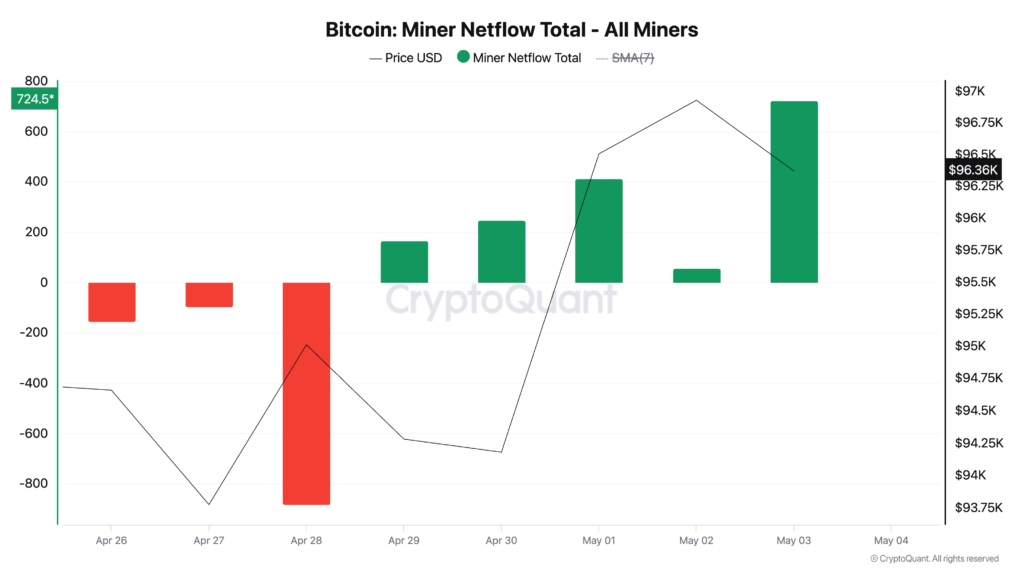

Bitcoin’s decisive break above $95,000 has brought a significant shift in miner sentiment. On-chain data from CryptoQuant reveals a sharp rebound in BTC miner reserves, which had reached a yearly low of 1.80 million BTC on April 28. By April 29, reserves began climbing, signaling renewed accumulation.

Miner reserves, a key indicator of coins held in miner wallets, often reflect their confidence in future price movements. The recent uptick suggests miners are betting on further upside by holding onto their assets rather than liquidating them.

Supporting this bullish narrative is the positive miner netflow since April 29, indicating that more coins are being stored in miner wallets rather than transferred to exchanges. Historically, such behavior from miners—typically long-term holders—has preceded bullish market trends.

Traders Remain Bearish Despite Price Rally

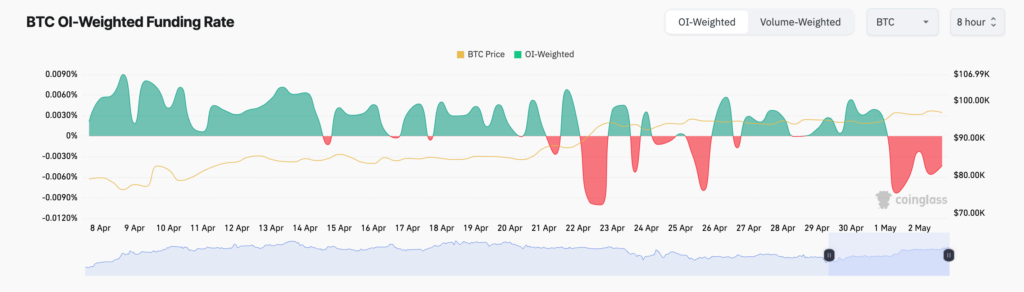

While miners accumulate, derivatives data paints a more cautious picture. Bitcoin’s funding rate in perpetual futures contracts has remained negative since early May, signaling a bearish bias among traders.

At the time of writing, the funding rate stands at -0.0056%, indicating that short positions outweigh long positions in the market. A negative funding rate often reflects expectations of a price pullback, as traders bet against near-term price gains.

This cautious stance underscores the market’s uncertainty, even as Bitcoin maintains its position above $95,000.

Key Levels to Watch: Breakout or Breakdown?

Bitcoin’s next moves hinge on the battle between bullish miners and cautious traders. If accumulation by miners strengthens and demand picks up, BTC could break above the critical resistance at $98,515. A sustained rally may then push the price towards the $102,080 mark, signaling a potential breakout.

Conversely, if bearish bets prevail and selling pressure increases, Bitcoin could face a reversal. A dip below $95,000 may open the door to a retest of $92,910, further solidifying the traders’ cautious outlook.

Market Sentiment: A Tug of War

The current divergence between miner confidence and trader caution highlights the complexities of Bitcoin’s market dynamics. Miners, buoyed by the price milestone, appear optimistic about long-term growth, while traders are wary of immediate corrections.

As Bitcoin navigates this tug of war, its ability to sustain momentum or face a pullback will depend on the interplay between demand, accumulation, and external market conditions.

Leave a Reply