Bitcoin’s bull run shows no sign of slowing, with on-chain indicators and analyst projections pointing to new all-time highs in the coming weeks. A fresh report from CryptoQuant highlights the potential for price expansion, setting long-term targets as high as $150,000.

NVT Golden Cross Signals More Upside

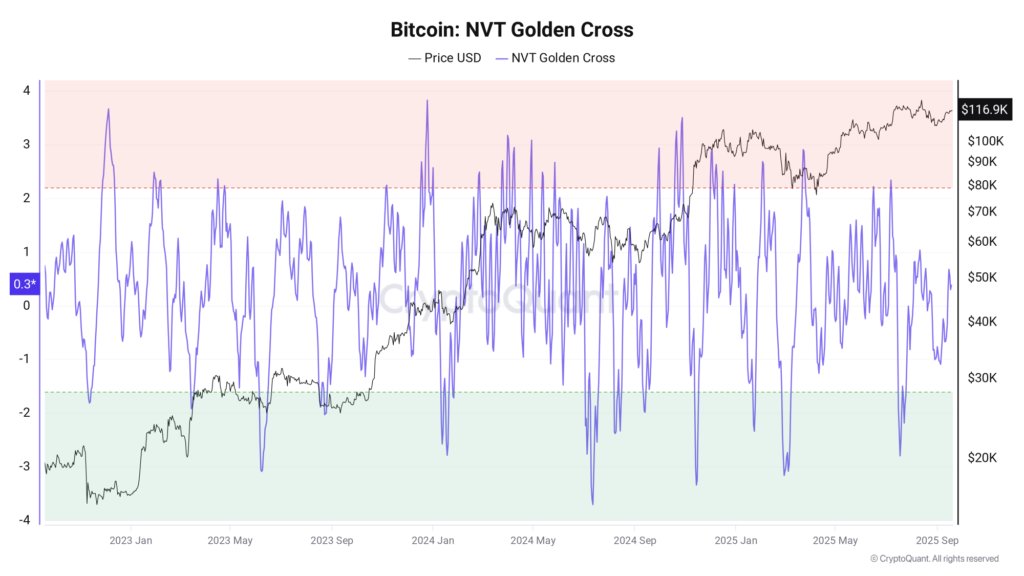

According to CryptoQuant’s latest research, Bitcoin remains in a “healthy uptrend,” supported by the network value to transaction golden cross (NVT-GC) indicator. This tool compares Bitcoin’s market capitalisation with the value of on-chain transactions over time, offering signals for price tops and bottoms.

At present, the NVT-GC sits in neutral territory, with a recent rebound from -2.8 in July to 0.3. Historically, values below -1.6 have preceded major price rallies, while readings above 2.2 tend to signal overvaluation and potential reversals.

CryptoQuant contributor Pelin Ay summarised:

“This indicates neither extreme overvaluation nor undervaluation, but rather a healthy uptrend. Bitcoin is not yet in bubble territory and there is still room for price expansion.”

The indicator’s track record reinforces optimism, with its last four dips into the “long” zone followed by significant price gains, including the rally in August 2024.

Consolidation Before Breakout

Despite the bullish momentum, analysts expect short-term consolidation before Bitcoin attempts a new all-time high. CryptoQuant contributor Axel Adler Jr. noted that Bitcoin currently trades just above the short-term holder (STH) realised price, the average cost basis for wallets holding coins for up to six months.

This position typically signals a pause in the market. Adler suggested a 1–2 week consolidation phase, which could set the stage for Bitcoin to push into price discovery territory by October.

Price Expansion Targets $117K and Beyond

CryptoQuant’s report highlighted $117,000 as a potential level for price expansion based on current on-chain metrics. Beyond this, historical trends suggest Bitcoin could climb even higher into the $120,000–$150,000 range in the coming months.

Ay added that Bitcoin remains far from overheated and stressed that the market does not yet show signs of a blow-off top. With momentum indicators such as the moving average convergence/divergence (MACD) also flashing “buy” signals, the probability of further upside appears strong.

Long-Term Outlook: Healthy Bull Market

Overall, analysts agree that the current market conditions point to a sustainable bull cycle rather than speculative excess. While corrections and short-term pullbacks remain possible, the weight of on-chain data suggests Bitcoin still has significant room to grow.

“Overall, Bitcoin is not in a high-risk zone,” Ay concluded. “Historical patterns suggest the price could climb toward the $120,000–$150,000 range in the coming months.”

If these projections play out, Bitcoin may soon enter a new phase of price discovery, confirming that the bull market is far from over.

Leave a Reply