Bitcoin dropped to its lowest level since early July on Friday, with a sharp sell-off pushing the price below $109,000. The decline came as major holders unloaded large amounts of BTC, triggering liquidations of more than half a billion dollars in the past 24 hours.

Fresh Pressure at Wall Street Open

Data from TradingView showed that Bitcoin slid nearly 4% after the Wall Street opening bell, reaching $108,365 at one point. The fall added to a series of weekly declines, with traders pointing to whale selling on Binance as the main driver of downward momentum.

Analytics platform CoinGlass estimated that around $540 million in crypto positions were liquidated in just one day, deepening concerns over Bitcoin’s ability to hold key support levels.

Bulls Struggle to Hold Key Levels

Market commentators highlighted that Bitcoin failed to reclaim $112,000 as support, while $114,000 remains a crucial weekly close threshold for the bullish case. Without a recovery, many traders see risks of the price drifting toward the $100,000 level.

However, some analysts continue to track technical indicators for signs of a rebound. A bullish divergence in the relative strength index (RSI) on the four-hour chart has offered a glimmer of hope. RSI has been making higher lows even as price action dips lower — a potential early signal of an upside reversal.

Crypto commentator Javon Marks suggested that this pattern could pave the way for a sharp bounce. “Despite the current action, we could see a move back near $123,000, which would mark a near 15% recovery,” he argued.

Macro Pressures and Seasonal Weakness

The downturn also reflects broader market caution over macroeconomic conditions. September is historically Bitcoin’s weakest month, and traders remain on edge as US inflation trends weigh on risk assets.

The latest Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, matched expectations but showed signs of a rebound in inflationary pressures. While markets still largely expect the Fed to cut interest rates in September, upcoming data could alter the outlook.

Fed Uncertainty Ahead of September Meeting

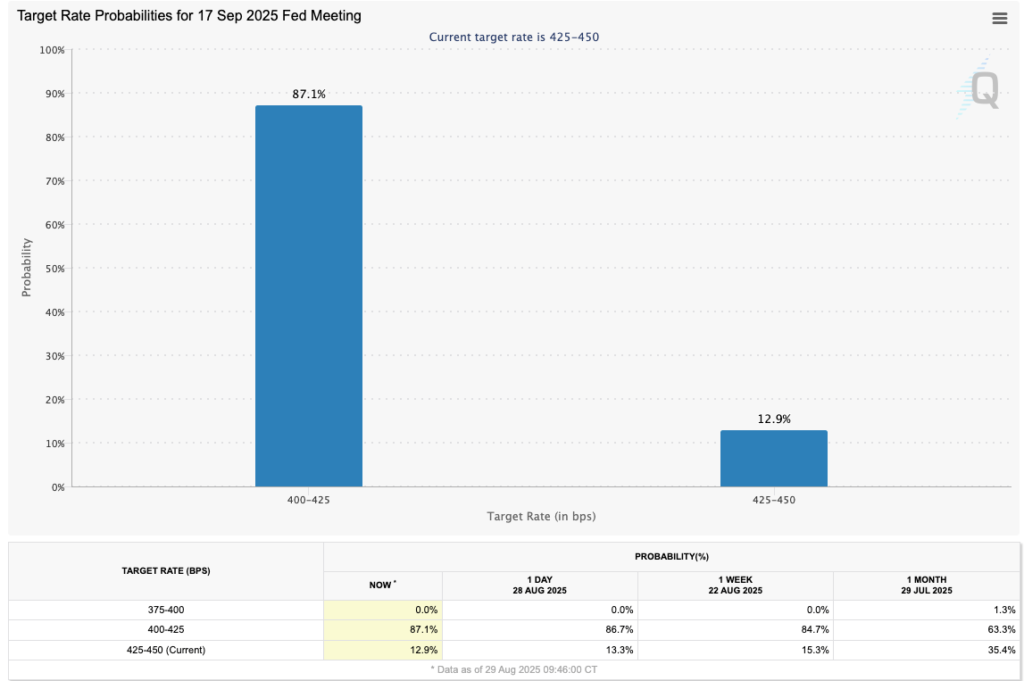

According to CME Group’s FedWatch Tool, traders are still betting on a September rate cut, which would typically act as a tailwind for Bitcoin and other risk-sensitive assets. Yet analysts warn that stronger-than-expected payroll data next week could prompt the Fed to hold rates steady.

Trading firm Mosaic Asset said the situation remains fluid. “The outlook for rate cuts could be in jeopardy if next week’s payrolls are stronger than expected,” the firm cautioned.

Outlook

With Bitcoin stuck below crucial resistance levels and macro uncertainty lingering, market sentiment remains fragile. Traders are watching closely to see if the bullish RSI divergence can spark a short-term recovery or if bearish momentum will drag the price closer to the $100,000 mark.

Leave a Reply