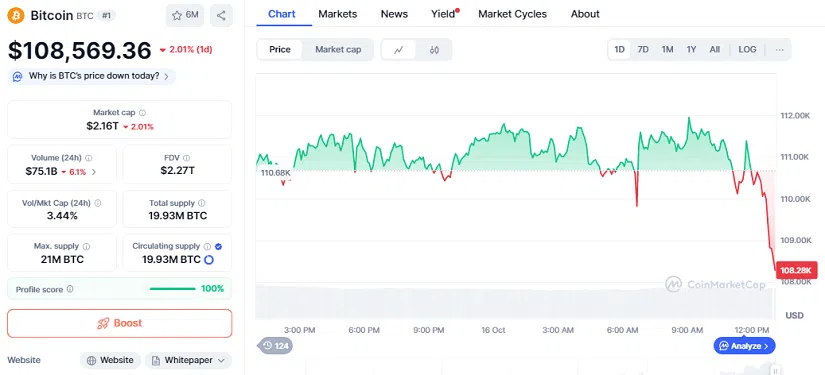

Bitcoin (BTC) has once again fallen below the critical $110,000 threshold, trading around $108,569 after a 2.01% daily decline, extending its weekly losses to over 9%. The move comes amid heightened market caution ahead of President Donald Trump’s upcoming policy speech, which could shape sentiment across global markets.

Despite the price retreat, long-term investors remain optimistic. Capital continues to flow into Bitcoin infrastructure, custody solutions and decentralised payment networks, signalling that institutional conviction remains strong even as short-term volatility spikes.

Broader macro uncertainty has added to the pressure. Washington remains deadlocked over government funding and speculation is mounting that Trump could announce new budget priorities or tariff measures on Chinese imports. Such policy details are widely expected to influence equities, commodities and digital assets alike.

Whale Moves and Heavy Short Bets

Whale activity and institutional positioning have become central talking points. Data from Coinalyze shows total Bitcoin derivatives open interest at $33 billion, with perpetual contracts comprising the bulk at $30.9 billion. Open interest has declined by 1.67% over the past 24 hours, suggesting that traders are trimming exposure rather than exiting entirely.

According to Greekslive, institutional traders have bought more than $1.15 billion in downside protection through put options, accounting for 28% of total transactions. Most of these bets target the $104,000–$108,000 range, forming a dense zone of activity. Market skew has turned sharply negative, approaching sentiment levels last seen after the $19 billion liquidation crash earlier in the month.

Adding to the bearish tone, on-chain trackers revealed that a major whale opened a $392 million short position, currently holding $5.7 million in unrealised gains. Two additional large traders reportedly built combined short positions worth $180 million across BTC, ETH, SOL and DOGE.

Social media chatter has amplified the intrigue, linking one “Trump insider” whale to another $120–$127 million short entry at around $111,386, fuelling rumours that market participants may be positioning ahead of the president’s remarks.

Technical Signals Flash Caution

From a technical standpoint, Bitcoin’s recent behaviour shows signs of weakening momentum. The $110,000 level, once a dependable support, is now acting as resistance, testing traders’ conviction. Indicators such as the Relative Strength Index (RSI) are sliding toward neutral territory, while MACD readings indicate fading upward pressure.

Analysts warn that a daily close below $109,000 could pave the way for a test near $105,000, although buyers have historically stepped in during similar pullbacks.

On higher timeframes, the weekly RSI shows bearish divergence, where price makes higher highs but momentum lags, a classic sign of exhaustion. Analyst Ali Martinez notes that each price advance since 2024 has carried less momentum, suggesting the uptrend is losing strength.

Meanwhile, long-term analyst Ted Pillows argues that Bitcoin’s famed four-year cycle may be giving way to a liquidity-driven market. “It was never about the halving; it’s about liquidity,” he said, suggesting that macroeconomic shifts could extend the next major top into 2026, rather than the previously expected December 2025 peak.

Institutional Confidence Amid Market Anxiety

Despite short-term fear, institutional sentiment remains resilient. Trading volume, at $75 billion in the past 24 hours, is down just 6%, indicating heavy repositioning rather than a market exodus.

Large funds continue to treat Bitcoin as a portfolio hedge and long-term store of value, especially with expectations of monetary easing in 2026. Banks, insurers, and payment firms are deepening their involvement, reinforcing Bitcoin’s status as a core digital asset.

Meanwhile, on-chain data from Onchain Lens showed a whale transferring 2,000 BTC (worth $222 million) into 51 new addresses, a move analysts interpret as routine privacy management rather than panic selling.

Andreas Brekken, founder of SideShift.ai, summarised the current environment succinctly: “The ongoing liquidation is targeting everyone who mixed the two deadliest substances in crypto, shitcoins and leverage. Alt season hopes are alive, but only for those holding spot positions in projects with real revenue.”

Outlook: Consolidation Before Clarity

With markets on edge and policy uncertainty rising, Bitcoin appears set for a consolidation phase between $105,000 and $120,000. The $104,000 level, where heavy put option interest lies, will be a critical test of buyer strength.

A decisive break below could expose the $96,500 MVRV fair value zone, while a rebound from support might restore confidence heading into the year’s final quarter.

For now, all eyes are on Washington, where the tone and content of Trump’s speech could determine whether Bitcoin steadies above key support or extends its correction deeper into October.

Leave a Reply