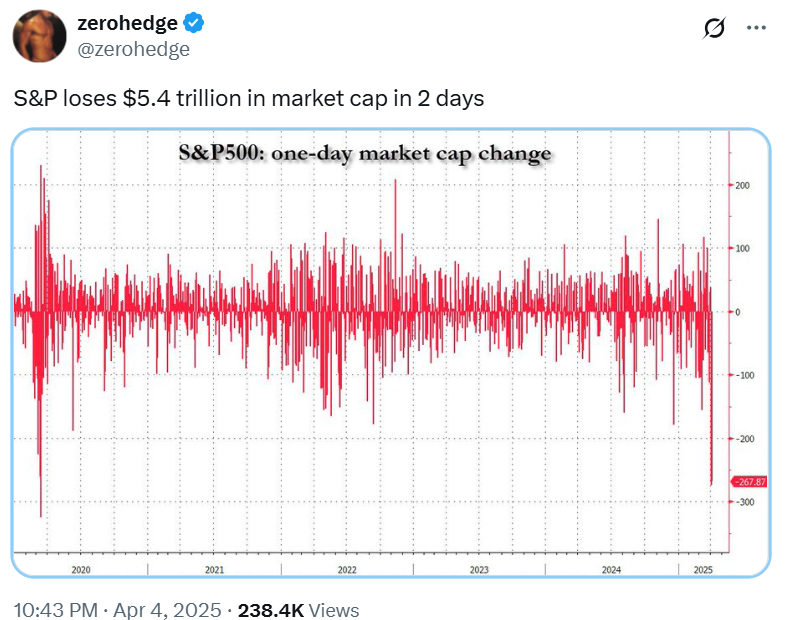

Amid the largest stock market plunge in history, Bitcoin is proving its mettle. As the S&P 500 lost $5 trillion in just two days following former President Donald Trump’s tariff announcement, Bitcoin dipped only 3.7%, signalling a potential shift in how investors view the leading cryptocurrency.

Tariffs Trigger Market Turmoil

The sell-off was sparked by Trump’s April 2 announcement of reciprocal import tariffs, aimed at reducing the $1.2 trillion trade deficit and promoting domestic manufacturing. While traditional markets reacted sharply, with losses eclipsing even the COVID-19 crash of March 2020, Bitcoin held its ground around $83,600, according to TradingView.

Analysts see this resilience as a sign that Bitcoin is moving away from being classified strictly as a risk asset, potentially evolving into a safer store of value during times of economic distress.

Bitcoin’s Resilience Signals Maturity

According to Marcin Kazmierczak, COO of RedStone, the limited price drop points to Bitcoin’s “evolving market positioning.” While Bitcoin has historically mirrored traditional risk assets during global shocks, this time it appears more stable.

Kazmierczak attributes this to Bitcoin’s fixed supply structure, which contrasts with fiat currencies that are vulnerable to inflation, particularly under tariff-driven economic policies.

Digital Gold Narrative Gains Ground

The idea of Bitcoin as “digital gold” is gaining traction. Iliya Kalchev, analyst at Nexo, noted that Bitcoin’s ability to hold above $82,000 despite heightened volatility suggests that structural demand remains strong.

Meanwhile, James Wo, CEO of DFG, cautions that Bitcoin’s initial dip still reflects investor hesitation, especially as Bitcoin ETFs increase institutional exposure, making the asset more sensitive to macroeconomic movements.

Still, if Bitcoin maintains its stability in the face of continued uncertainty, its hard-capped supply and decentralised architecture may solidify its place as a reliable store of value.

$132K in Sight for 2025?

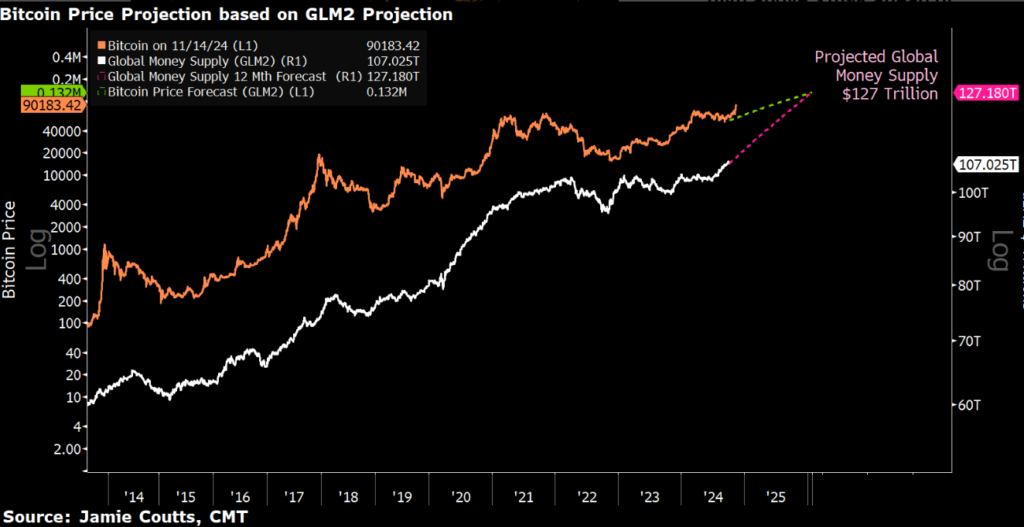

Despite current market unease, long-term outlooks remain bullish. Jamie Coutts, chief crypto analyst at Real Vision, predicts that expanding money supply could push Bitcoin to over $132,000 by the end of 2025.

As global economies navigate inflation, protectionism, and volatile equities, Bitcoin’s scarcity and decentralisation could prove more attractive than ever. The recent divergence from traditional markets may be just the beginning of Bitcoin’s next chapter — one where it earns its place as a true financial hedge.

Leave a Reply