As Bitcoin’s price climbs past $110,000, a renewed wave of corporate crypto adoption has helped fuel a broad rally in crypto-linked US stocks. On Monday, several publicly traded firms ranging from crypto miners to fintech newcomers saw their share prices rise, reflecting growing confidence in Bitcoin’s long-term trajectory and stability amid improving global economic signals.

Bitcoin Climbs Back Toward All-Time High

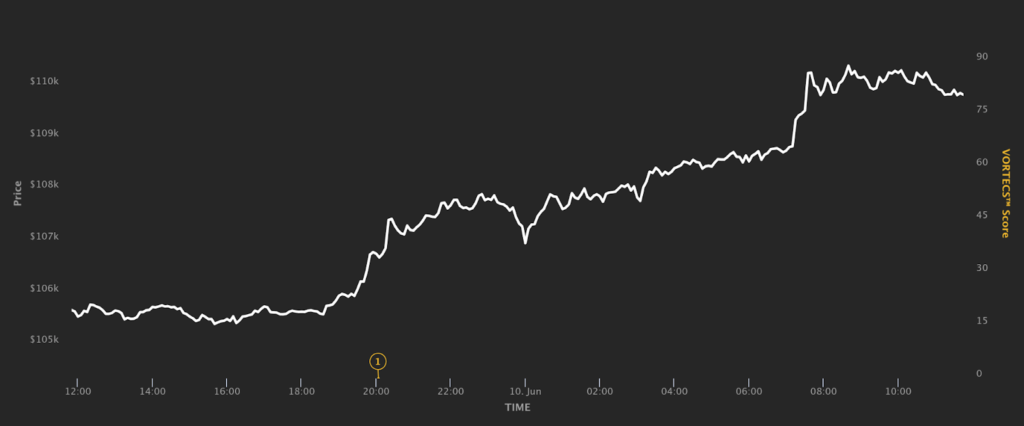

Bitcoin rose by 4% in 24 hours to hit $110,150, approaching its May 22 peak of $112,000. The upswing comes as US-China trade talks resumed in the UK, calming investor nerves and helping boost appetite for riskier assets. The crypto’s resilience continues to attract institutional interest, with several firms buying BTC for balance sheet diversification and market signalling.

MicroStrategy Inc. (MSTR), the most prominent corporate BTC holder, gained 4.71% in regular trading and added another 1% after-hours, closing at $396.61. The company’s consistent Bitcoin acquisition strategy appears to be paying off, especially amid broader market optimism.

US Crypto Stocks Follow Bitcoin’s Lead

Major crypto-linked stocks mirrored Bitcoin’s momentum throughout Monday’s trading session. Circle Internet Group (CRCL), a recently listed stablecoin issuer on Nasdaq, led gains with a 7% jump during the day and a further 2.2% rise after-hours, closing at $117.79.

Crypto miners also performed strongly:

- Core Scientific Inc. (CORZ) rose 4.27%, with an after-hours gain of 0.87%.

- CleanSpark Inc. (CLSK) and MARA Holdings Inc. (MARA) both climbed over 3%, followed by an additional 1% boost after-hours.

- Riot Platforms Inc. (RIOT) gained 2.74% during the day, adding another 1.2% in after-market trading.

These moves reflect renewed investor confidence in crypto infrastructure firms as Bitcoin’s price rally shows signs of stability.

BitMine and KULR Join the Bitcoin Treasury Club

More public companies are jumping on the Bitcoin bandwagon, hoping to leverage crypto assets for treasury optimisation and shareholder value.

On Monday, BitMine Immersion Technologies, Inc. (BMNR) announced its first significant Bitcoin buy 100 BTC acquired following an $18 million share offering. While the company’s stock initially dropped 8.7%, it clawed back 5.2% after-hours to $7.25, indicating cautious optimism from investors.

Similarly, KULR Technology Group, Inc. (KULR), which specialises in energy management systems, revealed a $13 million BTC purchase. The addition brought its total holdings to 920 BTC, with an average buy-in price of $98,760. KULR shares responded with a 4.2% climb on the day, reinforcing the market’s positive sentiment toward such strategic crypto moves.

Robinhood Falters as eToro Soars

Not all crypto-linked firms shared in the day’s gains. Robinhood Markets Inc. (HOOD) fell nearly 2% to $73.40 after failing to secure a spot in the S&P 500 during its quarterly rebalance. Market speculation had pegged Robinhood as a potential new entrant, and the lack of inclusion likely triggered short-term disappointment among investors.

In contrast, eToro Group Ltd. (ETOR), a rival trading platform that recently went public, surged 10.5% and extended its after-hours gains by another 2.4% to close at $77.79. Meanwhile, Coinbase Global Inc. (COIN) posted a modest 2% gain, ending the day at $256.63, as interest in exchange platforms remained steady.

Corporate Crypto Adoption Gains Steam

The trend of public companies adding Bitcoin to their reserves appears to be accelerating, with the market increasingly rewarding firms that signal confidence in crypto assets. Bitcoin’s rising price, combined with global macro stability and stronger investor sentiment, is creating fertile ground for further institutional adoption.

While not all companies are reaping immediate stock price benefits as seen with BitMine, the broader pattern shows that aligning with Bitcoin may serve as a long-term bullish strategy, especially in the eyes of forward-looking investors. As Bitcoin continues its journey toward a new all-time high, crypto markets may be entering another defining era of institutional buy-in.

Leave a Reply