Defunct crypto exchange Mt. Gox has once again delayed its long-awaited creditor repayments, pushing the deadline for Bitcoin distributions to October 2026. The exchange, which collapsed in 2014 following a massive hack, still controls roughly $4 billion worth of Bitcoin, according to data released this week.

This latest delay comes after a year of gradual repayments that began in mid-2024. Despite the release of around 75% of Mt. Gox’s Bitcoin reserves, the market has remained remarkably resilient. Data from Arkham Intelligence shows that the exchange’s Bitcoin holdings have fallen from 142,000 BTC to just 34,690 BTC, yet Bitcoin’s price has risen 85% during the same period.

The outcome has defied expectations. Many analysts had predicted a wave of selling pressure as creditors received their coins. Instead, the market easily absorbed the released supply, signalling that BTC demand is at historic highs.

Market Absorbs Supply with Ease

Since mid-2024, approximately $12 billion worth of Bitcoin has been redistributed by Mt. Gox. Normally, such a volume might have triggered a correction. However, demand from institutional players, ETFs and public companies has more than offset this potential downside.

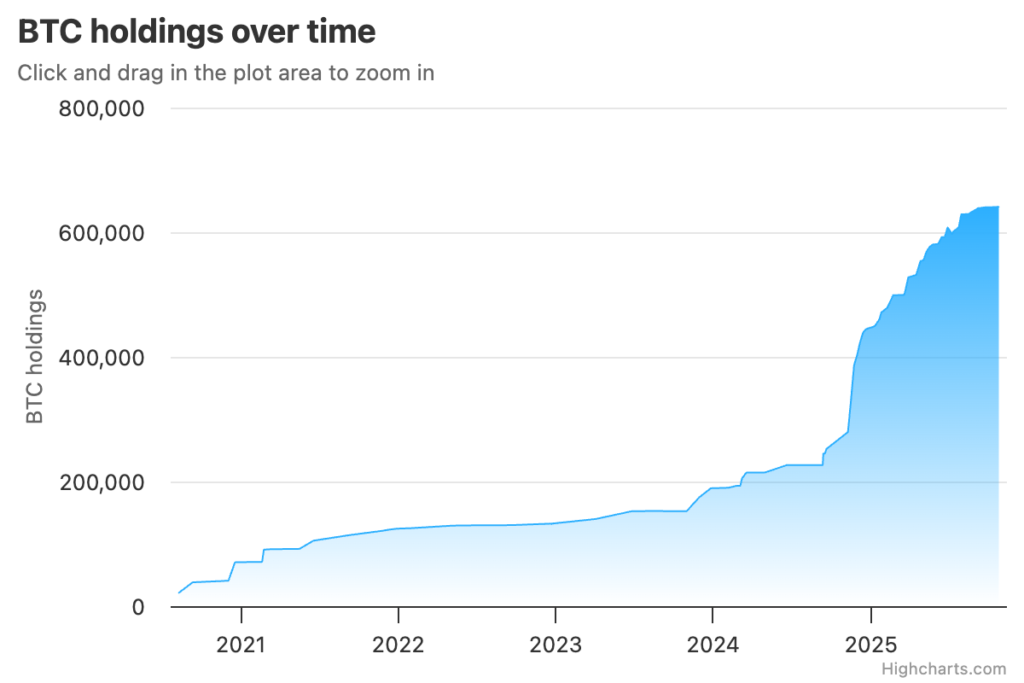

One of the strongest indicators of market depth comes from Strategy (MSTR), the Nasdaq-listed firm led by Michael Saylor. As per data from Bitbo.io, the company has accumulated 414,477 BTC (valued at around $47 billion) since July. That’s 3.9 times more Bitcoin than what Mt. Gox has distributed so far.

This scale of institutional buying underscores how different the current market environment is compared to earlier cycles. In 2017 or 2021, such large sell-offs could have sparked panic; in 2025, they are barely noticeable. The combined inflows into US spot Bitcoin ETFs, along with sovereign and corporate accumulation, have created a deep liquidity pool capable of absorbing billions of dollars in BTC without destabilising prices.

Delayed Repayments Reduce Immediate Selling Risk

The decision to delay the remaining repayments effectively keeps $4 billion worth of Bitcoin off the market for another year. That’s a meaningful reduction in potential short-term selling pressure.

In previous years, Mt. Gox’s large holdings had been a constant overhang on market sentiment, with traders fearing that any mass distribution would flood exchanges with Bitcoin. But with this postponement, such concerns are pushed well into 2026, giving the market more time to mature and strengthen further.

Analysts now argue that this delay could be net bullish for Bitcoin’s medium-term trajectory. The supply overhang diminishes just as demand-side forces, led by ETFs, corporations, and macro liquidity, continue to expand.

Macro Conditions Favour a Bullish Outlook

Beyond Mt. Gox, several macroeconomic factors are aligning in Bitcoin’s favour. The US Federal Reserve is widely expected to begin cutting interest rates, with markets pricing in multiple reductions over the next 12 months.

Lower borrowing costs tend to stimulate investment in risk assets, including Bitcoin. Analysts see this as part of a broader liquidity-driven cycle, similar to what occurred after the COVID-19 stimulus era. Global M2 money supply, a measure of total liquidity, is currently expanding at its fastest rate since 2020.

At the same time, progress toward a US–China trade deal has improved global risk appetite. With geopolitical and economic tensions easing, capital is flowing back into equities and crypto markets.

If Bitcoin continues to follow its historical pattern of responding positively to liquidity expansions, analysts suggest it could reach $150,000 by year-end and potentially surge toward $500,000 by 2026, mirroring its strongest previous uptrends.

Bottom Line: Strong Demand Outweighs Supply Concerns

The Mt. Gox delay is not the bearish signal many feared; quite the opposite. The Bitcoin market has already demonstrated that it can comfortably absorb large-scale redistributions, thanks to sustained institutional demand and robust macro tailwinds.

With $4 billion in Bitcoin remaining locked away until at least late 2026 and global liquidity on the rise, the fundamentals point to a bullish trajectory.

In short, the Mt. Gox delay could prove to be yet another catalyst in Bitcoin’s ongoing climb, reinforcing the idea that this market cycle is more resilient, more mature and more liquid than any before it.

Leave a Reply