Strong Spot Bid and Futures Liquidations Drive BTC Rally

Bitcoin (BTC) has reclaimed the $100,000 milestone, buoyed by a long-anticipated reset in funding rates and the resurgence of spot market demand. The flagship cryptocurrency’s robust rally follows a volatile start to the week and comes amidst growing optimism among analysts that BTC could soon target the $110,000 level.

The latest surge coincided with the release of the November Consumer Price Index (CPI) report, which revealed a slight increase in inflation in the United States. Historically, cryptocurrency markets experience a “risk-off” sentiment ahead of key macroeconomic announcements like CPI prints and Federal Reserve meetings. However, traders often re-enter the market following the data release, as seen in Bitcoin’s price recovery.

Coinbase Premium Signals Strong Spot Market Activity

A significant driver of Bitcoin’s recent gains has been the reappearance of the Coinbase premium—a key indicator of heightened demand in the spot market. This metric’s return signalled that institutional and retail buyers were back in force, pushing BTC toward its range highs.

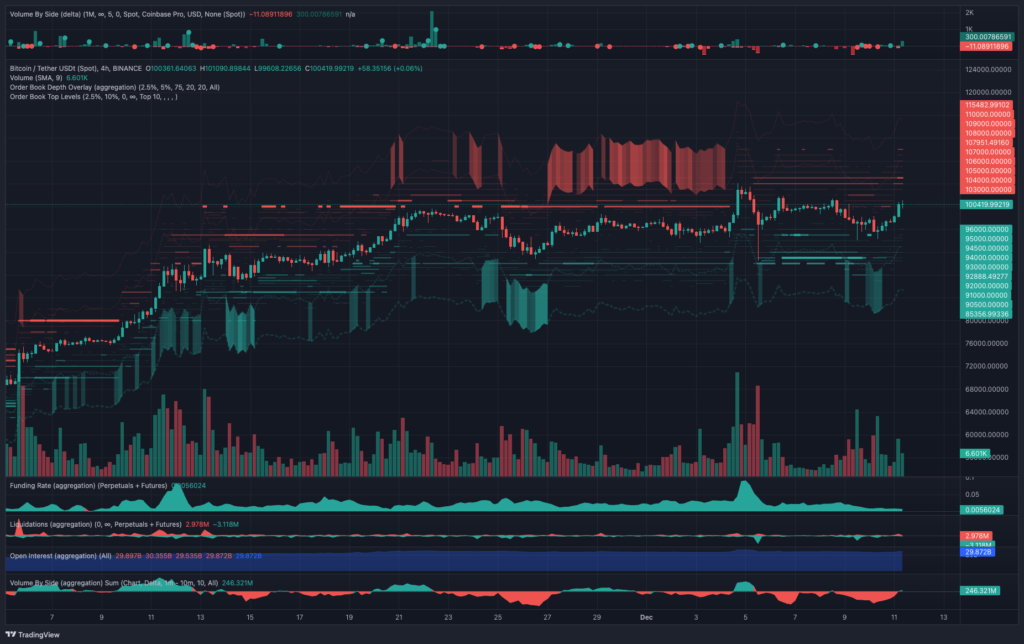

The rally was further supported by activity in the futures market. Data from CoinGlass revealed that liquidations of short positions played a pivotal role in Bitcoin’s upward momentum. The cascading liquidations fuelled additional buying pressure, helping BTC climb past the $100,000 mark.

Resistance at $101,500 Zone

Currently, Bitcoin faces a critical resistance level around $101,500, where a concentration of sell orders has created a significant barrier. Analysts suggest that traders will need to sustain buying pressure in this range to trigger further liquidations and propel BTC closer to its all-time high.

As the cryptocurrency market reacts to macroeconomic and market-specific catalysts, Bitcoin’s ability to maintain momentum above $100,000 will likely set the tone for its next move. Investors now watch closely to see whether the renewed demand can carry BTC toward fresh highs.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors.

Leave a Reply