Bitcoin’s price action turned volatile once again as the latest US inflation figures hit expectations, raising hopes of interest-rate cuts while leaving market participants divided on whether the cryptocurrency is set for new highs or another correction.

CPI Data in Focus as Markets React

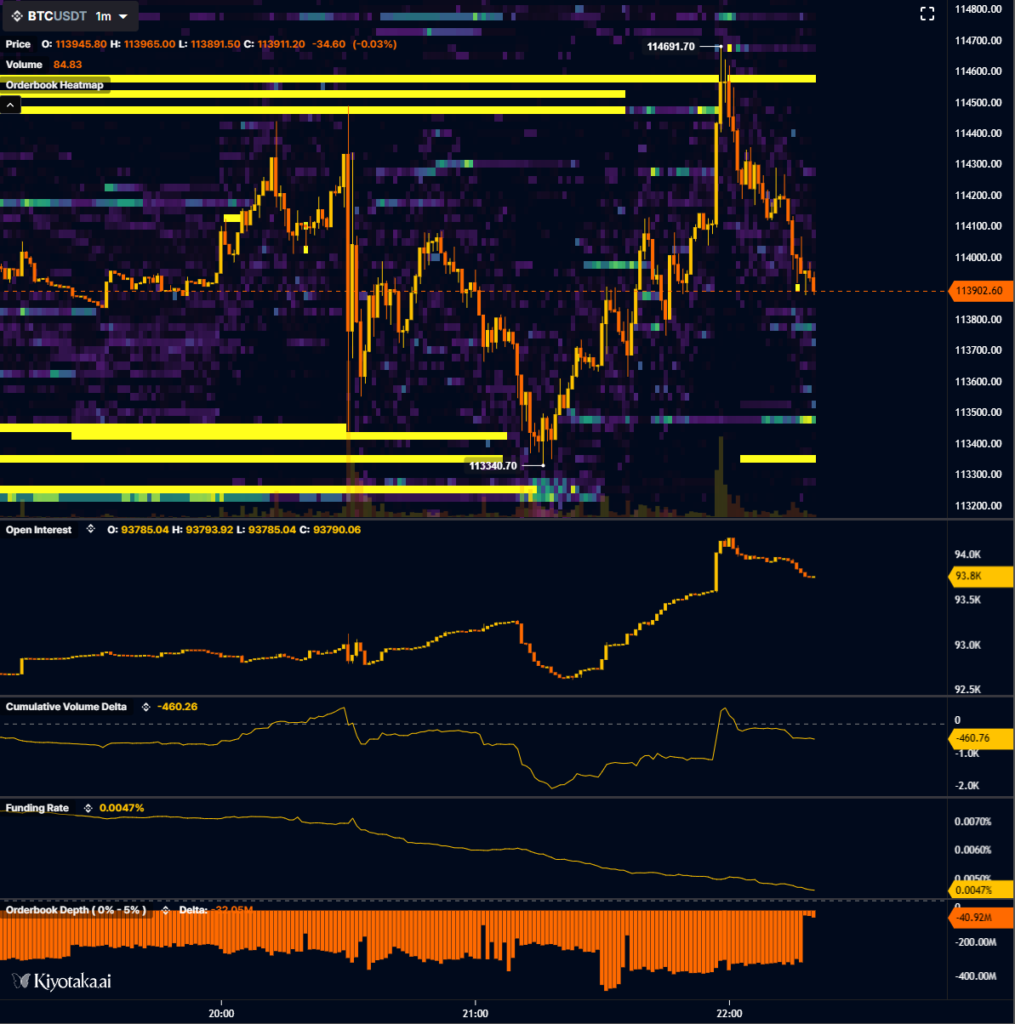

On Thursday, Bitcoin (BTC) spiked to $114,580 on major exchanges following the release of the August Consumer Price Index (CPI) data. According to figures, inflation was in line with market expectations, while the Producer Price Index (PPI) released a day earlier showed a sharper-than-expected cooling.

The labour market, however, painted a different picture. Jobless claims surged to 263,000, their highest since October 2021 and well above the expected 235,000. This raised concerns about weakening employment conditions, further fuelling speculation that the US Federal Reserve may be forced into cutting interest rates sooner rather than later.

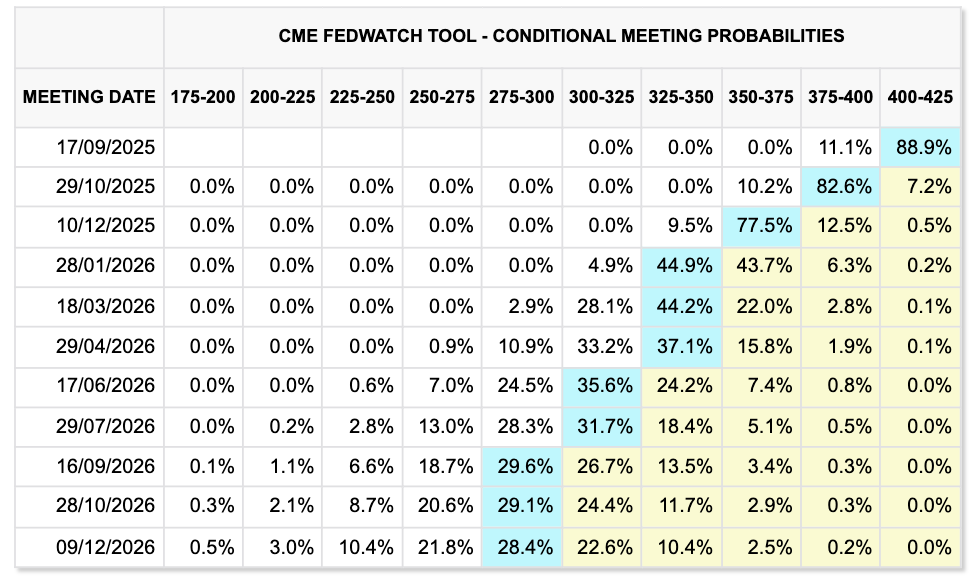

Market sentiment shifted quickly. The Kobeissi Letter, a trading research platform, highlighted that markets are now pricing in 75 basis points of rate cuts by year-end. Some analysts even noted an 11% chance that the Fed’s September meeting could bring a larger-than-expected cut of more than 0.25%.

Traders Eye Breakout but Warn of Traps

For bullish traders, the immediate outlook looked promising. Bitcoin’s reclaim of $113,500 as support was described as a key technical milestone, opening the path towards a retest of its all-time highs near $120,000.

“PPI much lower than expected, CPI as expected. Conclusion: Inflation not as bad as feared, bring on the rate cut later this month. News behind us, time to resume the scheduled programme: higher,” trader Jelle posted on X, reflecting broader optimism.

Yet not all voices agreed on the bullish narrative. Some warned that Bitcoin may be falling into a familiar “CPI trap.” In previous three CPI releases, the cryptocurrency initially rallied on the news before reversing sharply and posting new short-term lows.

Risk of Liquidations Looms

Market structure observers suggested the potential for near-term volatility remains high. Trader Skew noted that fresh liquidity of around 2,000 BTC had appeared on exchange order books, hinting that larger players might attempt to trigger long liquidations before allowing further upside.

“One more liquidation before higher,” Skew wrote, implying that a shakeout could catch overleveraged longs who entered during Thursday’s CPI rally.

Entrepreneur and investor Ted Pillows echoed the sentiment, arguing that the pattern of pre-CPI rallies followed by post-CPI dumps may repeat. “In the last three CPI data releases, Bitcoin rallied before CPI and dumped right after. This time looks no different,” he said, pointing to historical charts of BTC performance around inflation announcements.

Macro Pressures vs. Bullish Momentum

The short-term Bitcoin outlook now sits at the crossroads of macroeconomic forces and market psychology. On one hand, weaker employment data combined with contained inflation is seen as supportive for risk assets such as Bitcoin, especially with rate cuts appearing more likely. On the other hand, traders remain cautious about liquidity-driven volatility and the risk of Bitcoin repeating its prior behaviour of fading CPI rallies.

Ultimately, much will depend on the Fed’s decision at its 17 September policy meeting. If the central bank signals aggressive rate cuts, Bitcoin could extend its rally past $120,000 into uncharted price discovery. Conversely, if markets interpret the Fed as hesitant or if labour weakness sparks broader economic concerns, the cryptocurrency may face another pullback before resuming its bullish trajectory.

Key Levels to Watch

For now, the critical support zone lies at $113,500, which bulls will need to defend to sustain upward momentum. Immediate resistance sits around $120,000, with a breakout above potentially clearing the way towards fresh highs.

As traders remain divided, one thing is clear: Bitcoin’s reaction to macroeconomic data continues to highlight its growing sensitivity to traditional financial indicators. With CPI and jobless claims now absorbed, all eyes turn to the Fed’s next move, a decision that could set the tone for the rest of Bitcoin’s 2025 price action.

Leave a Reply