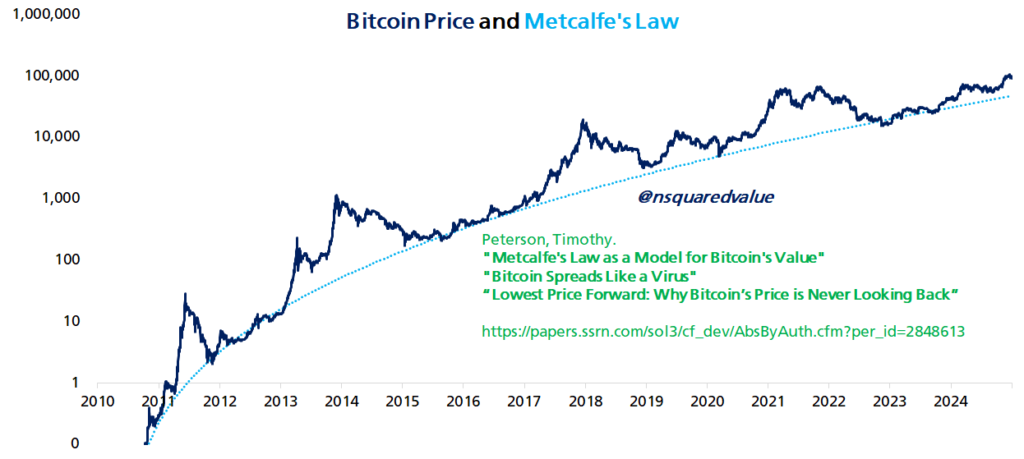

Bitcoin (BTC) could reach a staggering $1.5 million per coin within the next decade, according to network economist Timothy Peterson, a well-known advocate of the cryptocurrency. Peterson, the author of the influential paper “Metcalfe’s Law as a Model for Bitcoin’s Value,” reiterated his bullish long-term outlook in a post on social media platform X (formerly Twitter) on 8 January.

Peterson Predicts Bitcoin’s Meteoric Rise

Peterson’s forecast is based on his own model, which uses network expansion as the core factor driving Bitcoin’s future value. “The year is 2035. Bitcoin is at – and you can hold me to this – $1.5 million,” he stated in his commentary. Reflecting on the inevitability of Bitcoin’s growth, he quipped, “And somewhere someone is asking, ‘Is now a good time to buy Bitcoin?’”

Peterson has been a vocal supporter of Bitcoin’s potential, arguing that traditional financial models fail to capture its unique characteristics. His 2018 paper highlighted how mathematical laws governing network connectivity, such as Metcalfe’s Law, provide a compelling framework for understanding Bitcoin’s value.

A Proven Track Record

Peterson has correctly predicted major milestones in Bitcoin’s price performance in the past. In 2020, his Lowest Price Forward indicator accurately forecasted that Bitcoin would never again trade below $10,000. More recently, he timed Bitcoin’s local price bottom in September 2024 within a margin of just eight days.

Mixed Sentiment for Bitcoin in 2024

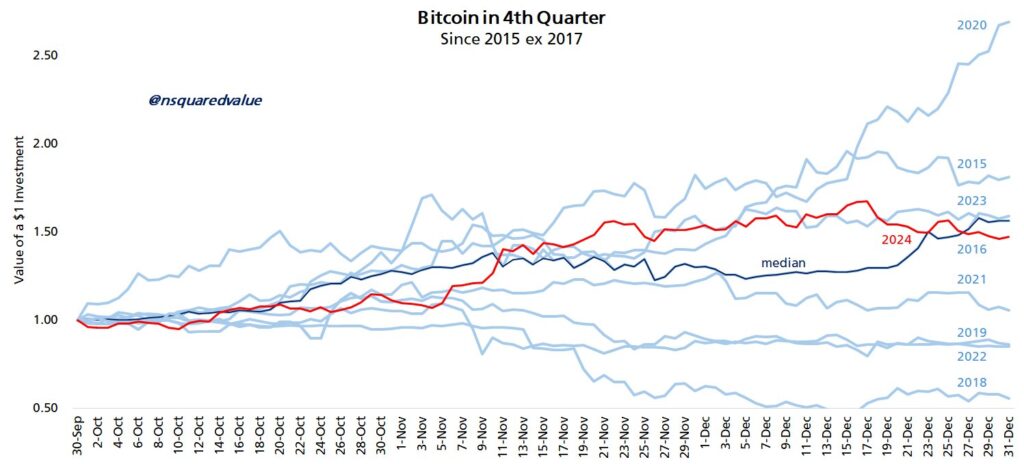

While Peterson is optimistic about Bitcoin’s long-term trajectory, the short-term outlook for BTC remains divisive. The cryptocurrency, currently trading around $93,743, has experienced a significant dip after a bullish Q4 rally.

Keith Alan, co-founder of trading resource Material Indicators, warned that Bitcoin’s price correction may not be over. “This dip isn’t done dipping,” he told his X followers on 9 January, suggesting that further downside movement is possible. Alan noted “suppression” of Bitcoin’s price as a current obstacle, with buyers waiting for lower levels to enter the market.

He cited $86,500 as a potential level to watch, explaining that it would represent a 20% correction from Bitcoin’s all-time high (ATH). If that level fails to hold, Alan speculated that the CME gap at $77,900 could come into play, further deepening the correction.

Eyes on Bitcoin’s Future

Despite short-term uncertainties, long-term proponents like Peterson remain steadfast in their belief in Bitcoin’s exponential growth potential. His $1.5 million prediction underscores the continuing optimism around the cryptocurrency as it evolves into a major global asset.

However, the mixed outlook for 2024 shows the duality of Bitcoin’s market – a space where volatility and long-term promise coexist. Whether the current dip develops into a deeper correction or marks a stepping stone for another rally remains to be seen.

For now, all eyes are on the market’s response to these forecasts, with investors balancing immediate risks against the prospect of substantial future gains.

Leave a Reply