Net Asset Values (NAVs) in Bitcoin treasury firms have seen a dramatic collapse, but analysts at 10x Research argue this downturn may signal the beginning of a new era rather than the end of one.

In a report shared with Cointelegraph on Friday, the research firm described the current market correction as a “reset” that could open up strategic entry points for skilled investors.

“The age of financial magic is ending for Bitcoin treasury companies,” 10x Research analysts wrote. “They conjured billions in paper wealth by issuing shares far above their real Bitcoin value, until the illusion vanished.”

According to the report, Digital Asset Treasuries (DATs) essentially transformed retail hype into real Bitcoin for the company, while shareholders absorbed the losses. As a result, billions in retail capital evaporated, while corporate treasuries strengthened their BTC holdings.

The Metaplanet Example: From Illusion to Reality

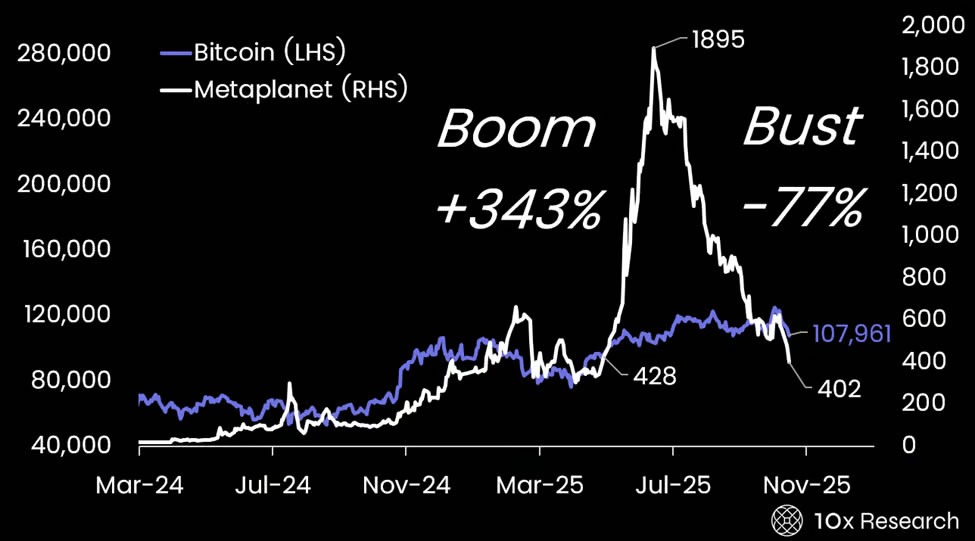

To illustrate the “financial alchemy” behind the phenomenon, 10x Research highlighted Japan-based Metaplanet, currently the fourth-largest Bitcoin treasury firm.

At one point, the company held roughly $1 billion in Bitcoin but traded with a market capitalisation near $8 billion, a staggering eightfold premium to its actual asset value.

Following the correction, Metaplanet’s market cap realigned to $3.1 billion, now backed by $3.3 billion in Bitcoin holdings, marking a rare instance where the firm’s BTC position exceeded its market valuation.

“Retail investors effectively paid two to seven times the actual Bitcoin value when buying these shares during the hype cycle,” the report noted. “Now, those premiums have vanished and many shareholders are left underwater, while the companies have converted that inflated equity into real Bitcoin.”

This phenomenon has not been limited to Metaplanet alone. Analysts pointed out that Michael Saylor’s MicroStrategy, referred to as “Strategy” in the report, has undergone a similar “boom-and-bust” in its NAV. The result has been a slowdown in Bitcoin accumulation as the market digests these distortions.

From Hype to Hard Assets: A New Era for Bitcoin Asset Managers

While retail investors have suffered heavy losses, 10x Research suggests that this correction could lay the foundation for a healthier ecosystem.

With many Bitcoin treasury firms now trading near or even below their NAV, investors are being presented with a rare opportunity to gain “pure Bitcoin exposure,” but this time, without the inflated premiums.

“Companies now trading at or below NAV offer Bitcoin exposure with optionality on future alpha generation and upside from trading profits,” analysts said.

They added that the NAV normalization has separated genuine operators from “marketing-driven machines,” signalling a new phase in the evolution of digital asset management.

Those firms that survive this transition, equipped with strong balance sheets, prudent management and disciplined trading strategies could emerge as a new class of professional Bitcoin asset managers.

“The firms that endure will be battle-tested and well-capitalised, capable of generating consistent returns,” the report concluded. “They will define the next bull market.”

Market Reaction: Strategy and Metaplanet Shares Slide

The NAV reset has not been kind to stock performance.

MicroStrategy (NASDAQ: MSTR) gained 2% on Friday to close at $289.87, but remains down 39% from its all-time high of $473.83 in November 2024, according to Google Finance.

Metaplanet’s shares (TSE: MTPLF) fell 6.5% on the Tokyo Stock Exchange, closing at 402 yen ($2.67). The stock has tumbled 79% since its mid-June peak of 1,895 yen ($12.58), reflecting the broader correction in Bitcoin-related equities.

Despite the pain, analysts maintain that the NAV normalization could be healthy for long-term investors.

As inflated valuations deflate and market premiums disappear, the surviving firms could offer one of the purest proxies for Bitcoin exposure in the public markets.

The Bottom Line: A Shakeout That Strengthens the Sector

The collapse in NAV premiums across Bitcoin treasuries marks the end of an era driven by speculative excess and possibly the dawn of a more sustainable one.

Retail investors, who bore the brunt of the correction, have provided the capital foundation that now powers more robust Bitcoin treasury holdings.

According to 10x Research, the firms emerging from this downturn will form the backbone of the next cycle: disciplined, transparent and strategically positioned to capture future upside.

“Bitcoin itself will continue to evolve,” the report concluded. “Digital Asset Treasury firms with strong capital bases and trading-savvy management teams may still generate meaningful alpha.”

In essence, while retail investors exit bruised, institutional-grade Bitcoin asset management may be just beginning its ascent.

Leave a Reply