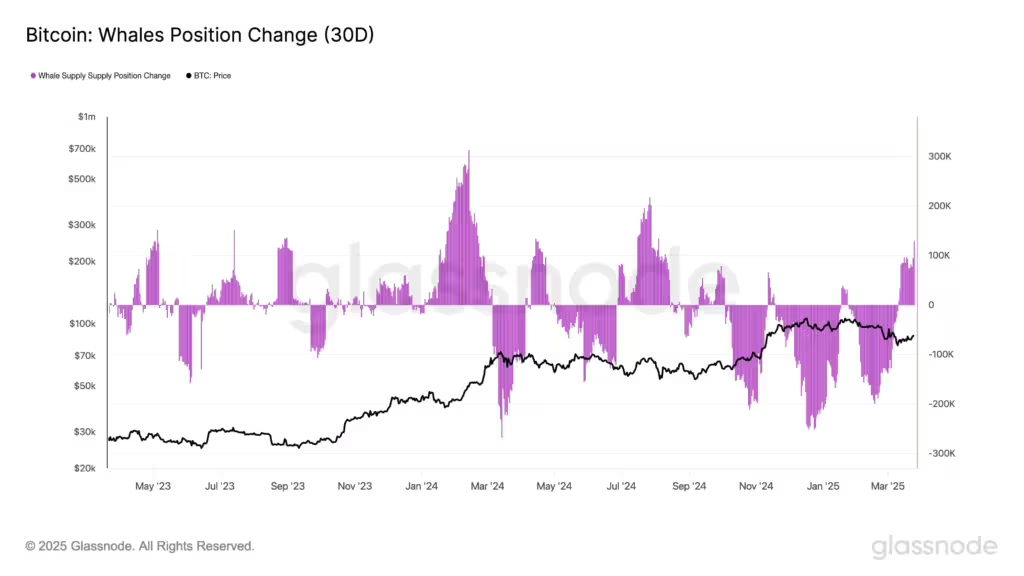

According to blockchain analytics firm Glassnode, bitcoin whales—wallets holding over 10,000 BTC—have acquired 129,000 BTC worth $11.2 billion since 11 March. This marks the largest accumulation rate since August 2024, indicating rising confidence among major market participants.

Bitcoin has rebounded from its lows under $78,000 to $87,500, with bullish sentiment fuelled by dovish Federal Reserve comments and optimism about Trump tariffs due on 2 April being less severe than anticipated.

Shift in Market Dynamics

While smaller holders have continued selling, whale activity has offset this trend, helping stabilise the market. Glassnode highlighted this divergence in sentiment, suggesting that whales are preparing for long-term gains as smaller investors exit the market.

Additional data from Bitbo Charts’ Bitcoin 1Y+ HOLD wave indicates a growing shift towards a holding strategy, with more investors opting to keep their assets for extended periods instead of selling amid volatility.

What’s Next for Bitcoin?

The current accumulation underscores renewed optimism among major players, but macroeconomic challenges and regulatory uncertainties remain hurdles. As Bitcoin regains its momentum, the actions of these whales could signal a sustained recovery—or caution ahead of further market turbulence.

For now, Bitcoin’s ability to attract significant investment speaks volumes about its long-term appeal, even as the broader market faces headwinds.

Leave a Reply