Key Economic Report Expected to Impact BTC Price

Bitcoin’s price movement in February is set to be influenced by the upcoming US labour market report, with analysts closely monitoring its impact on investor sentiment and Federal Reserve policy expectations.

The US Bureau of Labor Statistics will release its latest labour market data on 7 February, a report that could significantly shape Bitcoin’s trajectory heading into March. According to Ryan Lee, chief analyst at Bitget Research, the data will be a “critical factor” in determining Bitcoin’s next move.

Strong Labour Market May Weaken BTC’s Prospects

A robust US labour market typically reduces the chances of imminent Federal Reserve interest rate cuts, which could place downward pressure on Bitcoin’s price. Conversely, signs of weakness in the job market could strengthen expectations for rate cuts, creating a more supportive environment for the cryptocurrency.

“A strong labour market typically reduces the likelihood of imminent Fed rate cuts, which may result in a dip for Bitcoin prices. If the labour market data shows signs of weakening, it could strengthen the case for rate cuts. Such a shift in policy expectations would likely create a more supportive environment for Bitcoin,” Lee told.

Bitcoin Faces Short-Term Support Test

Bitcoin’s price surged over 13% in January but has struggled to maintain momentum, slipping 0.5% in the past seven days, according to Markets Pro data.

Some analysts warn that Bitcoin may correct below $96,000 if a key technical indicator—used to measure momentum reversal—materialises. To avoid such a downturn, BTC must hold above the $101,000 weekly support level in the near term.

Unemployment Rate Could Determine Market Direction

Next week’s labour market report is expected to play a crucial role in shaping Bitcoin’s price movement for the coming months. Benjamin Cowen, CEO of Into the Cryptoverse, highlighted the importance of the US unemployment rate in a recent social media post.

“If the unemployment rate is 4.1% or 4.2%, then there is a higher probability that BTC will follow the blueprint from last year and go higher in February and March. If the unemployment rate is too much higher, then it could make BTC a little bit more unsure,” Cowen stated.

Fed Policy and Market Expectations

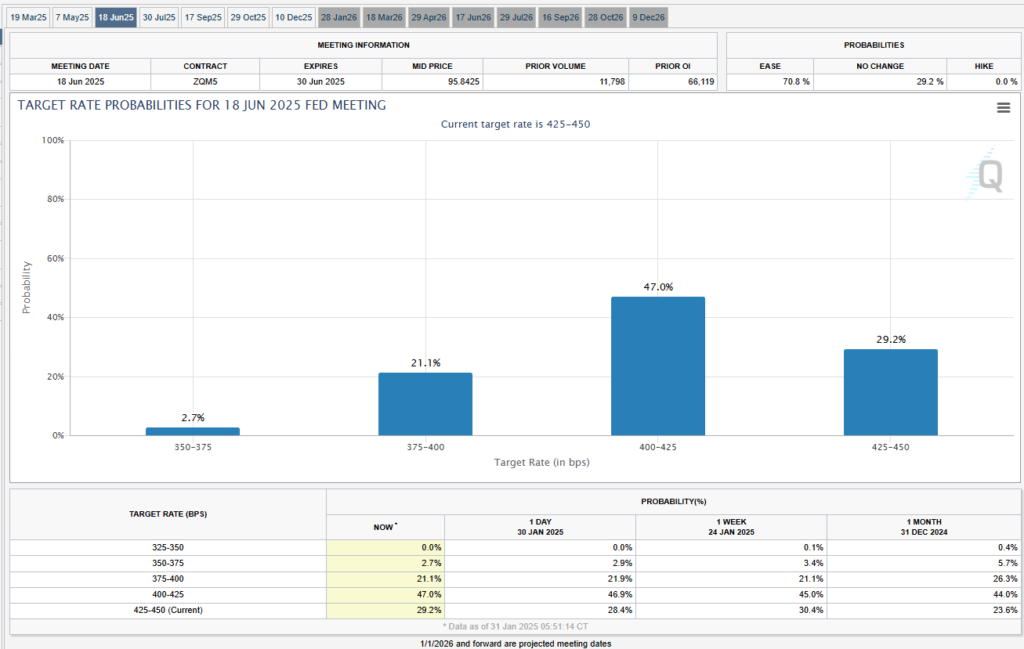

Bitcoin remains highly sensitive to macroeconomic conditions, particularly Federal Reserve monetary policy. Investors have been closely tracking expectations for interest rate cuts, which many believe could provide a boost to risk assets like Bitcoin.

According to the latest estimates from the CME Group’s FedWatch tool, markets now expect the next US interest rate cut to occur on 18 June. Until then, Bitcoin’s momentum may remain tied to evolving economic indicators and central bank policy signals.

Leave a Reply