Despite recent price fluctuations and global trade tensions, Bitcoin remains on track for a monumental rise to $1.8 million by 2035, according to market analyst Joe Burnett. The long-term outlook for the cryptocurrency giant continues to inspire confidence among industry leaders and investors.

The $1.8M Forecast: Models and Momentum

Joe Burnett, director of market research at Unchained, presented two compelling models during a live session on Cointelegraph’s Chainreaction:

- The Parallel Model, predicting Bitcoin at $1.8 million.

- Michael Saylor’s Bitcoin 24 Model, forecasting a price of $2.1 million.

Both scenarios align with the belief that Bitcoin could surpass gold’s $21 trillion market capitalisation in the coming decade. Burnett likened Bitcoin’s technological advancement to the automobile industry overtaking the horse and buggy, suggesting its growing dominance over traditional assets like gold.

Global Trade Tensions Impacting Investor Sentiment

While Bitcoin’s potential remains bullish, global trade tensions have dampened short-term investor appetite. Since Donald Trump’s inauguration, fears of tariff hikes and economic uncertainty have shifted investor focus towards safer assets like physical and tokenised gold.

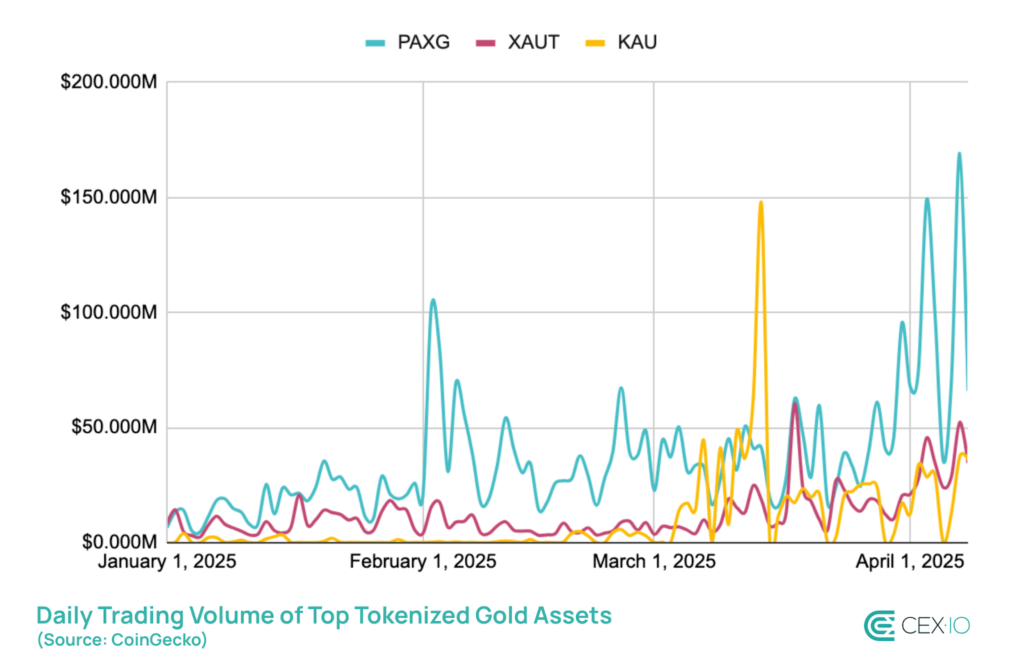

Gold’s appeal as a safe-haven asset has surged, with tokenised gold trading volumes hitting a two-year high of $1 billion this week. Meanwhile, Bitcoin’s price has dropped by over 10% year-to-date, underperforming gold, which has gained more than 23%.

Strong Hands Driving Bitcoin’s Resilience

Bitcoin’s volatility is declining as the asset matures. Burnett noted that bear markets transfer coins into the hands of strong, conviction-driven holders, creating a robust foundation for future growth.

While another 80% drawdown in bear markets remains possible, these periods act as strategic buying opportunities for long-term investors. This behaviour reinforces Bitcoin’s standing as a resilient asset class poised for eventual appreciation.

Broader Market Outlook and Alternative Predictions

Arthur Hayes, co-founder of BitMEX, added to the optimism by predicting Bitcoin could hit $250,000 by 2025 if the US Federal Reserve adopts quantitative easing measures.

However, caution persists in the near term, with investors rebalancing portfolios and focusing on assets like gold amid lingering tariff uncertainties. Emmanuel Cardozo, an analyst at Brickken, emphasised that Bitcoin ETFs are seeing outflows as market participants await clarity on trade negotiations.

Bitcoin’s Long-Term Potential Remains Unshaken

Despite short-term challenges, Bitcoin’s trajectory remains upward, supported by its technological advantages and the belief in its eventual parity with gold. Whether it reaches $1.8 million or $2.1 million by 2035, Bitcoin’s long-term prospects highlight its transformative role in global finance.

The road ahead may be volatile, but for those with strong hands, Bitcoin’s potential rewards continue to outweigh the risks.

Leave a Reply