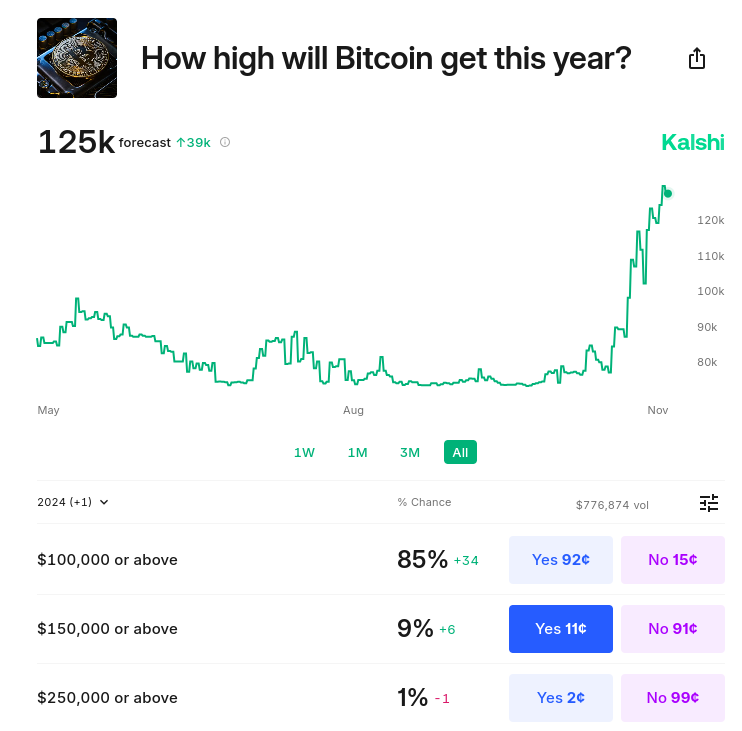

Bitcoin’s price trajectory has sparked excitement in prediction markets, with an 85% chance of the cryptocurrency reaching $100,000 by the end of 2024, according to data from Kalshi. Some forecasts are even wilder, placing Bitcoin at $125,000 or more by New Year’s Day, while a smaller segment bets on $150,000 or even $250,000.

Bulls Drive Six-Figure Hopes

Analysts from The Kobeissi Letter described the projections as “wild,” suggesting a $2.5 trillion market cap is plausible if Bitcoin hits $125,000. The cryptocurrency has gained nearly 40% in November and 55% this quarter, driven by strong buying momentum and a lack of significant consolidation or support retests.

ETFs Absorb Sell Pressure

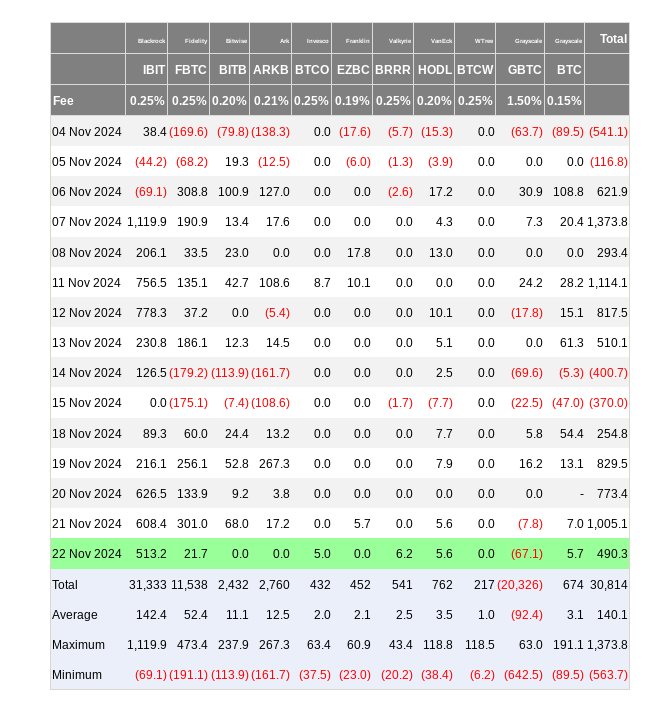

Institutional demand, particularly through Bitcoin ETFs, has played a vital role in offsetting selling pressure from long-term holders. According to Glassnode, ETFs absorbed over 90% of sell-side pressure from these holders in recent weeks. U.S.-based ETFs also saw record inflows, pushing total assets under management to over $100 billion.

Challenges Remain Amid Bullish Momentum

Despite the optimism, the psychological barrier of $100,000 remains a key hurdle. Some analysts suggest that a retracement may be necessary to support future growth. Long-term holders have begun to realise profits as Bitcoin approaches record highs, slightly outpacing ETF inflows in the short term.

Leave a Reply