European crypto exchange Bitpanda is taking a decisive step beyond digital assets, announcing plans to roll out stocks and exchange traded funds on the same platform. The move reflects a wider shift in the crypto industry, where major players are racing to become all in one financial apps rather than niche trading venues.

Starting January 29, Bitpanda users will be able to access around 10,000 stocks and ETFs directly through the platform. The Vienna based company says the expansion is aimed at making investing simpler by allowing customers to trade traditional financial products and cryptocurrencies side by side in a single app.

A major step beyond crypto

Bitpanda built its reputation as a retail friendly crypto platform, but this latest launch signals a broader ambition. By adding equities and ETFs, the company is positioning itself as a full spectrum investment destination rather than a crypto only exchange.

According to Bitpanda, trades in stocks and ETFs will be charged at a flat fee of one euro per transaction. The company says there will be no additional charges related to order flow, custody, or withdrawals, an approach designed to appeal to cost conscious retail investors.

The exchange described the rollout as part of a long term strategy to remove complexity from investing. Instead of juggling multiple apps or brokers, users can manage different asset classes within one ecosystem.

Focus on real stocks, not tokenized assets

One notable aspect of Bitpanda’s announcement is its emphasis on offering real stocks rather than tokenized representations. While tokenized equities have gained attention in crypto circles, they often raise regulatory and structural questions.

A Bitpanda spokesperson said the new stock and ETF products will be available across the entire European Union, reflecting the company’s focus on compliance within established financial frameworks. By sticking to traditional equity structures, Bitpanda appears to be aiming for broader regulatory acceptance and mainstream adoption.

This approach may help the platform attract users who are interested in crypto but still prefer the familiarity of conventional financial products.

The rise of the universal exchange model

Bitpanda’s expansion is part of a larger trend within the crypto industry. As competition intensifies, many exchanges are looking beyond pure crypto trading to sustain growth and retain users.

The idea of a universal exchange, one that combines crypto, equities, ETFs, and even commodities, is gaining traction. For platforms, the appeal lies in higher engagement and the ability to capture a larger share of a user’s financial activity. For users, the benefit is convenience and a more unified view of their investments.

Bitpanda chairman and co founder Eric Demuth framed the move as a natural evolution of the company’s mission. He said that after simplifying access to crypto more than a decade ago, the next step is to bring all major asset classes together under one roof.

Competition heats up among major platforms

Bitpanda is not alone in pursuing this strategy. Some of the world’s largest centralized crypto exchanges have already made similar moves.

In April 2025, Kraken announced the launch of trading for more than 11,000 US listed stocks and ETFs, offering commission free trades as part of a phased rollout. The company positioned the initiative as a way to merge equities and digital assets within a single trading experience.

Coinbase has also moved in this direction. Toward the end of 2025, the exchange introduced stock trading and rebranded its wallet as an everything app. The goal, according to Coinbase, is to enable round the clock trading across both traditional and digital markets.

A super app race takes shape

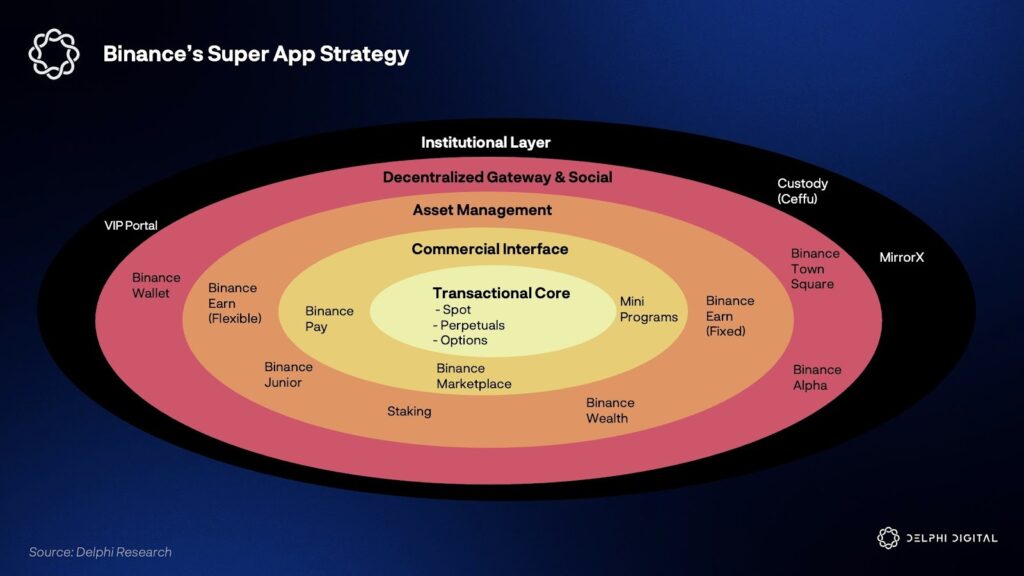

Industry analysts see these developments as part of a broader shift in where value is created in the crypto space. Research firm Delphi Digital has described the trend as a super app race, predicting an aggregation era in which platforms with the widest range of products and the largest user bases gain a clear advantage.

Rather than focusing solely on individual protocols or tokens, value is increasingly concentrating at the platform level. Exchanges that can offer seamless access to multiple asset classes are better positioned to lock in users and remain relevant as market conditions change.

For Bitpanda, the addition of stocks and ETFs is a significant bet on this future. If successful, it could strengthen the company’s position in Europe’s competitive fintech landscape and bring it closer to its vision of a universal exchange.

Leave a Reply