Telegram, the encrypted messaging platform with a strong presence in the crypto ecosystem, is set to raise $1.5 billion through a high-profile bond issuance. The deal has attracted major institutional investors, including BlackRock, Abu Dhabi’s Mubadala, and Citadel, as Telegram seeks to bolster its financial position and pave the way for future opportunities.

A High-Yield Opportunity with IPO Perks

The five-year bonds offer a 9% annual yield and come with a lucrative 20% discount for investors in the event of Telegram’s initial public offering (IPO). This enticing combination has drawn interest from existing backers like BlackRock and new participants, such as U.S.-based hedge fund Citadel.

Proceeds from the bond sale are earmarked for refinancing Telegram’s existing debt, specifically bonds issued in 2021 that are set to mature in March 2026. The bond issuance aligns with Telegram’s strategic financial management and its ongoing commitment to maintaining a competitive edge.

Institutional Confidence in Telegram

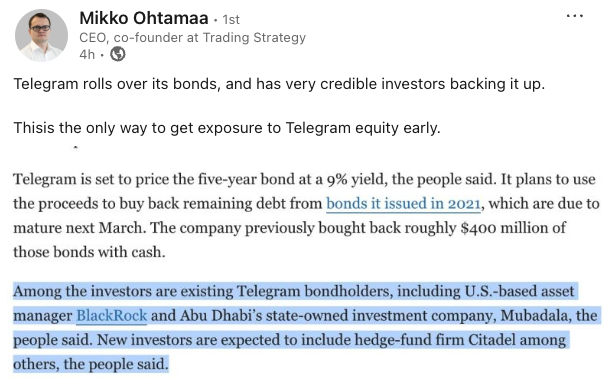

The involvement of heavyweight investors such as BlackRock and Mubadala underscores institutional confidence in Telegram’s growth potential. This bond sale, dubbed by market insiders as “the only way to get exposure to Telegram equity early,” is expected to attract further interest as the company continues to build its market presence.

Trading Strategy co-founder Mikko Ohtamaa highlighted the credibility of Telegram’s bond investors, describing the offering as a significant market opportunity. The Financial Times further reported that the structure mirrors terms from previous bond sales, solidifying Telegram’s reputation for investor-friendly financial strategies.

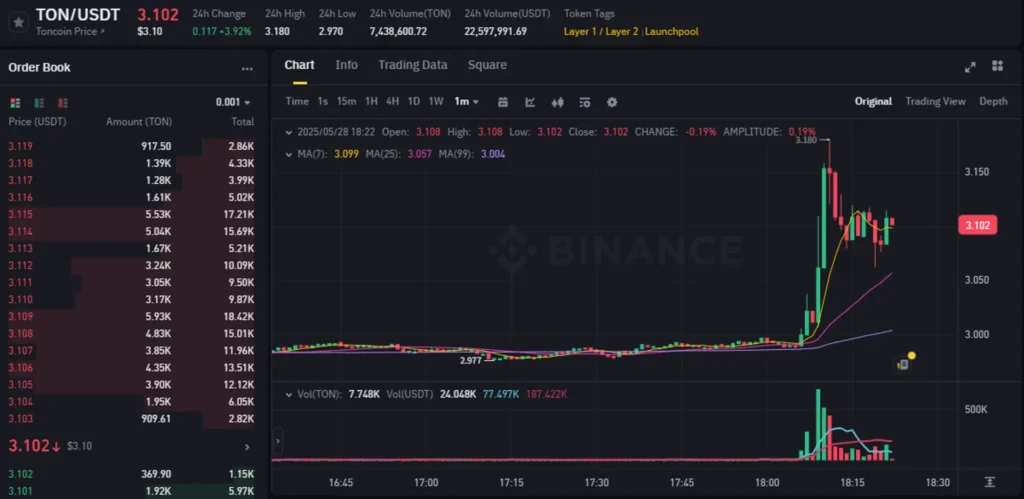

Toncoin Rallies on Bond News

News of the bond sale had a ripple effect on Telegram’s affiliated cryptocurrency, Toncoin. The token surged over 6% to $3.15, spurred by market excitement over BlackRock’s potential deeper involvement. With a market cap of $7.92 billion, Toncoin continues to attract attention, though it remains 61.6% below its all-time high recorded in 2024.

This price movement coincided with Telegram co-founder Pavel Durov’s announcement of surpassing 15 million paying users, double the previous year’s total. The platform’s projected revenue for 2025 stands at a robust $2 billion, reinforcing its appeal to both investors and users.

Challenges and Opportunities Ahead

Despite its growth, Telegram faces regulatory scrutiny. CEO Pavel Durov remains under preliminary charges in France for alleged non-cooperation in investigations related to illegal content on the platform. Durov’s movements have been restricted, though he has recently been granted limited permissions for travel, including a visit to Dubai in June, where he teased “good news ahead.”

Telegram’s partnership with Elon Musk’s xAI, announced the same day as the bond news, is another highlight. The $300 million deal to integrate xAI’s Grok chatbot into the messenger reflects Telegram’s commitment to innovation and user engagement.

The Road Ahead for Telegram

Telegram’s strategic bond issuance represents a critical step in securing financial stability while opening avenues for future growth, including a potential IPO. The backing of institutional giants like BlackRock and Mubadala further underscores the platform’s credibility and potential.

As Telegram continues to navigate challenges and seize opportunities, its role as a crypto-friendly platform and a growing tech powerhouse remains pivotal. The company’s bold moves in both finance and innovation signal a bright future for investors and users alike.

Leave a Reply