Blockchain transaction data linked to cryptocurrency payments on darknet markets may offer public health agencies an early warning system for emerging drug overdose crises, according to a new report from Chainalysis.

The analysis suggests that patterns in crypto payments to illicit drug suppliers often appear months before spikes in hospitalizations and overdose deaths are recorded in official health statistics. Researchers say this time gap could give authorities a rare chance to respond earlier to dangerous shifts in drug supply and distribution.

Darknet drug markets continue to operate at scale

Chainalysis examined illicit activity across darknet drug and fraud marketplaces and found that cryptocurrency flows connected to these markets reached nearly $2.6 billion in 2025. Despite repeated law enforcement takedowns, online drug markets remain resilient, with vendors quickly adapting to disruptions and continuing to operate at scale.

According to the report, sellers typically receive funds through personal crypto wallets and centralized exchanges. Even when major marketplaces are shut down, vendors often reappear on alternative platforms within weeks, maintaining supply chains with minimal interruption.

This persistence, Chainalysis said, makes blockchain data particularly valuable. Unlike traditional intelligence sources, onchain activity provides real time visibility into financial behavior across these markets.

Crypto payments mirror real world overdose trends

Beyond mapping criminal networks, the report argues that blockchain data can help explain changes in public health outcomes. One key finding involved fentanyl precursor chemicals. Crypto payments linked to suppliers of these chemicals declined sharply starting in mid 2023.

Several months later, overdose deaths in both the United States and Canada began to fall after peaking in 2023. Chainalysis noted that this lag aligns with how drug distribution works. Suppliers purchase chemicals first, producers manufacture drugs later, and users only encounter the substances months after the initial transactions take place.

Based on this pattern, the firm estimates that monitoring crypto payments tied to precursor suppliers could offer three to six months of advance warning before overdose trends become visible in government health data.

Larger transactions tied to hospitalizations in Canada

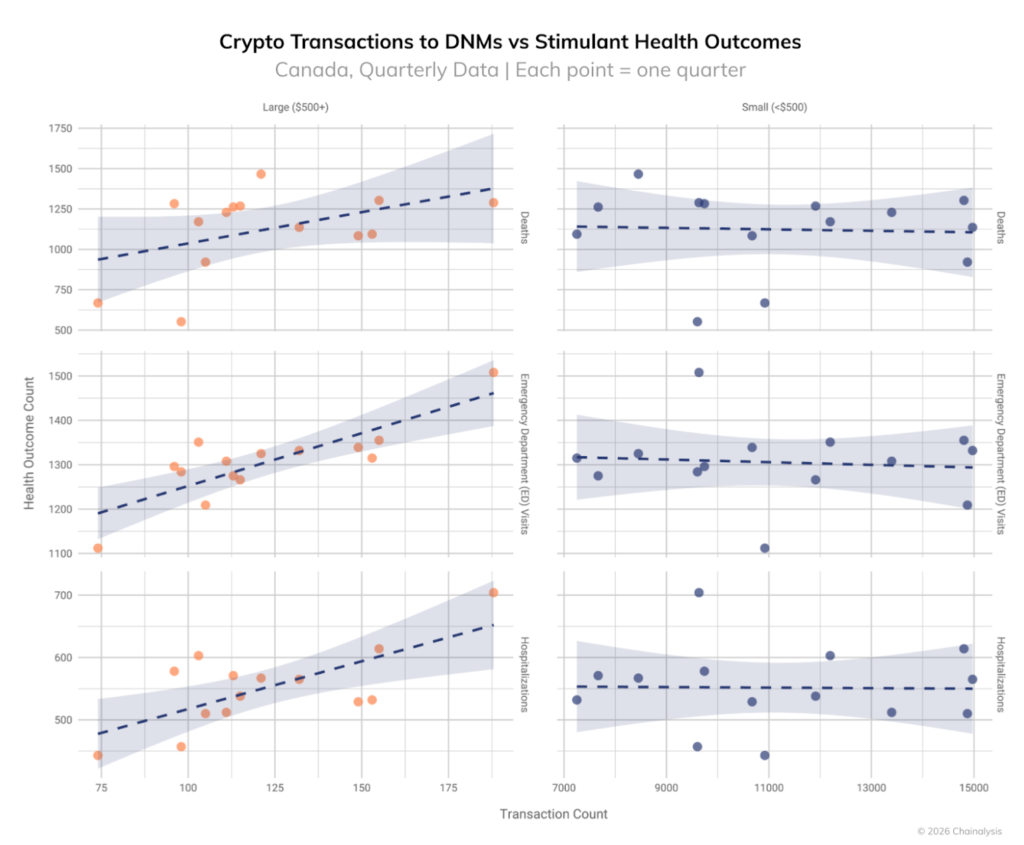

The study also compared blockchain transaction data with Canadian hospital records to better understand the relationship between crypto drug purchases and health outcomes. Smaller payments, typically under $500, showed no clear connection to emergency room visits or overdose deaths.

However, larger transfers told a different story. Transactions involving higher amounts were closely associated with increases in stimulant related hospitalizations and fatalities. Chainalysis said these payments likely represent bulk purchases or redistribution activity rather than personal drug use.

In the report, researchers explained that money tends to move well before a health crisis becomes visible. Drugs are bought, distributed, consumed and only later lead to medical emergencies. Because blockchain transactions are recorded instantly, they can provide an early signal long before hospitals and public health agencies see the impact.

Market closures trigger fast migration

The report highlighted how quickly darknet ecosystems recover after major disruptions. Following the closure of Abacus Market in July 2025, activity shifted rapidly to successor platforms such as TorZon.

Chainalysis observed that many vendors routinely operate across multiple platforms at the same time. When one market shuts down, sellers simply redirect customers and inventory elsewhere, keeping supply lines intact. This behavior underscores the challenge facing law enforcement and the value of tracking financial flows rather than individual marketplaces.

Fraud markets shrink but evolve

While drug related activity remained strong, fraud marketplaces showed a different trajectory. Onchain volumes tied to fraud shops fell sharply year over year, dropping from around $205 million to $87.5 million after infrastructure takedowns.

Despite the decline, the report found that fraud activity did not disappear. Instead, it shifted toward wholesale models, with fewer but larger transactions. Much of this activity was linked to Chinese language networks operating on Telegram, where bulk sales of stolen payment data and financial credentials are coordinated.

Chainalysis said these networks favor efficiency and scale, relying on trusted intermediaries rather than open marketplaces.

Human trafficking linked crypto flows surge

The report also raised alarms about human trafficking. Crypto transactions connected to suspected trafficking networks rose by 85 percent in 2025, reaching hundreds of millions of dollars.

Most of this activity was tied to Southeast Asia and closely connected to scam compounds, online gambling platforms and Chinese language money laundering groups. The findings add to growing evidence that organized crime groups are increasingly blending online fraud, forced labor and crypto based financial systems.

Chainalysis concluded that while blockchain data is often associated with tracking crime after it happens, its real power may lie in prevention. By identifying financial patterns early, authorities could gain valuable time to respond to drug supply changes, disrupt criminal networks and potentially save lives.

Leave a Reply