Itaú Asset Management Suggests 1 to 3 Percent Portfolio Exposure

Itaú Asset Management, the investment arm of Brazil’s largest private bank Itaú Unibanco, has recommended that investors consider holding between 1 percent and 3 percent of their portfolios in Bitcoin in 2026. The bank emphasises that Bitcoin can enhance portfolio diversification and serve as a hedge against currency risk despite the asset’s volatility over the past year.

Renato Eid, an analyst at Itaú Asset, stated that global factors such as geopolitical tensions, changing monetary policies and persistent currency risks strengthen the case for adding Bitcoin to investment portfolios. He described Bitcoin as “an asset distinct from fixed income, traditional stocks or domestic markets, with its own dynamics, return potential and a currency hedging function due to its global and decentralised nature.”

Bitcoin’s Performance in 2025

Bitcoin experienced a turbulent 2025. The cryptocurrency began the year near $95,000, dropped to around $80,000 amid a tariff crisis, surged to an all-time high of $125,000 and later stabilised near $95,000. Brazilian investors were affected more acutely due to the local currency, the real, strengthening by approximately 15 percent, which amplified local losses for holders of the digital asset.

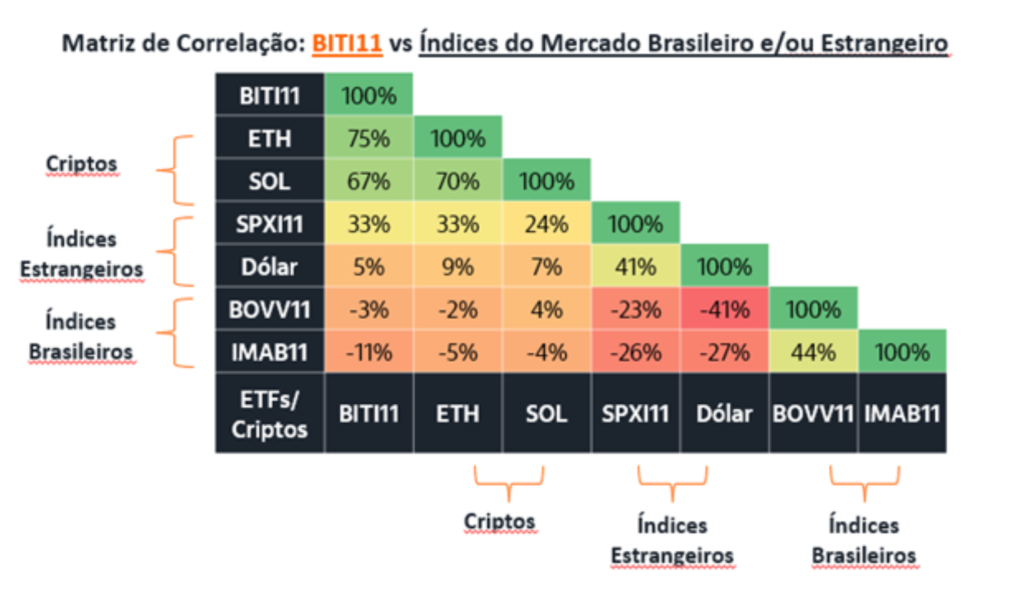

Eid noted that a small, consistent allocation to Bitcoin could help smooth risks that traditional assets fail to hedge. He highlighted the bank’s internal data showing low correlation between BITI11, Itaú’s locally listed Bitcoin ETF, and other major asset classes. This low correlation supports the potential benefit of adding a modest Bitcoin position to diversify portfolios.

Improving Portfolio Balance

“By allocating around 1 percent to 3 percent in their investment portfolio, investors will in fact be taking advantage of an asset that generates diversification,” Itaú Asset stated. The recommendation targets investors seeking to balance risk while gaining exposure to a high-potential asset.

Launch of Dedicated Crypto Division

In September 2025, Itaú Asset established a standalone crypto division led by former Hashdex executive João Marco Braga da Cunha. This new unit expands on Itaú’s existing digital asset offerings, which include a Bitcoin ETF and a retirement fund with crypto exposure.

The bank aims to develop a broader range of products, from fixed-income-style instruments to higher-volatility strategies such as derivatives and staking. The creation of a dedicated crypto unit signals Itaú’s commitment to integrating digital assets into mainstream investment services.

Looking Ahead

Itaú Asset Management’s guidance reflects a growing institutional interest in Bitcoin as part of diversified portfolios. While volatility remains high, the bank believes a measured allocation can offer long-term benefits including risk mitigation and currency hedging.

Leave a Reply