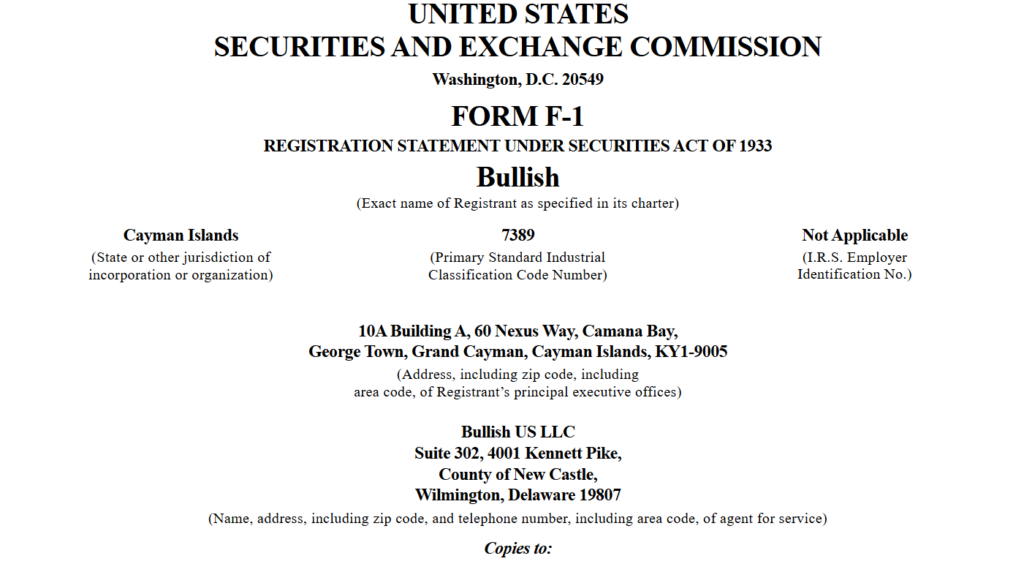

Bullish, the cryptocurrency exchange and parent company of crypto news outlet CoinDesk, has filed an updated F-1 document with the US Securities and Exchange Commission (SEC), signalling its intent to go public. The company is aiming to raise between $568 million and $629 million through an initial public offering (IPO), pricing its shares between $28 and $31. If successful, the move would place Bullish’s valuation at up to $4.2 billion.

The IPO is expected to debut as early as 12 August, marking a significant step for Bullish in its journey from a digital asset platform to a publicly traded fintech firm. The company plans to issue 20.3 million shares.

Importantly, the filing reveals that heavyweight institutional investors, including BlackRock and ARK Investment Management, have shown interest in purchasing up to $200 million worth of Bullish stock. These commitments reflect growing institutional confidence in digital assets and the infrastructure that supports them.

From Exchange to Media Giant

Bullish is not merely a crypto exchange, it has been strategically expanding its presence in the crypto ecosystem. In November 2023, the company acquired CoinDesk from Digital Currency Group for $72.6 million, diversifying into crypto-focused media. CoinDesk currently ranks as the second-largest crypto media platform globally, attracting an average of 4.9 million unique monthly viewers in 2024.

This acquisition strengthens Bullish’s brand and influence, giving it a dual role as both a service provider for institutional trading and a content leader within the crypto space. The IPO prospectus highlights the synergy between these verticals, positioning Bullish as a well-rounded player in the evolving digital asset landscape.

Additionally, Bullish’s digital asset exchange operates in over 50 jurisdictions globally, although it is not yet available to retail or institutional users within the United States.

Institutional Adoption Accelerates

The Bullish IPO is occurring at a time when institutional adoption of crypto assets is surging. The company’s decision to allocate a portion of IPO proceeds into US dollar–denominated stablecoins suggests a strategic pivot towards blockchain-native capital infrastructure. Stablecoins, long viewed as the bridge between traditional finance and decentralised finance (DeFi), are gaining credibility, particularly following recent US regulatory clarity.

Last month, President Donald Trump signed the GENIUS Act, a stablecoin-focused law aimed at providing clearer regulatory guidelines for the issuance and management of dollar-pegged digital assets. In addition, the US House of Representatives passed two new bills related to digital market structures and anti–central bank digital currency (CBDC) provisions.

These developments are contributing to renewed investor confidence and paving the way for digital asset companies to seek public market exposure in the United States.

Crypto IPO Momentum Builds

Bullish is far from the only crypto firm looking to tap into public markets. In July, crypto custodian BitGo filed for a US IPO, although it has not disclosed its target valuation. More recently, Kraken, another major crypto exchange, is reportedly seeking to raise $500 million via its IPO, with a projected valuation of $15 billion, an increase from its previous $11 billion mark.

Reports also indicate that OKX, a prominent global crypto exchange, is preparing for its own US public listing, following the relaunch of its services in the American market.

Meanwhile, Circle, the issuer of the widely-used USDC stablecoin, saw its market cap surge after the public launch of its CRCL shares. The company raised its IPO target to nearly $900 million, demonstrating the strong appetite from institutional investors for digital asset companies with robust fundamentals.

Bullish’s IPO ambitions mark a pivotal moment not just for the company itself but for the broader crypto industry. Backed by institutional giants and buoyed by improved regulatory clarity, Bullish is helping lead a new wave of crypto firms transitioning into the public financial markets. If successful, the move could further legitimise the role of digital assets in mainstream portfolios—and accelerate the integration of crypto infrastructure into the global financial system.

Leave a Reply