Bybit CEO Ben Zhou has weighed in on the recent $4 million loss suffered by decentralized exchange (DEX) Hyperliquid, highlighting the challenges faced by both decentralized and centralized exchanges when handling high-leverage trades.

$4M Loss from High-Leverage Ether Trade

On 12 March, a crypto trader managed to secure $1.8 million in profits while forcing Hyperliquid’s Hyperliquidity Pool (HLP) to absorb a staggering $4 million loss. The incident stemmed from a highly leveraged trade, with the investor using around 50x leverage to turn $10 million into a $270 million long position on Ether (ETH).

However, due to the size of the position, the trader faced difficulties exiting without significantly impacting the market. Instead of selling outright and causing a price drop, they withdrew collateral and offloaded assets strategically, shifting the financial burden onto Hyperliquid.

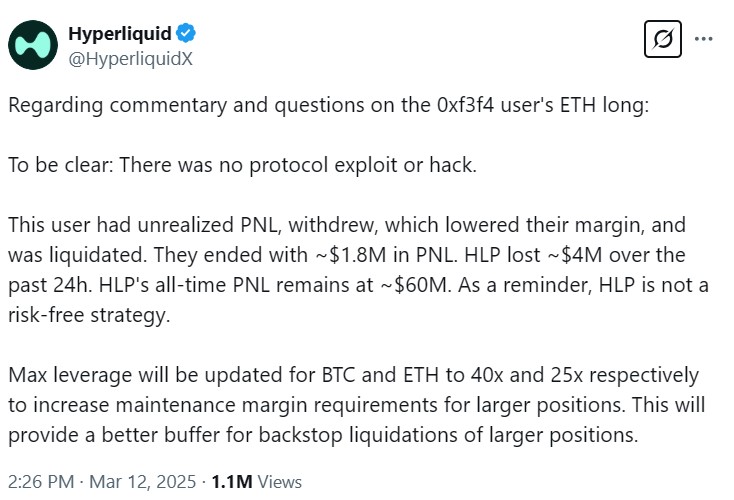

Despite the substantial losses, smart contract auditor Three Sigma confirmed that this was not the result of a protocol exploit or hack. Rather, it was described as a “brutal game of liquidity mechanics.” Hyperliquid also reiterated that the event was not due to a vulnerability in its system.

Hyperliquid Reduces Leverage Limits

In response to the incident, Hyperliquid swiftly introduced changes to its leverage limits. The platform reduced its maximum leverage for Bitcoin (BTC) to 40x and for Ether to 25x. These adjustments aim to increase maintenance margin requirements for larger positions, providing a more robust buffer against extreme liquidations.

“This will provide a better buffer for backstop liquidations of larger positions,” Hyperliquid stated in its official communication.

Bybit CEO Suggests Dynamic Risk Controls

Bybit CEO Ben Zhou commented on the situation, noting that centralized exchanges (CEXs) also face similar risks. He explained that when large traders are liquidated, CEXs rely on a liquidation engine to take over positions, mitigating potential market disruptions.

While Zhou acknowledged that reducing leverage is a logical solution, he pointed out that it could negatively impact business, as many traders seek high-leverage opportunities.

“I see that HP has already lowered their overall leverage; that’s one way to do it and probably the most effective one. However, this will hurt business as users would want higher leverage,” Zhou wrote in a post on X.

Instead of a blanket reduction, Zhou proposed a more dynamic risk management system, where leverage decreases as positions grow. On centralized platforms, he noted, a whale with massive open positions would be forced down to a leverage of around 1.5x.

However, Zhou also highlighted a potential loophole: traders could still create multiple accounts to bypass these restrictions. He further suggested that Hyperliquid should implement stronger monitoring tools, akin to those used by CEXs, to detect and counteract market manipulation.

Hyperliquid Faces $166M Net Outflow

The aftermath of the incident saw a sharp decline in Hyperliquid’s assets under management. Data from Dune Analytics revealed that on 12 March alone, the platform experienced a net outflow of $166 million. This exodus reflects a loss of confidence among users, likely driven by concerns over the platform’s ability to manage high-risk trades effectively.

As DEXs continue to grow in popularity, the balance between offering competitive leverage and maintaining financial stability remains a critical challenge. The recent Hyperliquid episode underscores the importance of risk management in the evolving crypto trading landscape.

Leave a Reply