XRP has outpaced Bitcoin by nearly 300 percent since Donald Trump’s re-election victory in November, with the token gaining fresh momentum from Ripple’s settlement with the US Securities and Exchange Commission (SEC) and speculation over a spot exchange-traded fund. The rally has reignited debate on whether XRP can sustain its lead over Bitcoin or if the world’s largest cryptocurrency will once again dominate as the cycle matures.

Bullish Chart Pattern Signals Potential for 100 Percent Upside

The XRP to Bitcoin trading pair has recently formed what analysts describe as the market’s most reliable bullish reversal structure, the inverse head and shoulders. The pair is currently testing the neckline resistance at 3,145 satoshi. A decisive weekly close above this level could validate the pattern and open the door to a rally towards 5,700 satoshi, representing gains of more than 100 percent by the end of 2025.

Further strengthening the bullish case is the golden cross that appeared on the weekly chart in August. This crossover occurs when the 50-week exponential moving average climbs above the 200-week exponential moving average, reinforcing momentum and suggesting that XRP could maintain its edge over Bitcoin deeper into the current bull cycle.

Resistance Zone from 2019 Holds the Key

Despite the optimism, XRP faces a significant hurdle. The token is approaching a resistance zone between 2,440 and 3,570 satoshi that has capped its advances since mid-2019. Repeated rejections over the years were partly driven by regulatory uncertainty surrounding Ripple’s legal battle with the SEC.

The partial settlement earlier in 2025 has eased some of these concerns, fuelling expectations that the token might finally secure a breakout that previous bull markets failed to deliver. Technical analyst Cryptoinsighttuk observed that a decisive move above this long-standing range could send XRP to 9,000 satoshi, marking a 250 percent gain from current levels.

Altcoin Rotation Could Provide Tailwinds

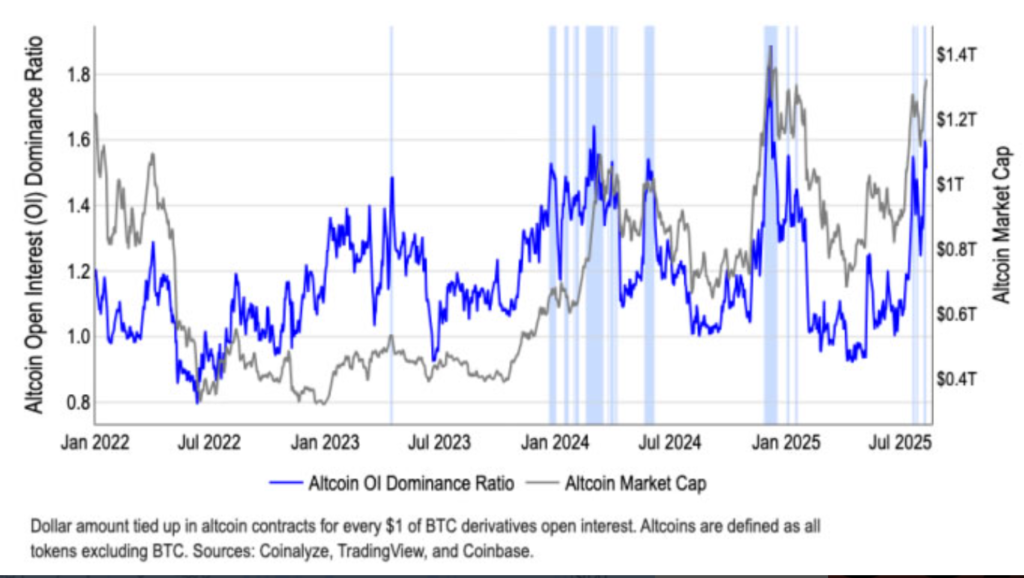

Beyond technical signals, broader market dynamics may also favour XRP. Recent analysis from Coinbase Institutional highlighted conditions that suggest an emerging shift towards a full-scale altcoin season. According to Coinbase, such a phase occurs when 75 percent of the top 50 alternative cryptocurrencies outperform Bitcoin over a 90-day period.

Bitcoin’s market dominance has already slipped to around 57 percent, its lowest since January. This decline hints at an early stage of capital rotation out of Bitcoin into alternative assets, with XRP positioned as one of the key beneficiaries.

ETF Speculation and Market Timing

Industry observers caution that while altcoin season could benefit XRP, the timing may depend on regulatory developments. Approval of additional cryptocurrency exchange-traded funds in the United States is widely expected to act as a catalyst for broader altcoin rallies. Until then, XRP’s performance is likely to remain closely tied to investor sentiment on both Ripple’s legal clarity and institutional inflows.

Outlook for the Remainder of 2025

XRP has already proven resilient by outperforming Bitcoin with a 300 percent surge since late 2024. With bullish technical indicators aligning and capital beginning to rotate towards alternative tokens, the case for continued outperformance is strong. However, much will depend on whether XRP can overcome the multi-year resistance band and sustain momentum into a broader altcoin rally.

For now, the crypto market remains divided. Some analysts argue that Bitcoin historically reclaims the spotlight as bull cycles mature, while others suggest that the combination of technical strength, regulatory relief, and shifting market structure could allow XRP to secure one of its strongest positions in years.

Leave a Reply