Cardano (ADA) is riding a wave of optimism this week as odds for a spot Cardano ETF approval in 2025 have climbed to 80%, according to data from decentralised prediction platform Polymarket. The token’s price has seen renewed strength as traders and investors position themselves for what could be one of the most significant milestones in ADA’s institutional adoption journey.

This surge in sentiment follows a series of developments, most notably the actions of Grayscale Investments, a leading digital asset manager, which has taken the first official steps towards launching a Cardano ETF.

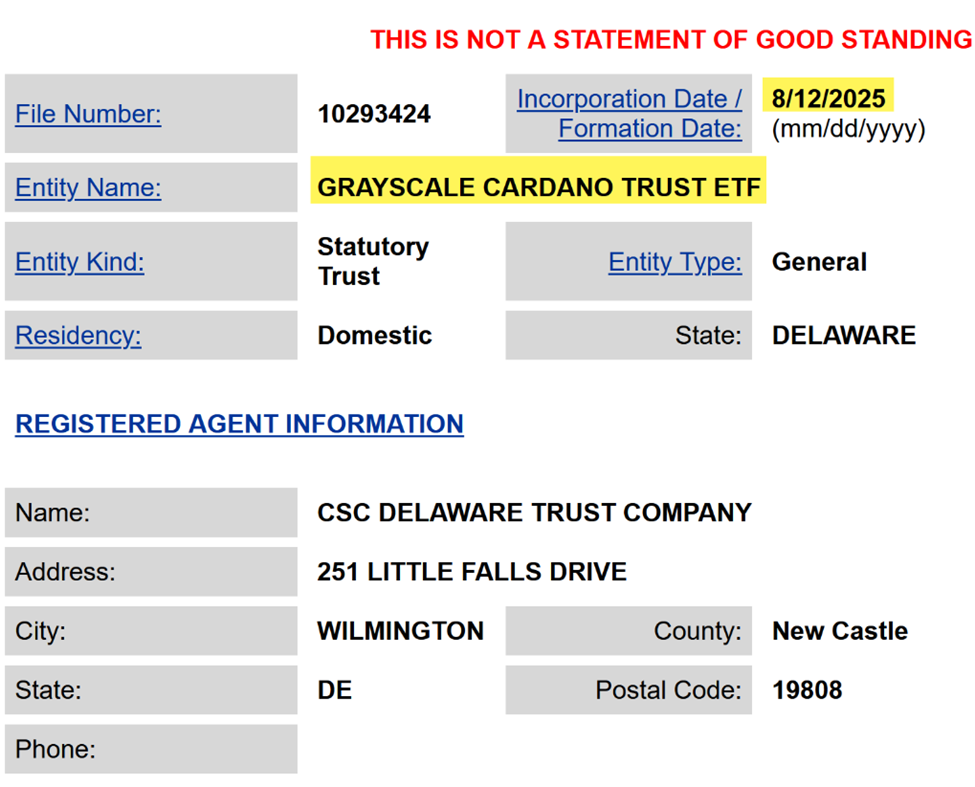

Grayscale Registers Cardano and Hedera Trusts in Delaware

On 12 August 2025, Grayscale filed registrations for both the Grayscale Cardano Trust ETF and the Grayscale Hedera Trust ETF in Delaware, with CSC Delaware Trust acting as the registered agent. These filings, publicly visible on Delaware’s corporate registry, are widely interpreted as a precursor to formal ETF applications with the US Securities and Exchange Commission (SEC).

Web3 researcher Justin Wu commented on the significance of the move, noting that both Cardano and Hedera have growing real-world asset (RWA) adoption cases. According to Wu, “This step often comes before a spot ETF filing; a green light can bring a wave of institutional capital.”

Grayscale has historically used statutory trust registrations as an early stage in its ETF launch strategy. In past cases with Bitcoin and Ethereum, this process was followed by S-1 filings to the SEC, the formal paperwork required for an ETF to be listed on an exchange.

SEC Review Process Underway

Adding to the optimism, the SEC has already acknowledged a 19b-4 filing submitted by NYSE Arca earlier this year for a proposed Cardano ETF. This acknowledgement is a critical procedural step, signalling that the regulator has formally engaged with the application rather than dismissing it outright.

The development mirrors the timeline of the first spot Bitcoin ETFs in the United States, where initial filings and acknowledgements paved the way for approval months later. If history repeats itself, a Cardano ETF could clear regulatory hurdles within the next year, aligning with the bullish outlook from Polymarket traders.

Approval would enable traditional investors to gain exposure to ADA without directly holding the cryptocurrency or managing private keys, a key factor in attracting institutional participation.

Growing Institutional Appetite for Altcoin ETFs

Grayscale’s expansion beyond Bitcoin and Ethereum comes at a time when institutional demand for diversified crypto exposure is rising. Cardano’s academic, peer-reviewed development model and focus on scalability have made it a strong candidate for mainstream adoption.

The SEC is also reportedly considering a more standardised framework for cryptocurrency ETFs, which could see multiple altcoin products approved simultaneously rather than individually. Such a shift could accelerate the launch of a Cardano ETF alongside other emerging projects like Hedera.

Industry analysts suggest that if a spot Cardano ETF is approved, it could unlock significant capital inflows, similar to the market reaction seen when the first US spot Bitcoin ETFs went live. The combination of regulatory progress, institutional interest, and ADA’s established blockchain infrastructure positions Cardano favourably for this next chapter.

Outlook for 2025

With an 80% probability now priced in by prediction markets, the next twelve months will be pivotal for Cardano. The trust registrations, SEC engagement, and political backdrop, particularly the pro-crypto stance of the Trump administration — all point towards an environment more conducive to altcoin ETF approvals than in previous years.

For ADA holders and the broader cryptocurrency market, the potential launch of a spot Cardano ETF represents not just a new investment vehicle, but a vote of confidence in the network’s long-term viability. If approved, it would mark another significant step in bridging the gap between decentralised blockchain networks and the traditional financial system.

Leave a Reply