Chainlink (LINK) has entered one of its strongest accumulation phases in years, with large-scale investors or “whales,” rapidly pulling tokens off exchanges in a coordinated buying spree.

On-chain metrics, coupled with technical indicators, signal that LINK may be positioning for a powerful rally, potentially targeting $23.61 in the short term and $46 in the medium term if the current trend continues.

Over the past week, a newly created wallet withdrew 771,095 LINK (valued at over $14 million) from Binance across two separate transactions. This is part of a much broader trend, where 39 new wallets have collectively moved nearly $188 million worth of LINK off the same exchange.

Analysts note that such large-scale withdrawals typically reflect confidence in long-term price growth, as holders seek to secure tokens in self-custody rather than keep them on exchanges for potential selling.

Exchange Balances Hit Record Low

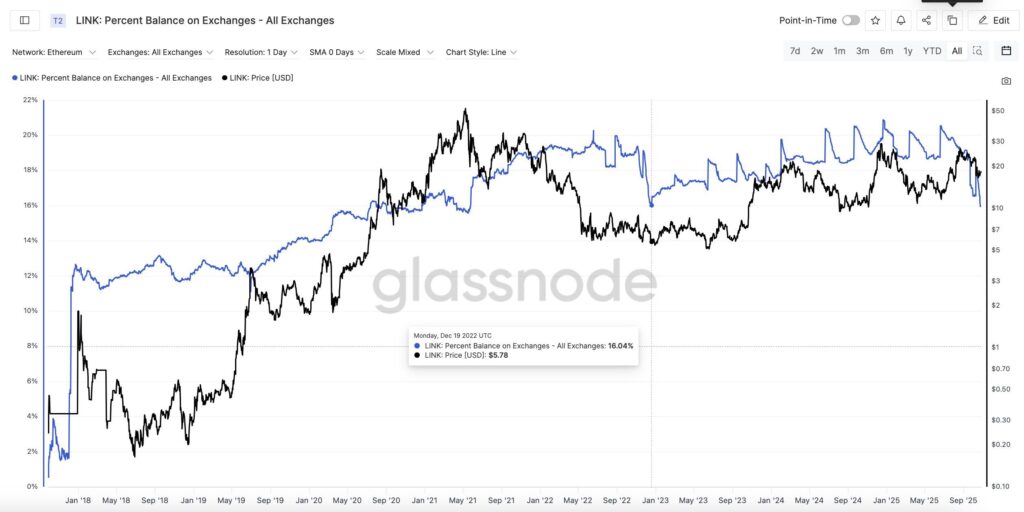

Recent on-chain data reveals a significant decline in LINK’s exchange supply, a crucial metric for understanding market sentiment.

According to Glassnode, the exchange balance has fallen from 205 million to 160 million LINK tokens since April 2025. This represents the lowest level of exchange reserves since December 2022, right after the FTX collapse.

This sharp decrease suggests a steep drop in selling pressure and a clear rise in accumulation sentiment. The Holder Accumulation Ratio now sits at 98.9%, indicating that nearly all active addresses are currently net buyers, a highly bullish signal.

Market observers view this as a pivotal moment for Chainlink, as the declining liquidity on exchanges could amplify upward price volatility during the next demand surge.

Technical Setup Points Toward a Breakout

At the time of writing, LINK is trading around $18.22, showing strong indications of an impending breakout from its descending trendline.

Technical analysts suggest that a sustained move above $20.19 would confirm a bullish reversal pattern, paving the way toward $23.61, a critical resistance level aligned with wave 3 of the Elliott Wave structure.

In the immediate term, the $19.20–$19.70 range remains a key resistance area. A clean breakout above this range could trigger a rapid move toward the psychological threshold of $20 and potentially higher.

Short-term traders have identified $46 as the ideal take-profit zone for the current wave, supported by both technical momentum and the broader market’s bullish bias.

Institutional Confidence Strengthens Chainlink’s Position

Beyond price action, institutional activity is providing a strong foundation for Chainlink’s long-term narrative.

Recent partnerships, such as the collaboration between Chainlink and S&P Global to develop a stablecoin risk rating framework, demonstrate the protocol’s growing influence across traditional finance and decentralised ecosystems alike.

The Chainlink Foundation has also been strategically accumulating tokens, recently repurchasing 63,000 LINK (worth around $1.15 million) as part of its ongoing reserve expansion strategy.

This move reinforces the project’s commitment to long-term sustainability and market confidence.

However, analysts highlight that the next challenge for Chainlink lies not in technology, but in increasing real token demand. While its oracle infrastructure has become the backbone of decentralised finance (DeFi), the project must now focus on expanding retail participation and institutional incentive programmes to translate its dominance into sustained capital inflows.

As one market strategist noted:

“The product is a done deal, Chainlink has already won in the oracle space. The focus now should be on driving token demand and building stronger engagement with mainstream investors.”

Outlook: LINK’s Next Big Move

With exchange supply shrinking, whale accumulation intensifying and institutional partnerships expanding, Chainlink’s fundamentals appear stronger than ever.

If bullish momentum holds, the next leg could see LINK testing $23.61, followed by a potential mid-term target near $46, a level many analysts view as the gateway to the next major bull phase.

The convergence of technical, on-chain and sentiment indicators paints a clear picture: Chainlink is entering a decisive accumulation zone and the market may soon witness one of the most significant breakouts of 2025.

Leave a Reply