Chainlink (LINK) is rapidly emerging as a cornerstone in institutional blockchain infrastructure, outperforming Ethereum in recent development activity and making significant strides in real-world asset (RWA) tokenization. Bolstered by its key role in the Hong Kong e-HKD+ CBDC pilot and increasing institutional adoption, Chainlink’s rise signals a broader shift towards enterprise-grade crypto solutions. This article explores the latest developments, market momentum, and price outlook for LINK as it cements itself as a leader in the crypto space.

Chainlink Overtakes Ethereum in GitHub Development Activity

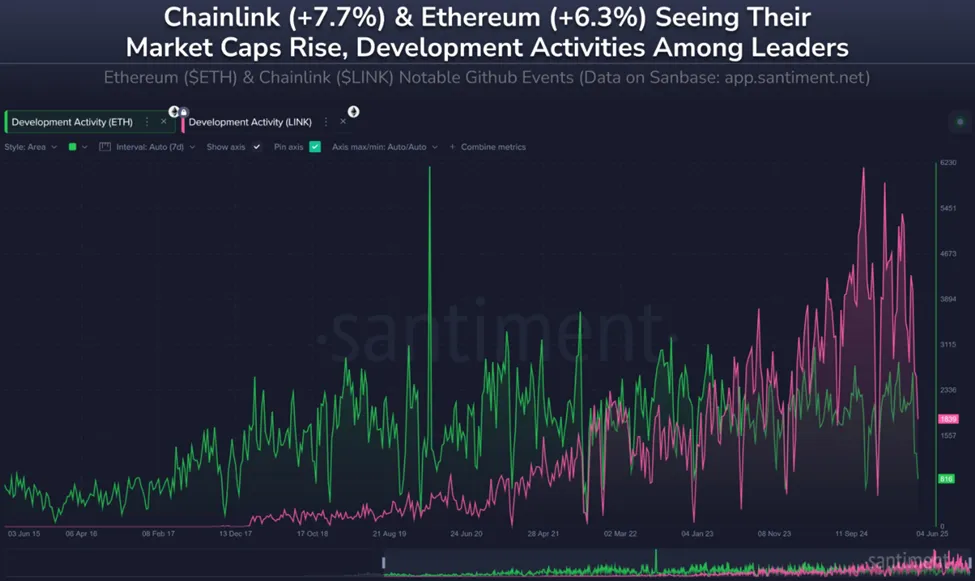

Chainlink has recently surpassed Ethereum in terms of GitHub development activity, marking a major milestone for the project. According to blockchain analytics firm Santiment, LINK ranked second overall in development events, with Ethereum lagging in eighth place. This surge underscores the active development of Chainlink’s ecosystem, particularly as it scales its infrastructure for enterprise-grade blockchain use.

The timing of this uptick in activity is notable, coinciding with growing institutional interest in blockchain technology. Chainlink has increasingly positioned itself as the backbone of institutional DeFi by offering secure data feeds, interoperability protocols, and regulatory-compliant frameworks for digital asset transactions. As Santiment noted, “While most of crypto stays flat Tuesday, Chainlink (+7.7%) and Ethereum (+6.3%) have continued to break out.”

This development edge further strengthens Chainlink’s role in the tokenization of real-world assets, a trend gaining traction across the financial sector.

RWA Momentum: Chainlink’s Role in Hong Kong’s e-HKD+ Pilot

Chainlink’s growing influence is further evidenced by its involvement in the Hong Kong Monetary Authority’s (HKMA) e-HKD+ pilot program. On June 9, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enabled a secure exchange between a Hong Kong central bank digital currency (CBDC) and an Australian dollar stablecoin.

This real-world test was executed with participation from major financial players such as Visa, ANZ, China AMC, and Fidelity International. Chainlink’s infrastructure was central to the pilot, validating its capabilities in cross-border settlement and on-chain interoperability.

Sergey Nazarov, co-founder of Chainlink, highlighted the importance of the initiative, stating that the platform addresses the three key challenges facing institutional smart contracts: secure data delivery, cross-chain functionality, and regulatory compliance. He cited a transaction executed within the HKMA’s compliance framework as proof of Chainlink’s ability to handle complex, high-value institutional use cases.

Nazarov further emphasised that as more institutions join the Chainlink ecosystem, the network’s standards and utility continue to grow, boosting its value proposition.

LINK Price Surges on Institutional Validation

Chainlink’s technical and institutional momentum has sparked renewed investor interest, resulting in a notable price surge. Following the announcement of its successful role in the e-HKD+ pilot, LINK rose from $13.90 to $14.60, an 8% increase. As of this writing, LINK trades at approximately $15.28, reflecting over 5% growth in the last 24 hours.

This positive market reaction underscores the growing belief that Chainlink is poised to become a core infrastructure layer for future institutional blockchain applications. Prominent crypto analyst Quinten François summed up the sentiment by stating, “There simply isn’t a project with the institutional adoption of Chainlink.”

The combination of GitHub dominance, institutional partnerships, and real-world test cases is placing Chainlink in a unique position compared to other crypto assets that are still struggling to find long-term utility.

Technical Analysis: LINK Prepares for Breakout

Despite the bullish fundamentals, Chainlink’s price is currently navigating key resistance zones. The price is facing a significant supply barrier between $16.04 and $17.43. Additionally, the token is approaching the upper boundary of a falling wedge pattern, a technical setup often considered a bullish reversal indicator.

If LINK breaks above this upper trendline and confirms with a strong daily close above $16.70 (the mean of the resistance zone), a long-term bullish breakout could be triggered. Analysts estimate a potential upside of 57%, which would propel LINK toward the $25 mark.

Supporting indicators include:

- 50-day SMA: Now flipped into support at $15.07

- 100-day SMA: Additional support at $14.35

- Relative Strength Index (RSI): Positioned above 50, indicating rising momentum

However, if LINK fails to breach the upper trendline, it risks falling back below the 50-day SMA. A loss of support at the 100-day SMA could open the door to a decline toward the demand zone between $10.78 and $11.46. This range may act as a strong buy zone for bulls, but a breakdown below it would pose further downside risk.

Chainlink’s recent accomplishments, from surpassing Ethereum in developer activity to playing a central role in real-world financial pilots, highlight its growing strategic relevance in the blockchain ecosystem. As traditional finance inches closer to on-chain integration, Chainlink is increasingly viewed as the leading gateway for institutions entering the space.

Leave a Reply