Despite maintaining one of the world’s toughest stances on cryptocurrency trading, China appears to be signalling a more flexible approach to stablecoins, particularly in Shanghai. A growing chorus of voices within the country, including local authorities and experts, are urging the government to adapt to the global rise of stable digital currencies.

Shanghai officials begin stablecoin discussions

In a significant move, the Shanghai State-owned Assets Supervision and Administration Commission recently convened to discuss how China could strategically respond to the rise of stablecoins and digital assets. Reuters reported that the meeting, held last Thursday, marks a rare public acknowledgement of stablecoins by a key government body in mainland China.

Following the meeting, He Qing, director of SASAC, took to the authority’s official platform to call for greater awareness of emerging technologies. He emphasised the need to increase research into digital currencies, aligning with broader calls from within China to develop a stablecoin linked to the Chinese yuan.

This push for a yuan-pegged stablecoin follows growing recognition of the global shift towards stable digital assets and the potential role China could play in shaping that future.

Central bank acknowledges stablecoin potential

The People’s Bank of China has also weighed in. In June, its governor Pan Gongsheng recognised the transformative impact that technologies like stablecoins may have on global financial systems. This statement reflects a notable change in tone from the central bank, which has historically taken a hardline stance against most forms of crypto.

PBOC adviser Huang Yiping further suggested that Hong Kong could serve as a testing ground for a stablecoin backed by the yuan. He explained that while mainland China is unlikely to relax its strict capital controls, Hong Kong’s offshore renminbi market may offer a viable alternative.

This idea was echoed by an article published on June 23 in the Securities Times, a prominent state-run media outlet, which argued that China should accelerate the development of stablecoins and avoid falling behind in the digital currency race.

FTX bankruptcy controversy intensifies speculation

China’s apparent softening stance comes as speculation grows about its broader involvement in the crypto sector. This has been amplified by events surrounding the bankruptcy proceedings of the collapsed crypto exchange FTX.

In early July, the FTX estate requested that a US bankruptcy court freeze payouts to creditors in several restricted countries, including China. Notably, China accounts for over 80 per cent of the value of the claims under question.

The request sparked backlash from Chinese creditors, many of whom pointed out that China has never explicitly banned individuals from holding cryptocurrency, despite banning crypto trading and mining. On Tuesday, a Chinese creditor formally objected to the FTX estate’s motion, representing over 300 individuals seeking compensation.

A court ruling on the matter is expected on July 22, and its outcome may fuel further debate on China’s crypto policies.

China rumoured to be holding large Bitcoin reserves

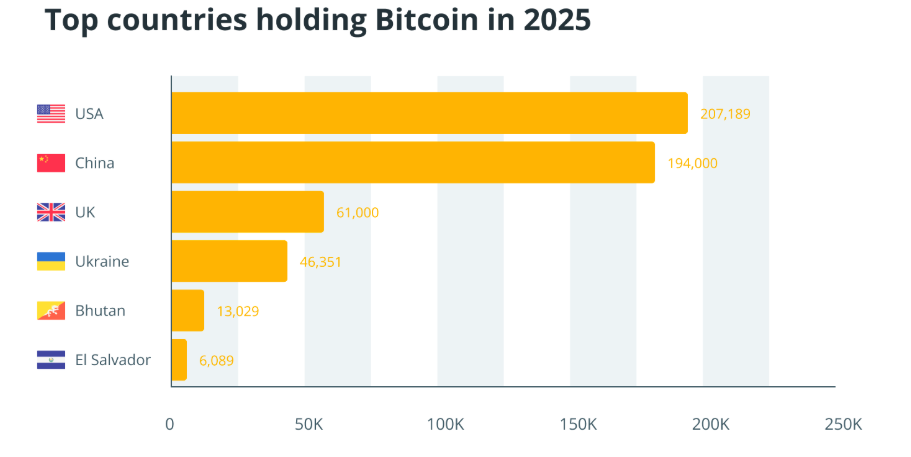

While China maintains strict restrictions on crypto-related activities, reports continue to circulate that the country has been quietly accumulating Bitcoin. Some suggest China could now be the second-largest holder of Bitcoin after the United States, although no official figures have ever been disclosed.

This claim, if true, would contradict the country’s public stance on crypto and raise questions about its long-term strategy regarding digital assets.

Mixed signals but signs of a new direction

Despite the ongoing ban on crypto trading, the recent developments in Shanghai, alongside statements from the PBOC and state media, suggest China is reevaluating its position on stablecoins. However, any shift is likely to remain tightly controlled and limited to initiatives aligned with government oversight.

Experts believe the focus will remain on creating a state-backed digital currency, potentially through Hong Kong, rather than fully embracing decentralised crypto systems.

As the global stablecoin race accelerates, China appears unwilling to remain on the sidelines, even as it continues to enforce strict rules on cryptocurrency at home. The next steps, particularly around yuan-backed stablecoins, may offer clearer signals on whether the world’s second-largest economy is preparing to join the new digital currency frontier.

Leave a Reply