The cryptocurrency market is once again at a turning point. After months of sideways moves, traders are watching closely to see if altcoins can break through their previous highs. The answer may not lie in the United States or Europe, but in China. The world’s second-largest economy is showing signs of slowing down, and its central bank could soon roll out major stimulus measures. If that happens, fresh liquidity might fuel the next stage of altseason, provided investors do not retreat in fear of a global recession.

Why China’s Monetary Policy Matters for Crypto

Central banks drive markets through their monetary policies. By cutting interest rates or easing financing conditions, they pump more money into the economy, which often boosts risk assets such as stocks and cryptocurrencies. A March 2025 report by 21Shares highlighted this connection, showing that Bitcoin’s price has a 94% correlation with global liquidity. That is higher than its link to the S&P 500 or even gold.

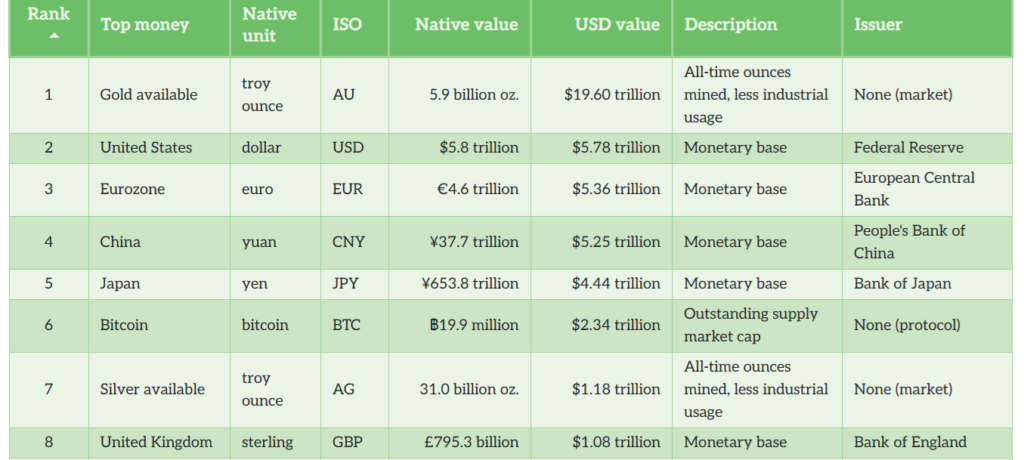

Currently, global liquidity is concentrated in four regions:

- United States: $5.8 trillion

- Eurozone: $5.4 trillion

- China: $5.2 trillion

- Japan: $4.4 trillion

With China contributing 19.5% of global GDP, its monetary stance is crucial. Even though the US Federal Reserve tends to dominate headlines, the People’s Bank of China (PBOC) holds immense power over the global flow of capital and by extension, crypto prices.

China’s Economic Slowdown Raises Pressure

China’s latest economic data paints a challenging picture. In July, retail sales dropped 0.1% from the previous month. Investment in fixed assets plunged 5.3% year-on-year, the steepest fall since March 2020. Industrial production barely grew at 0.4%, while the unemployment rate in urban areas climbed to 5.2%, up from 5% in June.

This slowdown has pushed analysts to predict fresh stimulus. Bloomberg Economics’ Chang Shu and Eric Zhu suggest that measures could come as soon as September. Economists at Nomura and Commerzbank share a similar view, saying it is only a matter of time before Beijing introduces stronger support policies.

For the crypto market, such intervention could be decisive. Additional liquidity from China would increase global risk appetite, setting the stage for altcoins to rally. But there is still a hurdle: global recession fears.

Recession Fears vs Market Optimism

In the United States, consumer sentiment is weakening. A University of Michigan survey revealed that 60% of Americans expect unemployment to rise within the next year, levels last seen during the 2008–09 financial crisis. Normally, such pessimism would weigh heavily on risk assets.

Yet markets have shown resilience. The S&P 500 continues to set new all-time highs. Yields on 5-year Treasurys, which had dropped to 3.74% in early August, rebounded to 3.83% by mid-month. Rising yields suggest investors are less fearful and willing to take on more risk.

This matters for crypto. If traders are not overly defensive, liquidity injected by China could flow into altcoins more easily. The balance between economic caution and investor optimism will shape how far altseason can run.

The Road Ahead for Altseason

The next phase of altseason depends on two key factors:

- China’s stimulus response – If the PBOC eases aggressively, the liquidity boost could unlock new highs for cryptocurrencies.

- Global risk appetite – If recession fears stay under control, investors may rotate into risk assets like altcoins.

Put simply, China holds the key. If its central bank delivers meaningful stimulus while global markets remain optimistic, altcoins could finally break past resistance levels and enter a fresh bull cycle. However, if recession fears dominate, investors may stay cautious, leaving altseason delayed once again.

For now, traders are watching September closely. A bold move from Beijing could set the stage for a breakout, not only for stocks and bonds, but for the entire cryptocurrency market.

Leave a Reply