US Moves Towards Strategic Bitcoin Reserve

On 7 March, US President Donald Trump signed an executive order to establish a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile.” This move signifies a major policy shift, with the US government now treating Bitcoin as a long-term store of value rather than simply seizing and liquidating digital assets.

The reserve will initially be funded using Bitcoin and other digital assets confiscated in criminal cases. White House AI and crypto czar David Sacks confirmed that the government does not intend to sell Bitcoin from the reserve. Instead, the US will explore “budget-neutral strategies” to increase its holdings, such as issuing bonds or selling gold.

China’s Potential Response

With the US formally recognising Bitcoin as a strategic asset, speculation is mounting over whether China will respond with a similar policy. Bitcoin advocate David Bailey, one of the key figures behind Trump’s shift towards pro-Bitcoin policies, claimed that China has held closed-door discussions on Bitcoin since the 2024 US elections. However, there has been no official confirmation from Beijing.

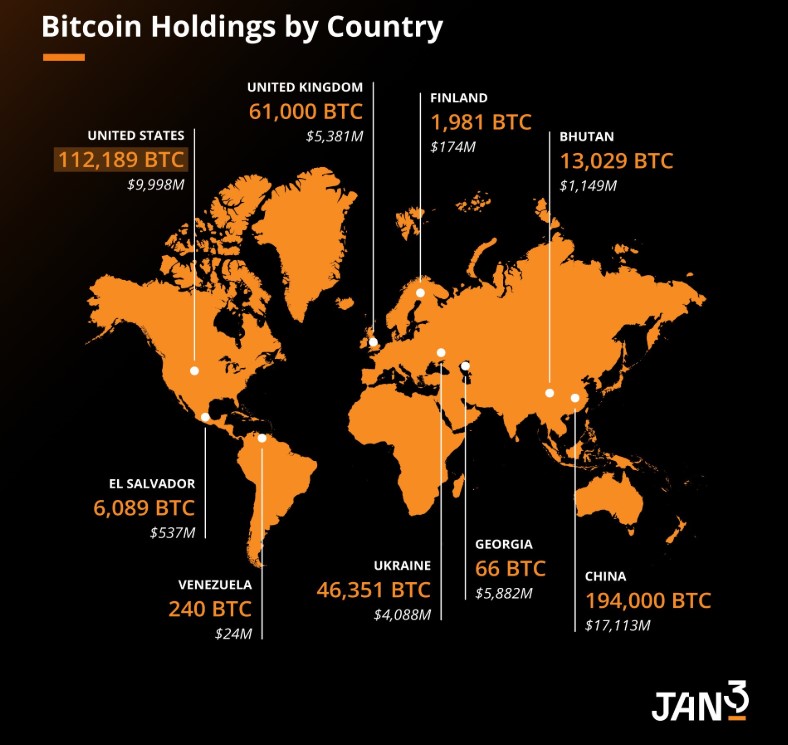

If China adopts a Bitcoin reserve strategy, it could immediately emerge as one of the world’s largest Bitcoin holders, rivaling the US. The American government currently holds approximately 198,109 BTC, valued at over $17 billion. However, some of these holdings will be returned to the crypto exchange Bitfinex, reducing the US’s effective reserves to around 112,000 BTC.

This would place China in a stronger position, assuming it still retains the 195,000 BTC seized from the PlusToken Ponzi scheme in 2020.

China’s Bitcoin Holdings: Still Intact?

China has never officially disclosed whether it still possesses the Bitcoin seized in the PlusToken case. In 2020, a ruling by the Yancheng Intermediate People’s Court declared that all confiscated digital assets, including nearly 195,000 BTC, would be forfeited to the national treasury.

CryptoQuant founder Ki Young Ju speculated in January 2024 that China may have already liquidated its Bitcoin reserves. He argued that the Chinese Communist Party would be unlikely to hold “censorship-resistant money.” However, this remains unverified, as no official statements have been made regarding the fate of these holdings.

Global Bitcoin Reserve Race Begins

The US’s move to establish a Strategic Bitcoin Reserve has triggered what Jan3 CEO Samson Mow describes as the beginning of a “real race” for nation-state Bitcoin adoption. He noted that even though some Bitcoin advocates criticised the US for not immediately purchasing BTC, the long-term impact of the initiative will be significant.

Mow also highlighted that if China still retains its 195,000 BTC, it would be ahead of the US in terms of Bitcoin reserves. Given the geopolitical rivalry between the two nations, Washington is unlikely to accept falling behind and may accelerate efforts to accumulate more Bitcoin.

Meanwhile, Hong Kong lawmakers are exploring Bitcoin adoption within China’s “one country, two systems” framework. On 30 December, Hong Kong Legislative Council member Wu Jiexhuang suggested studying the potential market impact of US spot Bitcoin exchange-traded funds (ETFs). He also noted that Trump’s proposal to make Bitcoin a strategic reserve asset could influence global financial markets.

With the US now setting a precedent for national Bitcoin reserves, all eyes are on China to see whether it will make a similar move—or risk falling behind in the digital asset race.

Leave a Reply