Basel Regulators Consider Softer Approach to Crypto Capital Rules

Global banking regulators are preparing to revisit their strictest crypto requirements as the United States and the United Kingdom refuse to implement them. The Basel Committee’s long-standing consensus faces pressure after both nations pushed back against the 1,250% risk weighting currently applied to banks’ crypto exposures.

Erik Thedéen, governor of Sweden’s central bank and chair of the Basel Committee on Banking Supervision, told the Financial Times that the committee may need a “different approach” to the framework. The rule requires banks to hold capital equal to the full value of any crypto asset they hold.

Thedéen acknowledged that the rapid expansion of regulated stablecoins has reshaped the policy environment. He noted that the strong rise in stablecoin use and the scale of assets in circulation make the existing approach increasingly impractical. Under the framework, even permissionless-blockchain assets such as USDT and USDC are treated as high-risk venture-type exposures.

US Senate Targets December Vote for Crypto Market Structure Bill

Senate Banking Committee Chair Tim Scott said he aims to advance a major crypto market structure bill in December. He told Fox Business that he intends to bring the legislation to the Senate floor early next year with the goal of having it reach President Donald Trump by early 2026.

Scott criticised Democrats for delaying progress and stressed that the bill would help establish the United States as a global hub for digital assets. The House passed the CLARITY Act in July. The legislation outlines the regulatory roles of the Commodity Futures Trading Commission and the Securities and Exchange Commission. A parallel Senate effort is underway through the Banking Committee and the Agriculture Committee as lawmakers work to merge the two versions.

In a video posted to X, Coinbase chief executive Brian Armstrong said he had been lobbying in Washington for clearer market rules. He noted significant progress and expressed optimism that a December markup is achievable.

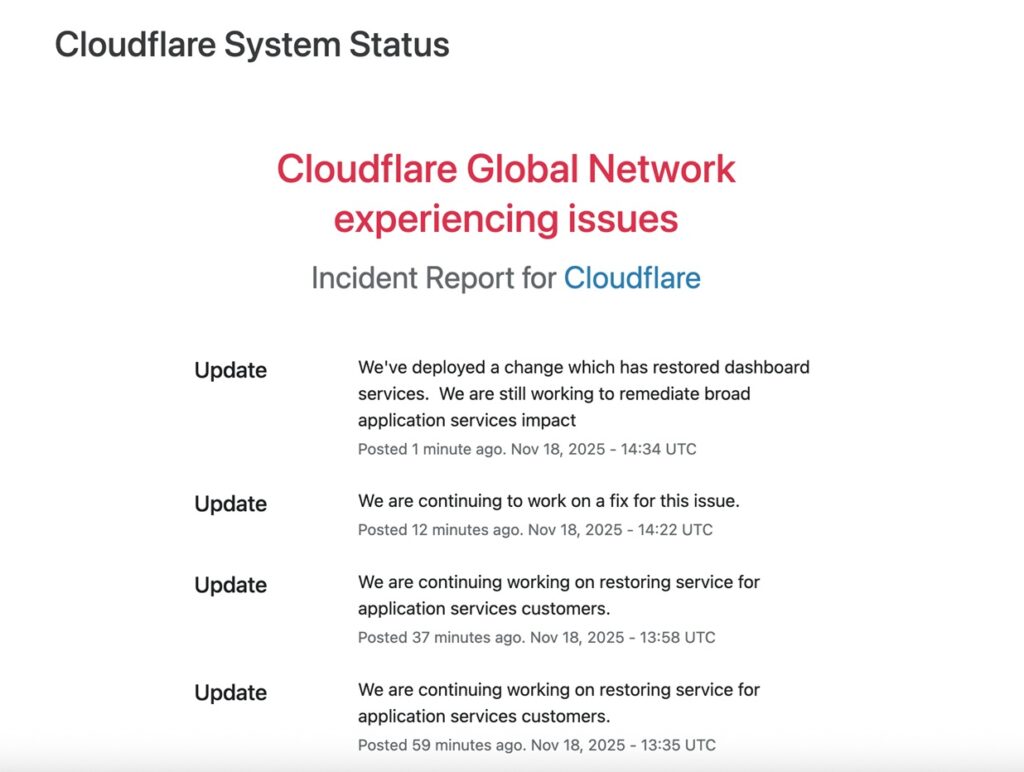

Cloudflare Outage Disrupts Major Crypto Platforms

A widespread Cloudflare disruption temporarily blocked access to the front end of multiple crypto websites on Tuesday. Several major exchanges and blockchain platforms experienced downtime as the outage affected user-facing services.

Coinbase, BitMEX, Ledger, Blockchain.com, Toncoin and DefiLlama were among the platforms impacted. Kraken also reported issues but later confirmed that its services had been restored.

Cloudflare attributed the problem to an internal service degradation linked to a configuration file used to manage threat traffic. The file grew beyond its expected size and triggered a crash in the software responsible for handling traffic across various Cloudflare systems.

The incident highlighted the continued dependence of decentralised platforms on centralised infrastructure, which leaves them susceptible to outages that interrupt trading and access.

Growing Tension Between Regulation and Market Expansion

Today’s developments reveal the increasing tension between rapid growth in digital assets and the evolving regulatory frameworks that govern them. Calls for updated Basel rules reflect a global shift toward recognising the changing role of stablecoins in the financial system.

At the same time, US lawmakers are pushing for comprehensive legislation that could define the industry’s regulatory future. The Cloudflare outage served as a reminder that even the most innovative crypto platforms remain vulnerable to centralised service failures.

Leave a Reply