A new policy paper from the Coinbase Institute argues that the biggest divide in modern finance is no longer between high earners and low earners, but between people who can directly access capital markets and those who cannot. According to the report, the ability to own productive assets or raise capital at scale has become the real driver of long term wealth creation, overtaking income growth and even basic banking access.

Coinbase describes this divide as one between the brokered and the unbrokered. The brokered are individuals and institutions with direct access to markets for stocks, bonds, funds and other financial instruments. The unbrokered, estimated at around four billion people globally, remain locked out by layers of intermediaries that make participation uneconomical or impossible.

Capital income has outpaced wages for decades

The report points to long term data to support its argument. In the United States over the past four decades, income derived from capital has grown by 136 percent, while labor income has increased by just 57 percent. This gap, Coinbase argues, explains why wealth has concentrated among those who already own assets rather than those who rely primarily on wages.

While access to banking services has improved in many parts of the world, the paper says banking alone is no longer enough. Without affordable and direct access to capital markets, individuals remain unable to benefit from the growth of productive assets or to fund new ventures efficiently.

The cost of intermediaries creates a capital gap

Traditional financial systems rely on a web of brokers, custodians, clearing houses and settlement agents. These intermediaries serve an important role, but they also add cost and complexity. For smaller investors and issuers, those costs often outweigh the potential benefits of participation.

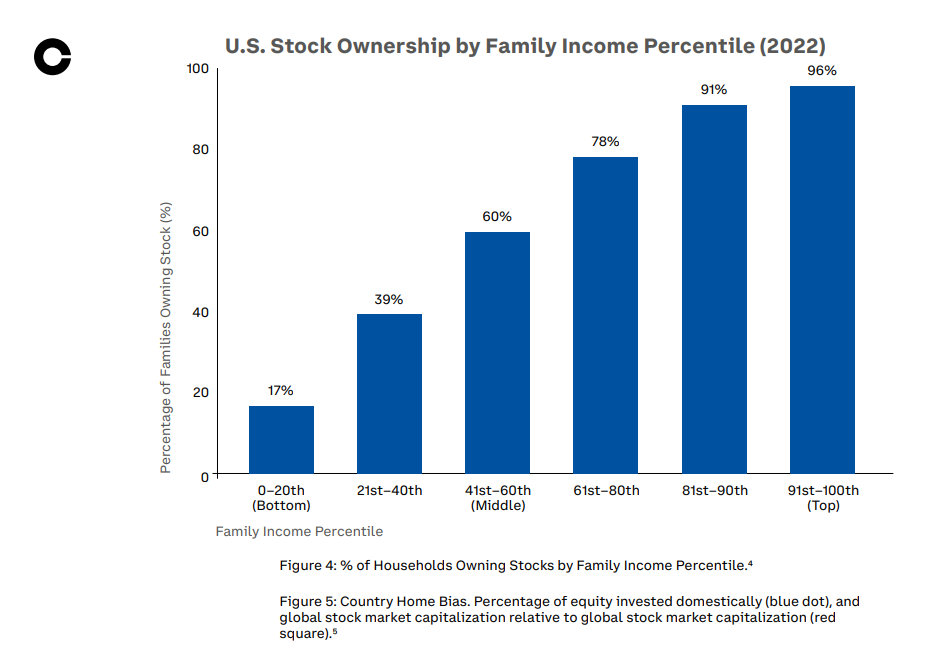

Coinbase calls this the capital chasm, a structural gap where only large players and already wealthy households can justify access to markets. As a result, ownership of stocks, bonds and funds remains heavily concentrated in advanced economies and among households that are already well served by financial institutions.

The report argues that closing this gap will require a redesign of core market infrastructure, allowing individuals and smaller businesses to interact with markets more directly rather than through multiple layers of gatekeepers.

Why Coinbase is pushing permissionless tokenization

At the center of Coinbase’s proposal is tokenization, but with a clear distinction. The company argues that permissionless tokenization on open blockchains is critical if broader participation is the goal.

According to the paper, permissioned or consortium based blockchain systems often recreate the same power structures found in traditional finance. A small group still decides who can issue assets, who can access them and under what conditions. Coinbase warns that such models risk reinforcing existing inequalities rather than reducing them.

By contrast, the report compares permissionless blockchains to internet protocols like TCP/IP. Anyone can build on them, and interoperability is not controlled by a single authority. In this model, access cannot be quietly restricted later, and innovation can emerge from outside established institutions.

Tokenization is already moving into live markets

The report lands at a time when tokenization is no longer theoretical. Several major financial players are already using blockchain based systems in live environments.

Franklin Templeton, for example, has issued shares of a US money market fund on public blockchains. Investors hold onchain fund units that settle more quickly while still operating within existing securities regulations.

In banking, JPMorgan runs a Tokenized Collateral Network on its Kinexys platform. The system uses blockchain based tokens to represent assets such as money market fund shares, allowing institutional clients to move collateral more efficiently while the underlying assets remain on the bank’s balance sheet.

Market infrastructure is also evolving. The New York Stock Exchange recently announced plans for a 24 hour trading venue for tokenized stocks and exchange traded funds, supported by blockchain based post trade systems and stablecoin settlement.

Policy discussions take center stage in Davos

The release of the Coinbase Institute report coincides with the World Economic Forum’s annual meeting in Davos, where financial reform and market structure are high on the agenda. Coinbase CEO Brian Armstrong said in a post on X that he planned to use the meetings to push discussions around tokenization, updated market structure legislation and what he described as economic freedom through modernized financial systems.

The report positions tokenization not just as a technological upgrade, but as a potential shift in who gets to participate in wealth creation. Whether policymakers embrace permissionless models or favor more controlled approaches could determine how much that promise extends beyond the already brokered world.

Leave a Reply