Coinbase has temporarily paused its local fiat operations in Argentina, less than a year after officially entering the market. The move limits peso-based services while leaving crypto trading and transfers fully functional, marking a strategic retreat from local banking rails rather than a full exit from the country.

Peso-Based On and Off Ramps Put on Hold

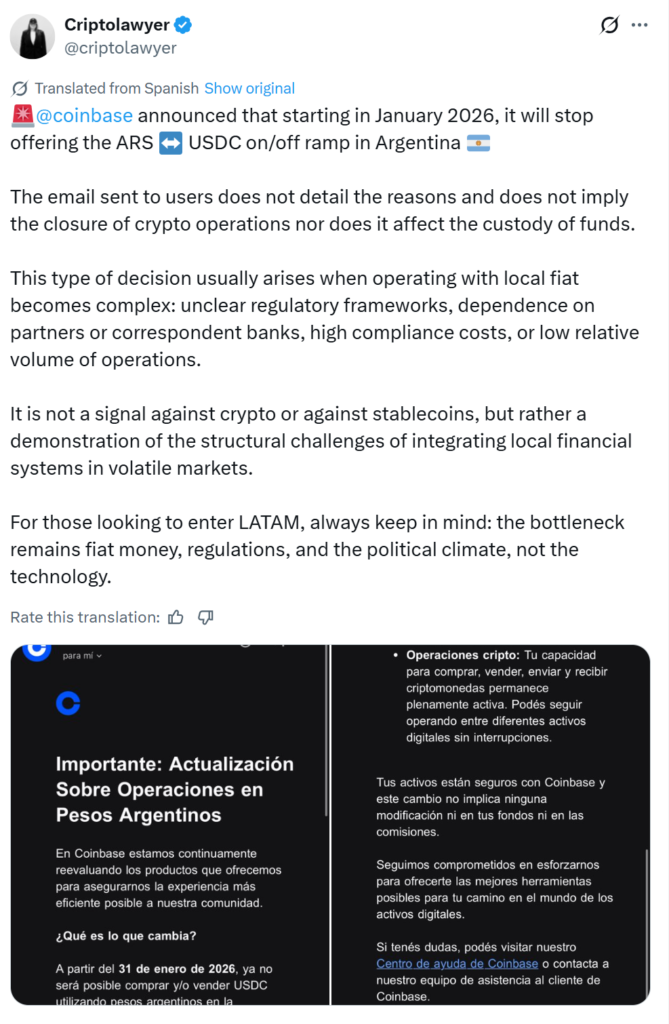

According to reports from Forbes Argentina, Coinbase informed users that it is halting Argentine peso ARS based services as part of an internal review of its local operations. The pause affects the ability to buy or sell USD Coin USDC using pesos, as well as withdrawing funds to local bank accounts.

The exchange said that from Jan. 31, 2026, peso-linked USDC transactions will no longer be available. Users have been given a 30-day window to complete any pending peso-based purchases, sales or withdrawals before the cutoff takes effect.

Coinbase described the decision as a deliberate pause, stressing that it is reassessing how to offer local services in a more sustainable way. The company added that this does not signal a permanent withdrawal from Argentina.

Crypto Trading Continues Without Disruption

While fiat rails are being scaled back, Coinbase confirmed that its core crypto services remain unaffected. Users can continue to buy, sell, send and receive cryptocurrencies as usual, and customer funds remain secure on the platform.

The company emphasized that the pause is limited to local banking integrations and does not impact crypto to crypto activity. For Argentine users who rely primarily on digital asset trading rather than peso conversions, the platform will continue to function normally.

Structural Challenges Behind the Decision

Commenting on the development, Ana Gabriela Ojeda, a prominent figure in Latin America’s Web3 ecosystem, said such pauses are often driven by the complexity of operating local fiat services in volatile markets.

In a post on X, Ojeda pointed to unclear regulations, dependence on correspondent banks, rising compliance costs and relatively low transaction volumes as common pressure points. She noted that the move should not be read as a loss of confidence in crypto or stablecoins, but rather as a reflection of the difficulties involved in connecting global crypto platforms with local financial systems.

Argentina’s history of currency controls, inflation and shifting regulatory frameworks has long made banking integrations challenging for both domestic and foreign financial firms.

Ongoing Presence Through Base and Local Partnerships

Despite pulling back from peso-based services, Coinbase plans to maintain an active footprint in Argentina through Base, its Ethereum layer 2 network. Forbes Argentina reported that the company will continue working with local partners, including crypto exchange Ripio, on initiatives related to Base.

This suggests Coinbase is refocusing its efforts on infrastructure and blockchain development rather than direct fiat access, at least for the time being. The company had announced its Argentina launch in early 2025, following months of preparation and market analysis during 2024.

At the time of publication, Coinbase had not issued an official public statement beyond user communications. Media inquiries seeking further comment had not received a response.

Argentina Considers Easing Bank Restrictions on Crypto

The timing of Coinbase’s decision comes as Argentina’s central bank is reportedly reviewing its stance on crypto activity by traditional banks. The Banco Central de la República Argentina is said to be drafting new rules that could allow banks to trade cryptocurrencies directly, though details and timelines remain uncertain.

Such a move would represent a significant shift from the central bank’s 2022 position, when it barred financial institutions from offering crypto trading services. That earlier decision was taken after several major banks explored digital asset products, with regulators citing risks to consumers and the financial system.

If the proposed changes move forward, they could reshape the local crypto landscape and potentially improve conditions for exchanges seeking deeper integration with the banking sector.

Leave a Reply