The US IPO market delivered uneven returns in 2025, with investors finding better gains in the S&P 500 than in newly listed companies. Despite a long awaited reopening of public markets and renewed enthusiasm around crypto and artificial intelligence, several high profile debuts failed to meet expectations, pulling down overall IPO performance.

Data compiled by Bloomberg shows that shares of US companies that went public in 2025 rose 13.9 percent on a weighted average basis, excluding blank check firms and closed end funds. That return lagged the S&P 500, which gained about 16 percent over the same period, highlighting the challenges faced by new listings even as broader equities advanced.

Crypto and AI weigh on overall IPO returns

Crypto and AI focused companies played a major role in shaping last year’s IPO story. After years of caution, Wall Street showed renewed confidence in crypto firms, encouraged by a more supportive regulatory tone under the Trump administration. Several major digital asset players tapped public markets, raising billions of dollars and drawing strong initial interest.

However, post listing performance told a more complicated story. While some stocks surged early, many struggled to sustain momentum as market conditions shifted and risk appetite cooled. AI related IPOs also proved unpredictable, with investors becoming more selective about business models and profitability prospects.

The mixed performance of these high profile sectors weighed on the broader IPO cohort, contributing to its underperformance versus the benchmark index.

Circle shines early but gives up gains

One of the standout crypto debuts of 2025 was stablecoin issuer Circle Internet Group. The company raised $1.05 billion in its June IPO, pricing shares at $31. On its first day of trading, the stock soared about 170 percent, making it one of the most successful openings of the year.

That early excitement faded in the months that followed. As Bitcoin retreated from its October highs, sentiment around crypto stocks weakened. Circle shares closed the year at $79.30, below their debut day closing price. From a peak above $263, the stock is now down nearly 70 percent, despite a modest recovery to $84.80 by Monday’s close.

Circle’s trajectory underscored how closely crypto related equities remained tied to broader digital asset market swings.

Gemini and Bullish struggle after listing

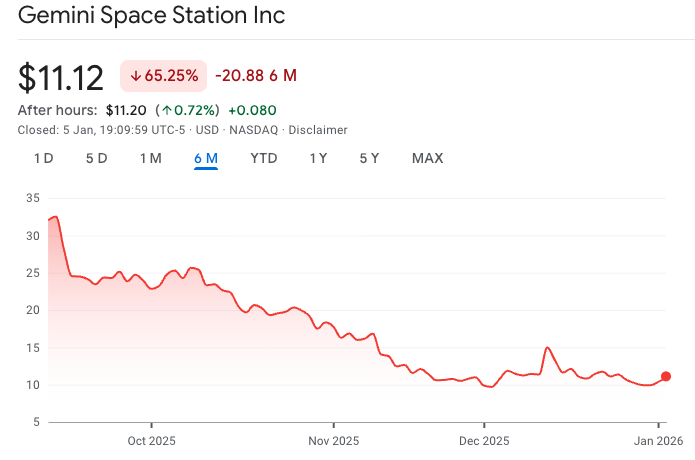

Not all crypto IPOs enjoyed even a brief surge. The Winklevoss twins’ exchange Gemini ranked among the worst performing public debuts of the year. Gemini priced its IPO at $28 in September and initially climbed above $32.50. By the end of December, however, the stock had fallen 64.5 percent to $9.92. A small rebound brought shares to $11.12 by Monday.

Crypto exchange Bullish, which went public in August, fared slightly better but still disappointed longer term investors. The stock opened at $37 and ended its first trading day at $68, signaling strong demand. Those gains gradually eroded, with shares closing at $37.87 on Dec. 31, close to the original offering price.

Together, these performances highlighted the risks investors faced when betting on crypto firms amid volatile market conditions.

Mid sized IPOs lag as selectivity rises

Beyond crypto and AI, performance varied widely across deal sizes. According to Bloomberg, medium sized IPOs were among the weakest performers. Companies valued between $500 million and $1 billion at pricing delivered an average weighted return of just 5.6 percent.

Larger offerings told a different story. IPOs valued at $1 billion or more posted average gains of around 20 percent, suggesting that scale and perceived stability played a key role in attracting sustained investor interest.

Mike Bellin, US IPO leader at PwC, said 2025 marked a selective reopening of the market. He noted that early stage tech companies faced a much higher bar, as investors focused less on hype and more on execution and financial fundamentals.

Big debuts show sharp contrasts

The year’s largest IPO came from medical equipment supplier Medline, which raised $7.2 billion. Since its mid December debut, Medline shares have climbed about 40 percent, making it one of the strongest performers among new listings.

In contrast, gas exporter Venture Global delivered one of the year’s worst results. The company reduced its $1.75 billion offering by 40 percent ahead of listing, yet its shares still plunged 72 percent after going public. The sharp decline served as a reminder that even established businesses can struggle if investor expectations and market realities diverge.

Bellin said the key takeaway from the year was a clear return to fundamentals. Investors, he explained, have become far more discerning, rewarding companies that enter the market with a clear narrative, solid operations, and realistic growth plans.

Leave a Reply