Once viewed as an experimental innovation, crypto cards have evolved into a mainstream financial tool, with global usage surging across generations and borders. According to recent projections, the market for crypto cards is expected to reach a staggering $152.2 billion by 2031, a clear indicator of how deeply integrated digital assets have become in daily life.

From everyday shopping to international travel, crypto cards are now used widely, especially in countries like the US, Brazil, Portugal, and Slovenia. Nearly one in 10 Americans already use them, and adoption rates are even higher in other regions.

Gen Z, Millennials and HNWIs Lead the Shift

The explosive growth in crypto card usage is largely driven by younger generations and high-net-worth individuals (HNWIs). A European Economic Area (EEA) report from Nexo revealed a remarkable 72% year-over-year increase in crypto-backed borrowing through its Nexo Card. Particularly in the EEA, card transaction volume soared by over 203% in the past year.

Users increasingly use crypto cards not just to spend but to leverage digital assets like Bitcoin and Ethereum as collateral. In 2024 alone, more than 100,000 BTC and 750,000 ETH were saved from liquidation through Nexo’s credit line model. This allowed users to spend without selling their crypto, maintaining long-term investment positions while managing immediate expenses.

Weekly card transaction frequency also spiked by 324%, a statistic that reflects how crypto cards have shifted from occasional use to being part of users’ regular financial behaviour.

A Cross-Generational, Digital Spending Revolution

Nexo’s study emphasises that crypto card adoption is no longer a trend isolated to tech-savvy youth. Gen Z leads the way, representing 37.7% of Nexo Card users who treat the card as a seamless extension of their digital lives. Millennials follow at roughly 30%, while Gen X and baby boomers make up the remaining 32%.

Interestingly, spending habits vary by age group. Younger users typically favour debit-style spending, aligning with day-to-day budgeting and convenience, while older users, especially HNWIs, tend to prefer credit-backed usage, leveraging their crypto without liquidating holdings.

This diverse usage highlights a key conclusion from the report: crypto card spending is no longer niche. It is a “cross-generational, cross-border shift in behaviour from saving to spending, from holding to leveraging.”

Stablecoins Become Everyday Currency

The study also sheds light on how users are choosing to spend. In 2024, 65% of Nexo Card debit transactions were made using stablecoins, a clear sign that digital dollars like USDT and USDC are increasingly viewed as viable everyday currencies.

Whether it’s buying groceries, booking flights, or funding lifestyle experiences, stablecoins have become the “everyday money of the internet,” offering users low volatility, fast settlements, and greater financial flexibility.

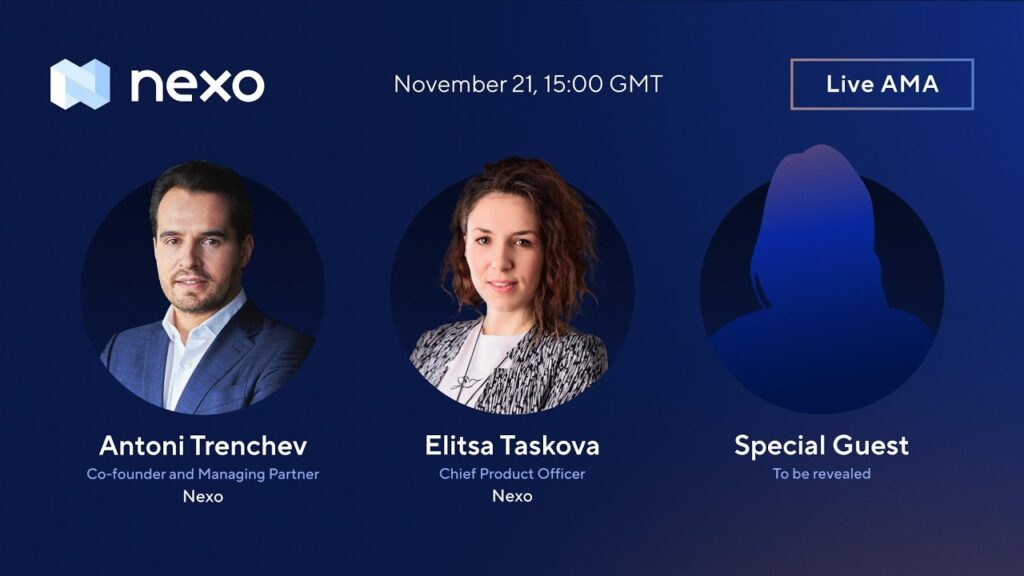

Nexo’s Chief Product Officer, Elitsa Taskova, summarised this evolution succinctly: “Today, people don’t want to choose between their financial future and their present needs and the Nexo Card reflects that.”

The Road Ahead: Crypto Cards as Financial Bridges

As crypto cards continue to blur the lines between traditional finance and decentralised assets, they are becoming essential bridges in the digital economy. Empowering users to retain their long-term investments while enjoying liquidity for daily needs, crypto cards embody the next phase of fintech innovation.

With the market expected to exceed $152 billion by 2031, and adoption cutting across age, geography, and income levels, crypto cards are no longer experimental. They’re now integral to the future of global payments, smart, flexible, and borderless.

Leave a Reply