Crypto investment products surged last week as institutional appetite strengthened, pushing inflows to their highest level of the year so far. Bitcoin once again dominated investor interest, accounting for more than two thirds of new capital entering the market, while Ether and select altcoins showed resilience despite regulatory headwinds in the United States.

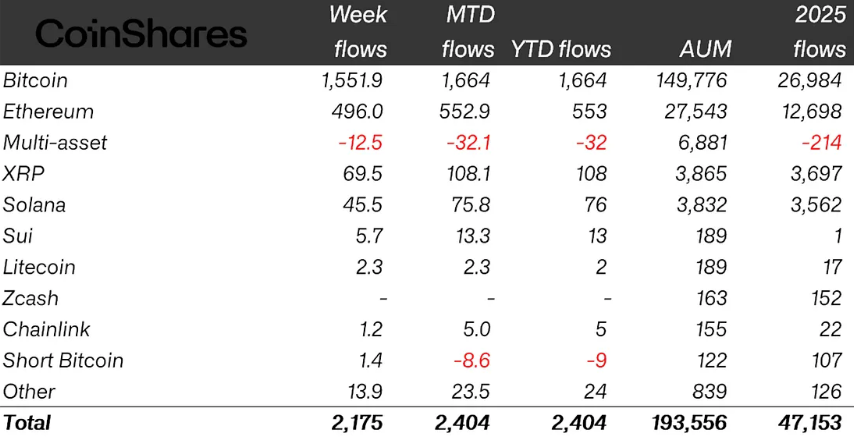

According to data released by European digital asset manager CoinShares, crypto exchange traded products attracted $2.17 billion in inflows over the past week, marking the strongest weekly performance since October last year and the best showing in 2026 to date.

Inflows accelerate after steady start to the year

The latest figures suggest momentum is building across crypto investment vehicles after a relatively muted start to the year. CoinShares noted that inflows earlier in the week were particularly strong, reflecting improving sentiment among professional investors.

However, the week did not end without turbulence. Friday recorded $378 million in outflows as global markets reacted to renewed geopolitical tensions linked to Greenland and growing concerns over potential tariff escalations. These factors briefly dented risk appetite across asset classes, including crypto.

CoinShares head of research James Butterfill said investor sentiment was also affected by political speculation in the US. Reports suggesting that Kevin Hassett, seen as a leading candidate for the next Federal Reserve chair and widely regarded as a policy dove, may remain in his current role added to market uncertainty late in the week.

Bitcoin commands investor attention

Bitcoin remained the clear leader among crypto investment products, drawing $1.55 billion in inflows during the week. This represented over 71 percent of total crypto fund inflows, reinforcing Bitcoin’s position as the primary institutional gateway into digital assets.

The strong performance comes as Bitcoin continues to trade near elevated levels, with investors viewing it as both a long term store of value and a hedge against macroeconomic uncertainty. Fund flows suggest that confidence in Bitcoin remains firm even as broader markets navigate political and economic crosscurrents.

Short Bitcoin products, however, moved in the opposite direction. These funds recorded monthly outflows of $8.6 million, indicating reduced appetite for bearish positioning as prices stabilized.

Ether and Solana stay resilient despite regulatory noise

Ether followed Bitcoin with $496 million in weekly inflows, a figure that exceeded total inflows into all crypto products combined during the previous week. The data points to renewed interest in Ethereum based investment vehicles, likely driven by continued activity in decentralized finance and staking related strategies.

Solana and XRP also posted solid gains. XRP products attracted around $70 million, while Solana funds saw $46 million in inflows. Smaller assets such as Sui and Hedera recorded modest but positive contributions, with inflows of $5.7 million and $2.6 million respectively.

Butterfill noted that Ether and Solana inflows held up well despite proposals under the CLARITY Act currently being discussed in the US Senate Banking Committee. These proposals could place restrictions on stablecoin yield offerings, a development that some market participants see as a potential headwind for certain blockchain ecosystems.

Multi asset crypto funds were among the few categories to see monthly outflows, totaling $32 million, suggesting investors are favoring more targeted exposure over diversified baskets for now.

Major issuers benefit as assets under management rise

All major crypto ETP issuers reported strong inflows last week. BlackRock’s iShares crypto ETFs led by a wide margin, pulling in $1.3 billion. Grayscale Investments followed with $257 million, while Fidelity Investments recorded $229 million in new capital.

The concentration of inflows among established asset managers highlights the role of trusted brands in attracting institutional money, particularly during periods of heightened market sensitivity.

Regionally, the United States accounted for the vast majority of inflows at $2 billion. In contrast, Sweden and Brazil experienced small outflows of $4.3 million and $1 million, respectively, underscoring uneven regional demand.

With the latest wave of inflows, total assets under management across crypto investment funds climbed above $193 billion. This marks the highest level since early November and signals a renewed expansion phase for the crypto ETP market.

As macroeconomic signals, regulatory developments, and geopolitical risks continue to shape investor behavior, last week’s data suggests that crypto, led by Bitcoin, is regaining favor as a strategic allocation rather than a speculative trade.

Leave a Reply