Crypto Investments Surge to All-Time High

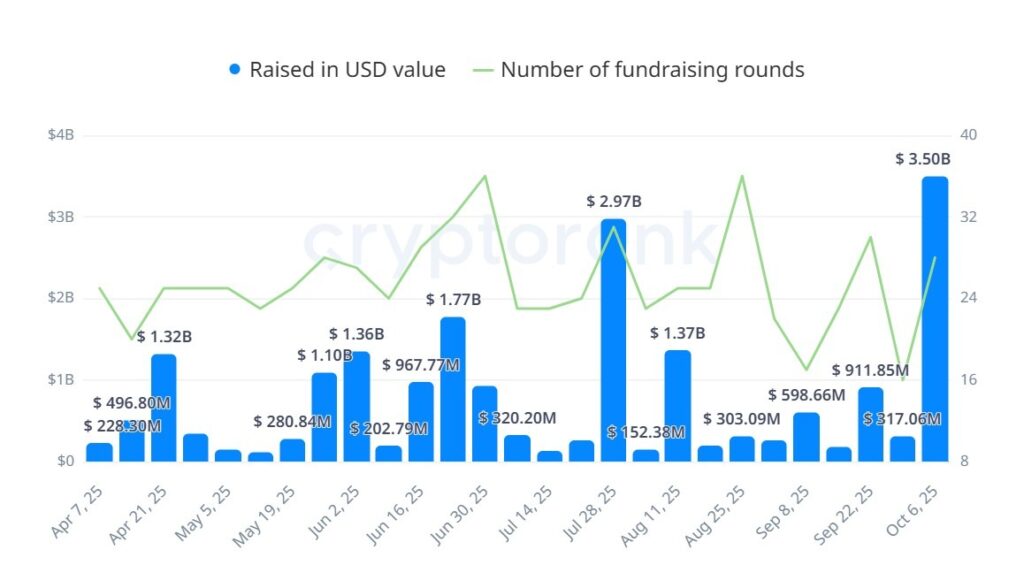

Crypto fundraising reached unprecedented levels last week, with companies raising $3.5 billion across 28 funding rounds. The surge occurred before a sudden market crash on Friday. Data from Cryptorank revealed that the week spanning 6 October to Sunday marked the highest weekly fundraising ever, surpassing the previous peak of nearly $3 billion raised between 28 July and 3 August. This sharp rise followed seven consecutive weeks of sub-$1 billion fundraising, signalling a sudden resurgence in investor confidence.

Over the past six months, weekly fundraising has varied significantly, ranging from $150 million to $2.9 billion. October’s surge represents a notable breakout in venture activity, coinciding with Bitcoin reaching a record high of $126,000 on 6 October. The milestone was achieved shortly before a major liquidation event sent the crypto markets tumbling.

Blockchain Services Lead Funding Rounds

Analysis of Cryptorank data indicates that blockchain services dominated last week’s investment activity. Of the 28 funding rounds, 12 were allocated to blockchain service providers, making it the most active sector. Centralised finance (CeFi) projects followed with six rounds, while the remainder went to blockchain infrastructure, decentralised finance (DeFi), gaming and social ventures.

The trend highlights a growing investor preference for service-oriented ventures within the crypto industry. Pantera Capital emerged as the most active investor last week, participating in four deals, two in blockchain services and two in CeFi and social ventures.

Over the past year, Coinbase Ventures has maintained the highest level of activity, completing 73 investments across multiple sectors. Animoca Brands follows with 63 deals, while Binance-affiliated YZi Labs secured 38 rounds. Amber Group and Andreessen Horowitz’s crypto accelerator, a16z CSX, rounded out the top tier with 37 deals each.

Record Fundraising Amid Bitcoin Highs and Market Volatility

The record weekly fundraising took place between Bitcoin reaching a new all-time high and the crypto market experiencing one of its largest crashes. On 6 October, Bitcoin surged to $126,000 according to CoinGecko. The rise was linked to a shift of the asset from centralised exchanges into self-custody wallets, institutional funds and corporate digital asset treasuries.

However, the bullish momentum was short-lived. On Friday, US President Donald Trump announced a 100% tariff on Chinese imports. Bitcoin prices fell below $110,000, resulting in a sharp decline of $16,700 or 13.7% in less than eight hours. The sudden correction also wiped out 13% of futures open interest in Bitcoin, triggering nearly $20 billion in liquidations. The largest losses occurred on Hyperliquid, a decentralised perpetuals exchange.

Investor Confidence Remains Resilient

Despite the market turbulence, the surge in fundraising suggests that investors continue to show strong interest in crypto ventures. The spike in funding rounds demonstrates confidence in blockchain services, CeFi platforms and emerging sectors such as DeFi and crypto gaming.

Industry analysts suggest that the rapid growth in investment activity is a response to the ongoing evolution of crypto markets. Institutional adoption, alongside innovations in blockchain technology, has attracted significant capital inflows. The record fundraising week highlights the sector’s potential to rebound even amid high volatility.

Future Outlook for Crypto Venture Activity

The crypto industry faces a mixed outlook following the record fundraising and subsequent market crash. While short-term volatility remains a concern, long-term prospects appear promising. Investors are likely to continue focusing on blockchain services, CeFi and DeFi projects as these sectors expand.

Market watchers caution that regulatory developments, macroeconomic events and global trade policies can influence crypto prices and fundraising activity. Nonetheless, the recent surge indicates that investor appetite for digital asset ventures remains strong.

Leave a Reply