The crypto industry, once marked by its scrappy origins and informal operations, is now stepping confidently onto the public stage. Crypto IPOs by firms are gaining momentum, driven by increased regulatory clarity and a more mature market ecosystem.

“Crypto is no longer a nascent industry run from garages,” said Tracy Jin, Chief Operating Officer (COO) of MEXC, in an interview with Cointelegraph. With robust governance, audited financials, and scalable revenue models, crypto companies are ready to embrace public markets.

Record-Breaking Listings Drive Optimism

Recent IPOs reflect the sector’s evolution. On June 5, Circle, the issuer of the USDC stablecoin, debuted publicly, raising $1.1 billion and achieving a staggering 167% gain on its first trading day. Following Circle’s success, Gemini confidentially filed for a US listing on June 6, while Bullish, backed by billionaire Peter Thiel, made a similar move on June 10.

Jin highlighted improved market sentiment as a key factor, pointing to the surge in capital flowing into Bitcoin and Ether ETFs in the United States. This bullish environment has bolstered valuations and created a wealth effect for early crypto investors, opening the IPO window.

Regulatory Clarity Spurs Institutional Confidence

The shift toward public listings isn’t solely market-driven. Long-awaited regulatory frameworks like the EU’s Markets in Crypto-Assets Regulation (MiCA) and US ETF approvals have reduced ambiguity, making the crypto space more appealing to institutional investors.

“For years, the lack of clarity in jurisdictions like the United States kept public market investors hesitant,” Jin noted. These frameworks are not exhaustive but offer enough structure to legitimize crypto firms in the eyes of Wall Street.

Mature companies with defensible business models are leading the charge. Jin sees infrastructure-focused firms, such as blockchain analytics providers, staking services, and custody solutions, as prime candidates for IPO success.

The Next Crypto Hotspot

Asia is emerging as a pivotal region for the next phase of crypto growth. Jin pointed to Metaplanet’s Bitcoin treasury strategy as evidence of increasing adoption in the region. In Japan, concerns over currency depreciation have further spurred interest in Bitcoin as a hedge.

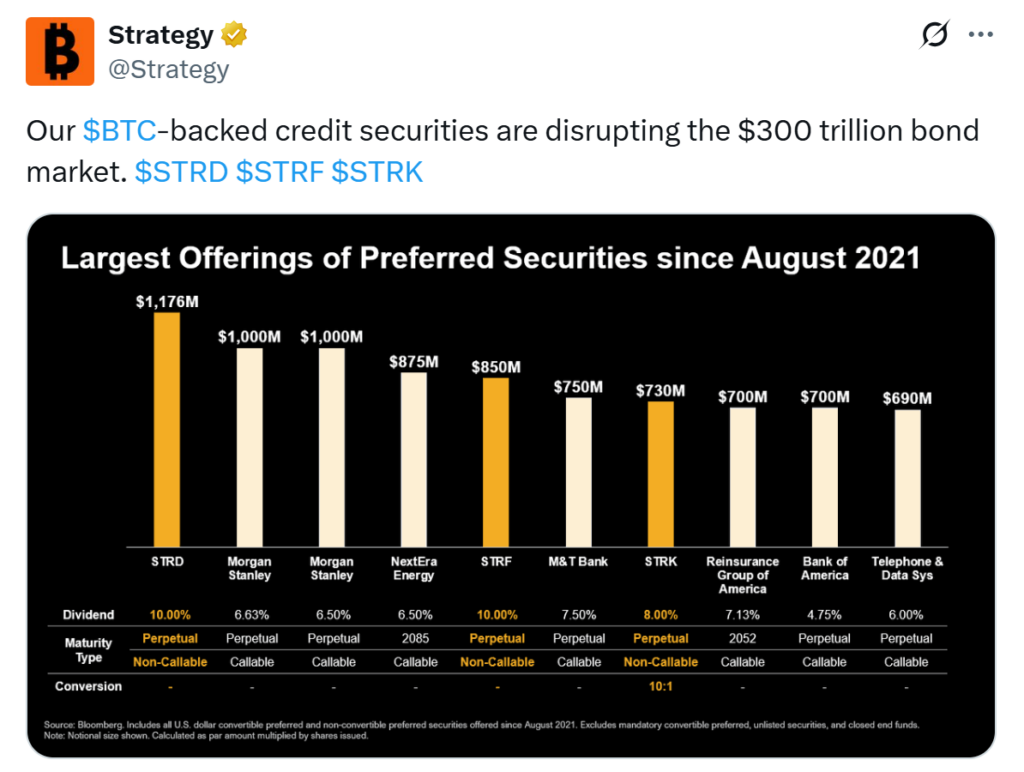

Additionally, crypto-linked financial engineering is gaining traction. Jin cited structured products like convertible notes that offer yield and upside exposure as an example. “We’ll see major banks like Goldman Sachs and JP Morgan adopting similar strategies,” she said, describing these instruments as a stepping stone toward broader institutional adoption.

Sustainable Momentum for Crypto IPOs

Jin believes the momentum in crypto IPOs is sustainable but selective. Companies with solid governance, sustainable revenue streams, and tech-oriented business models are best positioned to succeed. She predicts that the IPO boom will usher in a new era for crypto, bridging the gap between traditional finance and digital assets.

While institutions may not fully integrate crypto into their balance sheets just yet, innovative financial instruments are paving the way for gradual acceptance. As Jin put it, “This is a blueprint for mainstream adoption.”

With the confluence of market maturity, regulatory clarity, and innovative financial strategies, the crypto industry is poised for a transformative era of public market participation.

Leave a Reply