The cryptocurrency market has faced a sharp downturn today, with total market capitalisation dropping by 3% to approximately $3.1 trillion on 24 February. Several factors have contributed to this decline, including continued investment outflows and the fallout from the recent Bybit hack.

Bybit Hack and Market Correction

The downturn is linked to the repercussions of the $1.4 billion Bybit cryptocurrency exchange hack that occurred on 21 February. This incident, the largest-ever crypto heist, has continued to unsettle investors, leading to a sustained sell-off.

Ethereum (ETH) has been hit the hardest, plunging by 5% in the past 24 hours to trade just below $2,700. Bitcoin (BTC) and Solana (SOL) have also recorded losses of 0.8% and 9%, respectively. Other major cryptocurrencies, including XRP, Dogecoin (DOGE), and Cardano (ADA), have also suffered declines of 4.5%, 6.3%, and 6%.

Leveraged Liquidations Intensify the Sell-Off

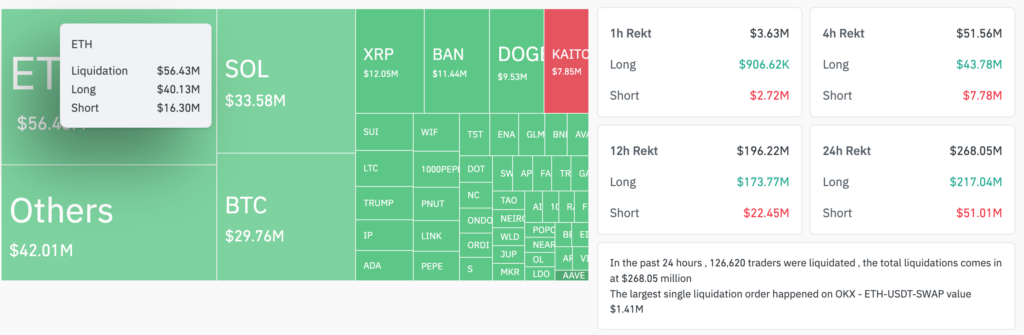

Significant liquidations in the derivatives market have compounded the selling pressure. Over the past 24 hours, leveraged position closures have totalled $268 million. Ethereum accounted for $40.13 million in liquidations, surpassing Bitcoin’s $21.4 million in long-position liquidations.

More than 126,620 traders were liquidated in the past day, with the largest single liquidation occurring on OKX involving an ETH/USDT swap worth $1.41 million. The predominance of long liquidations suggests that the crypto market had been overleveraged on the bullish side.

Despite the bearish sentiment, cryptocurrency trading platform QCP Capital noted that the market response has been more measured than the reaction to the FTX collapse in 2022.

“The growing maturity of the crypto landscape is evident,” QCP Capital stated. “Bybit’s swift securing of a bridge loan to cover liquidity gaps underscores the resilience of the lending sector.”

Institutional Outflows and De-Risking

The ongoing correction aligns with significant capital outflows from crypto investment products. Digital asset investment products have seen outflows for the second consecutive week, with total withdrawals amounting to $508 million for the week ending 21 February, according to a CoinShares report.

Bitcoin bore the brunt of the outflows, totalling $571 million. As a result, year-to-date inflows dropped from $7.4 billion to $6.6 billion over the past fortnight.

CoinShares Head of Research, James Butterfill, attributed the decline to investor caution amid economic uncertainty.

“We believe investors are exercising caution following the US presidential inauguration, given the ongoing uncertainty surrounding trade tariffs, inflation, and monetary policy,” he said.

Economic Data and Federal Reserve Policy

Market participants are also closely watching the upcoming US inflation data, with the Personal Consumption Expenditures (PCE) Index—widely regarded as the Federal Reserve’s preferred inflation gauge—set to be released on 28 February.

Recent job market data has also influenced market sentiment. Initial jobless claims exceeded expectations by 4,000, reaching 219,000, indicating weakening labour market conditions. This has significantly reduced expectations for multiple interest rate cuts in 2025. According to the CME Group’s FedWatch Tool, the likelihood of the Fed maintaining its current interest rates at its next two meetings stands at 97.5% for March and 73% for May.

Key Resistance Levels for Crypto Market

The latest downturn is part of a broader correction that began on 31 January, with key support levels turning into resistance zones.

Currently, the total crypto market capitalisation (TOTAL) trades below a major supply zone between $3.28 trillion and $3.31 trillion, corresponding to the 50-day and 100-day simple moving averages (SMAs), respectively. The Relative Strength Index (RSI) is at 40, indicating continued downside pressure. Further selling could push the market towards the $3.03 trillion support level, which has held since 20 November. A break below this level could trigger a decline towards the 200-day SMA at $2.72 trillion.

Conversely, a rebound above $3.2 trillion could lead to a test of the resistance levels mentioned above.

According to popular analyst Crypto Zone, “the crypto market is navigating a period of neutrality,” with the Fear and Greed Index currently at 40.

“This suggests investors are weighing their moves carefully, making it a critical time for strategic decision-making,” the analyst added.

Leave a Reply