The crypto market is flashing green, with Bitcoin (BTC) maintaining crucial support and the total market capitalisation inching closer to a breakout zone. Meanwhile, Ethena (ENA) has emerged as the top-performing altcoin, securing double-digit gains over the past 24 hours. Despite optimism, volatility remains a defining factor, leaving traders watchful for the next decisive move.

Total Market Cap Eyes Breakout but Remains Rangebound

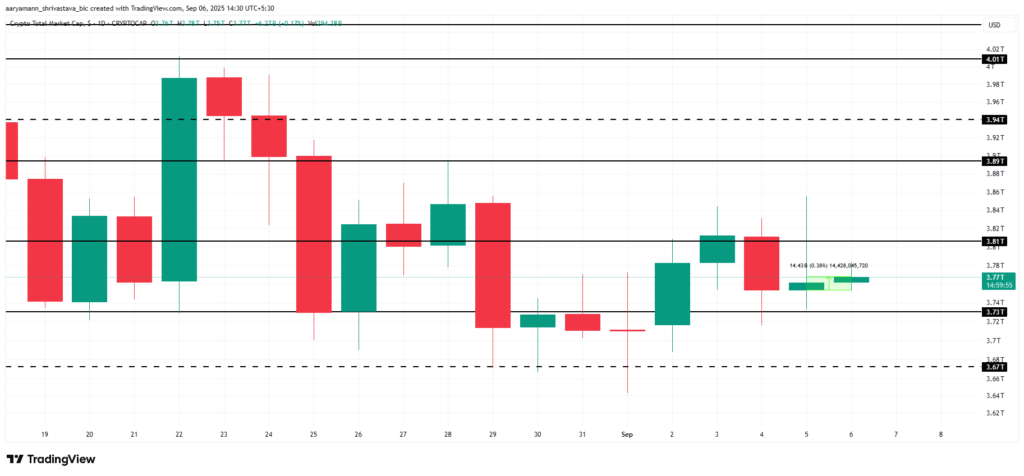

The global crypto market cap (TOTAL) added $14.4 billion in the past 24 hours, climbing to $3.77 trillion. While this uptick reflects healthy inflows, the market remains capped below the key $3.81 trillion resistance. A breakout above this level is seen as critical for the next bullish leg higher.

At present, the market is consolidating between $3.72 trillion and $3.81 trillion. Analysts note that intraday volatility is still dominant, with no clear signals emerging from either macroeconomic developments or technical charts.

For investors, the coming week could prove pivotal. If institutional demand through exchange-traded funds (ETFs) and traditional finance products increases, the market may flip $3.81 trillion into a firm support zone. Such a development would pave the way for TOTAL to extend gains toward $3.89 trillion, potentially triggering renewed confidence across the sector.

Bitcoin Holds Firm Above $110,000

Bitcoin continues to demonstrate resilience, trading at $110,958 at press time. The flagship cryptocurrency is firmly holding above $110,000, a psychological and technical support level. Over the past two days, BTC has traded rangebound between $110,000 and $112,500, with minimal volatility compared to earlier weeks.

The 50-day Exponential Moving Average (EMA) is providing underlying support, but it also highlights ongoing caution in the market. Analysts suggest the probability of a sharp decline is currently low, barring any sudden shifts in investor sentiment or macroeconomic shocks.

If buying momentum strengthens, BTC could push past $112,500. A successful flip of this resistance into support would set the stage for a rally toward $115,000. Such a move could act as a confidence booster, signalling the potential start of a broader recovery phase after weeks of consolidation.

Ethena Leads the Altcoin Pack

Among altcoins, Ethena (ENA) stands out as the day’s top performer. The token surged 15% in the past 24 hours, trading at $0.746. Notably, ENA is defending the $0.732 support level, reinforcing investor optimism despite wider market uncertainty.

A sustained bounce from this support could power ENA toward $0.794, a level that would effectively recover its August losses. Market watchers argue that this price zone is critical for Ethena’s mid-term trajectory.

However, risks remain. A failure to hold $0.732 could invite profit-taking, dragging the token toward $0.676 or even $0.628. Such a decline would invalidate the current bullish outlook and erase recent gains. As such, ENA traders are closely monitoring both support and resistance markers in the near term.

Institutional Inflows Could Set the Tone

While price action across the crypto market is encouraging, the broader outlook hinges on institutional inflows and macroeconomic clarity. ETF adoption and traditional finance engagement could act as key catalysts in breaking resistance levels for both Bitcoin and the total market.

Until then, consolidation remains the prevailing theme. Bitcoin’s ability to hold above $110,000 and challenge $112,500 will likely set the tone for the coming days, while altcoins such as Ethena continue to provide high-beta opportunities for risk-tolerant traders.

In short, the crypto market is steady but cautious. A breakout looms, but until resistance levels are flipped into support, investors may need to navigate choppy waters with patience.

Leave a Reply